- Daily Energy Market Update

- Posts

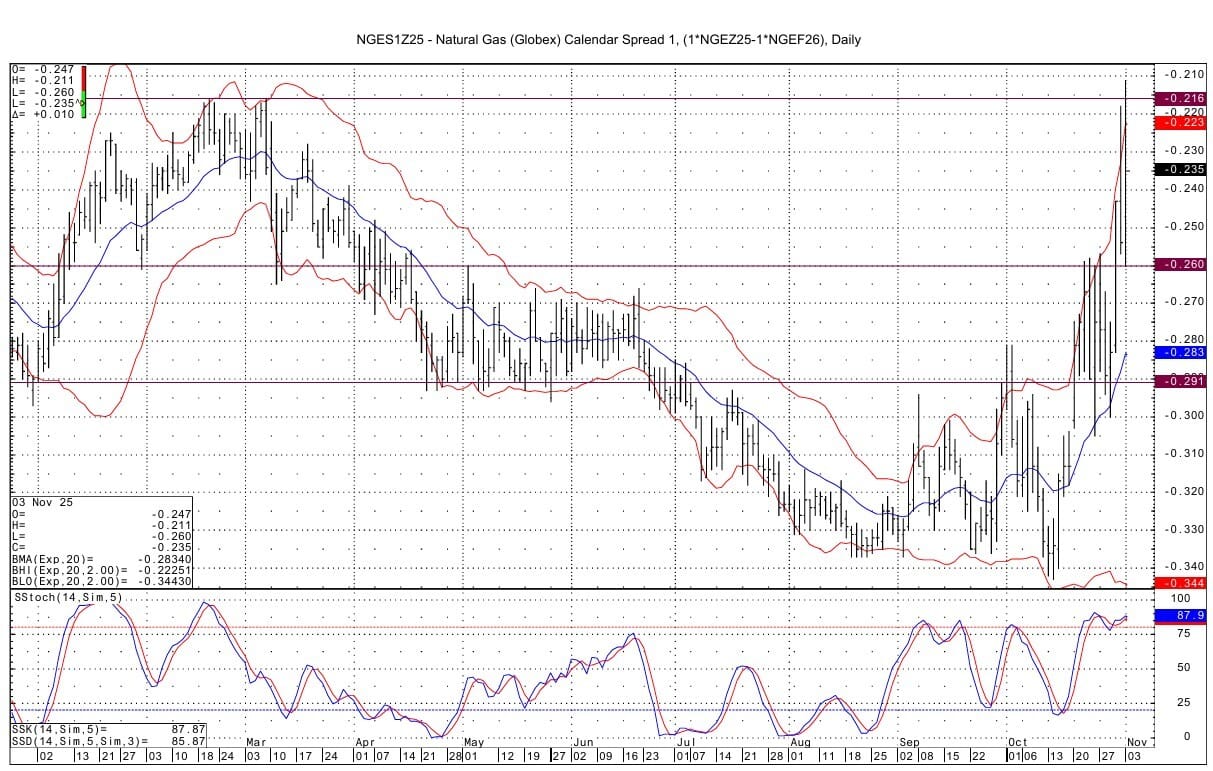

- NG December January spread

NG December January spread

Liquidity Energy, LLC

November 3,2025

Overview

As would be expected, the December January NG spread today rose to its narrowest/best value in months, even making a fresh contract high on the back of the strong overnight spot futures rally.

Technically, the spread tested the upper bollinger band on the daily chart, as it did Friday. There is a mean reversion setup from the close from Friday being over the daily chart upper bollinger band. That band intersects today at minus 22.3 cents.

The spread today broke the prior contract high of minus 21.6 cents, reaching a high of minus 21.1 cents. But, momentum still favors the December gaining.

On a retracement to the downside in the spread, December should see support versus January at minus 26 and then minus 29 cents.

A colleague suggests that a big rally in NG spot futures will be led by January and the Q1 strip. That may also be the case if speculators were to buy futures aggressively, whereby they would more likely add positions in the 2nd or further back months rather than the more expensive margin-basis December futures. We wish to add that current storage inventories are ample thus allaying any near term fears of a price spike that would favor the December versus further out months. Also, current weather forecasts signal overall light to moderate demand.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply