- Daily Energy Market Update

- Posts

- Natural Gas --Jan Feb March butterfly

Natural Gas --Jan Feb March butterfly

Liquidity Energy, LLC

October 23,2025

Overview

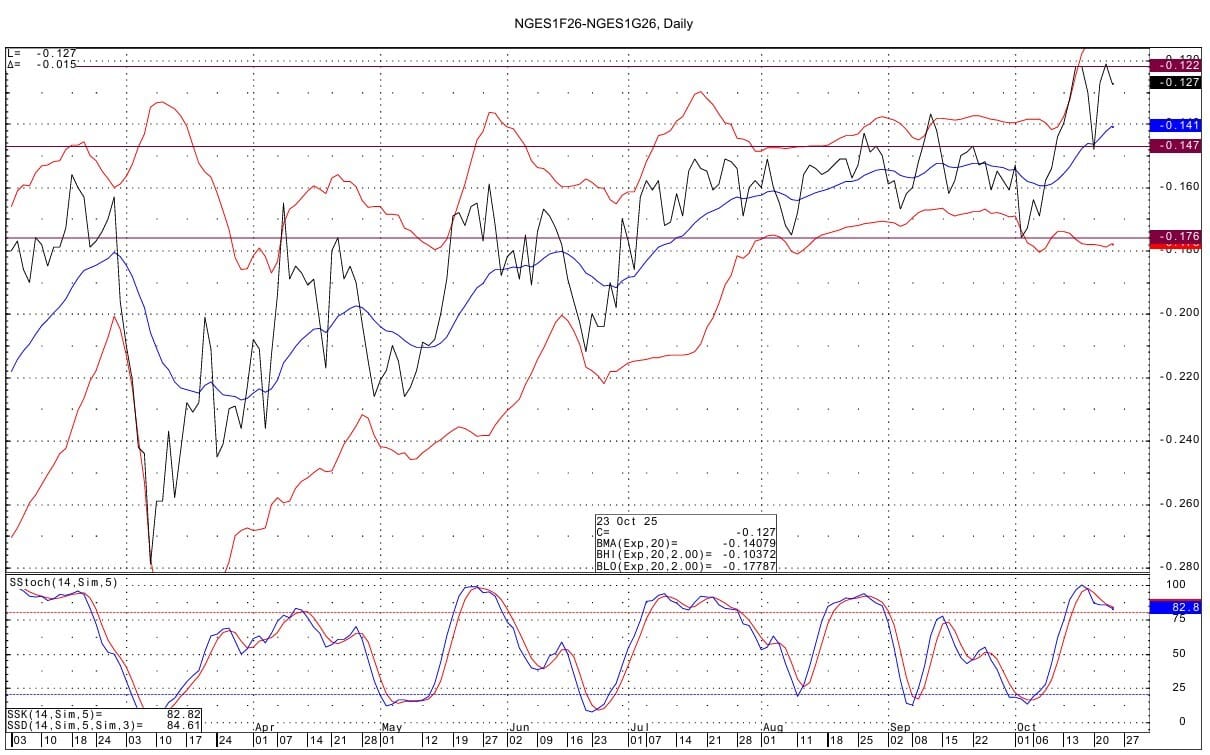

The Natural Gas January February March 2026 butterfly recently made a new high at -12.1 cents. But, this now has made the butterfly have a double top at -12.2/-12.1 cents.

Strength in the butterfly seen of late is likely a function of the sharp rally seen in the flat price, as the market over the weekend saw revised weather forecasts that boosted demand expectations.

But, the flat price NG futures have eased back over the past 24 hours as weather forecasts have reduced some of the expected demand. Additionally, in the past 24 hours, the next day cash Henry Hub price has eased, dragging the futures price down with it. Given the ample amount of gas in storage, it is hard to see the butterfly rallying strongly to the upside at current without a significant boost in heating demand.

Technically, as stated above the butterfly currently has a double top at -12.1/-12.2 cents. From this past year's chart history, we see upside resistance for the current 2026 butterfly possible at -11.0 and then at -8.4 cent, if the current double top were to be broken. Downside support for the current year's butterfly is seen at -14.7 and then at -17.6 cents.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply