- Daily Energy Market Update

- Posts

- March Heating Oil versus Gasoil (HOGO)

March Heating Oil versus Gasoil (HOGO)

Liquidity Energy, LLC

March 3, 2026

Overview

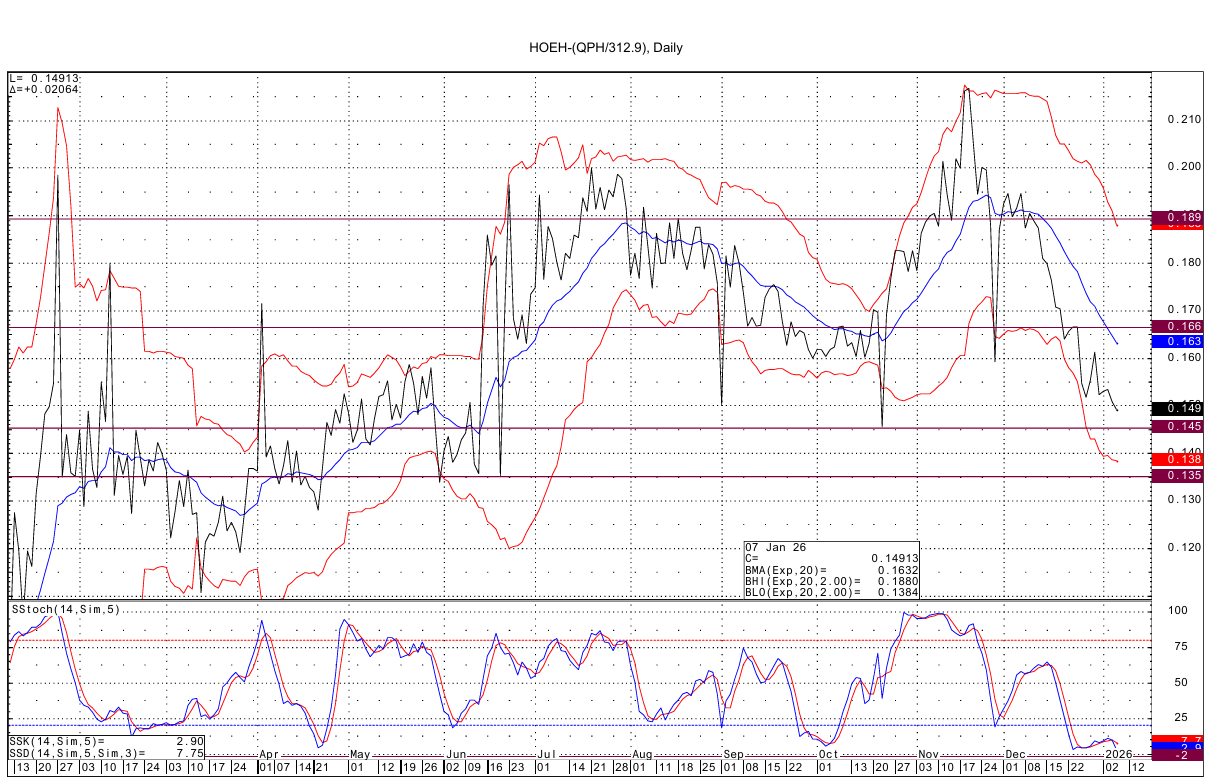

The March Heating Oil versus Gasoil (HOGO) is currently valued at about 14.8 cents. The current value is the narrowest/lowest value for the Heating Oil versus Gasoil since a spike low seen in late October 2025.

The HOGO has lost value since peaking in mid November. The drop in the HOGO values is concurrent with the rise in distillate production seen over that period as refiners took advantage of a very strong margin for the distillate portion of the refined products barrel. Today's DOE statistics reaffirmed the strong production level and coupled with weak demand has led to the distillate complex today seeing crack spreads at their lowest value since August, as well as the forward curve weakening with the Feb March spread falling to a fresh contract low.

Thus, given the above narrative for the ULSD/HO contract, it is hard to see the Heating Oil gaining much ground on the Gasoil. Although some news seen today may arrest the slide in the HOGO value. Monthly shipments of diesel-type fuel from Russia’s Baltic Port of Primorsk surged in December, according to a port report and Bloomberg ship tracking data. Exports stood at 1.67million metric tons (=403 MBPD) compared to 1.16 million metric tons (=289 MBPD) in November and 0.906 million metric tons (= 219 MBPD) in October. But, given sanctions on Russian fuel into Europe, these exports out of Russia may not have as great a downside effect on Gasoil as might have been seen in prior years. Yet, the increase in Russian exports may reduce demand for European gasoil for export.

Technically the March HOGO still has some negative momentum, suggesting that the Heating Oil will slip further against the Gasoil. Downside support lies at the low of 14.5 cents seen in October and below that support comes in at 13.5 cents. Upside resistance is seen at 16.6 cents and then at 18.9 cents.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply