- Daily Energy Market Update

- Posts

- Daily Energy Market Update September 9,2025

Daily Energy Market Update September 9,2025

Liquidity Energy, LLC

Liquidity’s Daily Market Overview

Energies are higher. The market is supported by the small increase in production announced by OPEC+ over the weekend and by concerns over further sanctions on Russian oil. Crude oil is also drawing support from the latest Chinese data showing resilient demand, though fears of a global supply surplus continue to cast a shadow over the outlook, as per WSJ commentary.

The OPEC+ announcement of an increase of 137 MBPD for October was thus much less than the over 500 MBPD increase seen in the prior 2 months. Also, the market believes that OPEC+ will be hard pressed to come up with the full 137 MBPD increase. UBS' oil analyst said :" "The realization that the October OPEC+ supply increase could be 60,000-70,000 barrels per day is one factor, the other is that OPEC+ spare capacity is much smaller than many thought,". (Reuters) The energy cartel's latest move suggests that "defending market share now outweighs defending prices," one economist says. While another market analyst said:" OPEC+ said it remains flexible on increases depending on market conditions, and committed to compensation for previous overproduction by some members. “So, when you consider the compensation cuts, we are not really going to see that many more barrels of oil,” .

Speculation of more sanctions on Russia after the country's biggest air attack on Ukraine set fire to a government building in Kyiv also supported prices. President Trump said over the weekend that he was ready to move to a second phase of restrictions. This comes after last week, the EU rolled out its 18th sanctions package. Also, Britain and the European Union lowered the price cap on Russian crude from $60 to $47.60 per barrel, requiring buyers to submit attestations within 30 days of loading to maintain access to Western insurance and shipping services. (Reuters)

China's stockpiling of oil, which has helped soak up excess production this year, is likely to continue at a similar rate in 2026, the chief strategist for commodity trading house Gunvor said on Monday. Another analyst adds :" China according to data has been buying around 0.5 MMBPD towards stockpiling,". (Reuters) China's implied stockpiling between March and July amounts to an average of 1.4 MMBPD, according to Commerzbank analysis.

Saudi Arabia lowered their OSP for October loadings by more than expected. The flagship A-light crude grade price to Asia for October loadings was lowered by $1.00. A Reuters survey had suggested that the price drop would be in the range of 40 to 70 cents. The price for medium and heavy crude to Asia was lowered by 90 cents. This price drop "might be an indication that Saudi is using price to push the increased production into the market,", as per one analyst's comments. The October price drop gives back the $1.00 increase seen last month. The prices for crude shipped to the Mediterranean and to NW Europe were lowered by 80 cents across the board. The price to the U.S for A-Light was unchanged, while the other grades saw a reduction of 10 cents.

The EIA's monthly oil report (STEO) will be issued today. The OPEC and IEA monthly reports will be released Thursday Sept. 11.

Reuters yesterday had an article detailing how the oil industry is laying off workers and slowing spending. Late last week Conoco said that it would cut up to 25% of its staff. That followed a similar announcement in February by rival Chevron, which said it would lay off 20% of its workforce, totaling roughly 8,000 people. Oilfield service company SLB said it was reducing its workforce earlier this year, while Halliburton has cut staff in recent weeks. Lower oil prices and rising costs have pushed 22 public U.S. producers, including Occidental Petroleum Corp, ConocoPhillips, Diamondback Energy, to cut their capital expenditures by $2 billion, according to a Reuters analysis of second quarter earnings announcements. The U.S. oil rig count – an indicator of future activity – has fallen by about 69 to 414 this year, according to Baker Hughes. We noted yesterday that the Permian basin has seen the rig count drop by 52 rigs in the past year. Research firm Energy Aspects expects U.S. onshore output to drop by 300 MBPD in 2025 from last year, while rival Wood Mackenzie estimates U.S. onshore growth from lower 48 U.S. states of 200 MBPD, the smallest increase since 2021 when COVID-19 ravaged demand. Operating costs having risen is seen affecting production. As an example, Diamondback Energy says that operating costs had risen to 35% of total spending compared with about 20% historically. They thus point out that it is harder to compete.

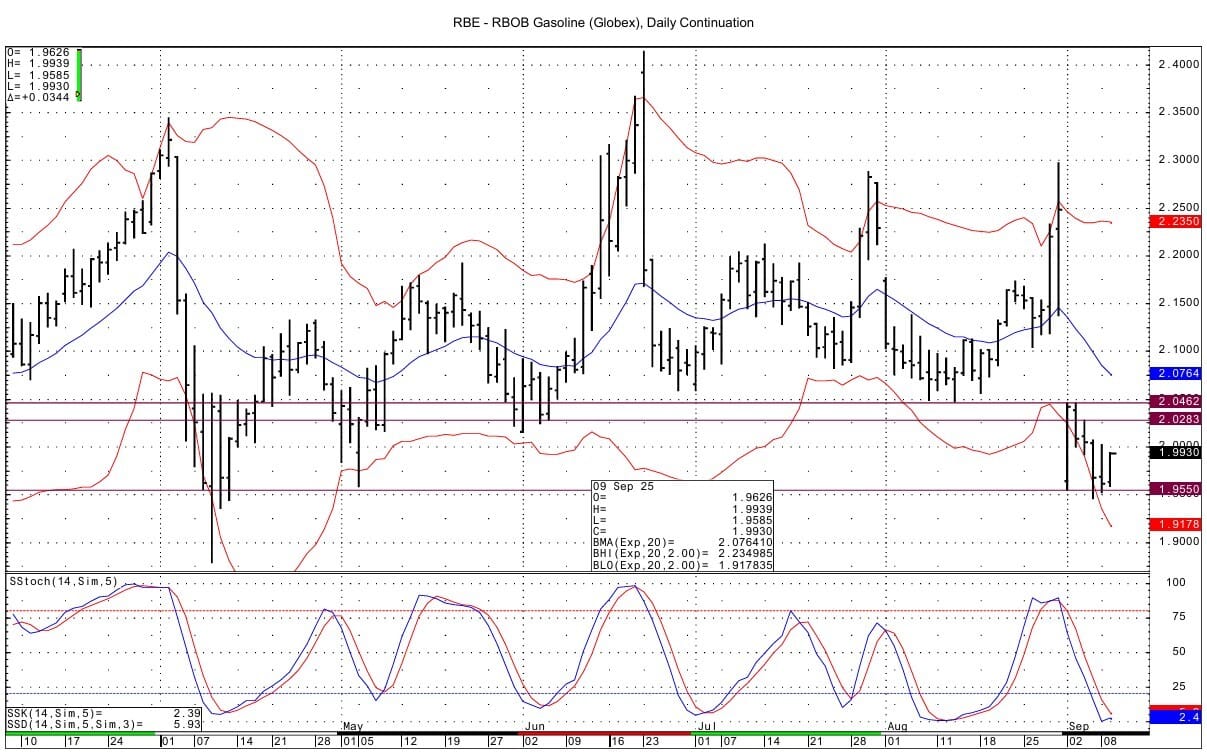

Energy Market Technicals

RB & the crude oils are having their 2nd straight day of prices trading within the range of the previous day. RB momentum basis the DC chart is getting oversold, while that for the WTI remains negative. ULSD momentum basis the DC chart has turned negative.

WTI spot futures see support at last week's low at 61.45. Resistance comes in at 64.34-64.42 and then at 65.10-65.11.

October ULSD support is seen at 2.2774-2.2790. Resistance lies at 2.3508-2.3522 and then at 2.3907-2.3921.

RB support for October futures is seen at 1.9550-1.9556. resistance lies at 2.0268-2.0283 and then at 2.0462-2.0466.

Natural Gas Market Overview

Natural Gas--NG is up 4.7 cents

NG futures are higher, buoyed by an underlying positive sentiment as warmer temperatures in mid-September are seen boosting demand. Also supporting prices are supply concerns/a tighter supply/demand balance, which seems to be somewhat a function of pipeline maintenance.

Repairs have been extended for an extra week at a gas compressor station in Liberty County, Texas, on the Kinder Morgan pipeline, known as NGPL, which is reducing gas flows between Texas and Louisiana. The repairs are now seen lasting until next Monday. This news likely helped boost the next day Henry Hub (HH) cash price Monday, which rose to $3.10 from Friday's price near $3.06. But the October futures seem to have gotten ahead of themselves yesterday. When the HH was valued near $3.10 early in the AM, the October futures were printing near $3.19. This +9 cent differential was up from the flat price for the cash versus futures seen late last week.

Natural gas prices also found support Monday after forecaster Atmospheric G2 said forecasts shifted warmer over the eastern two-thirds of the US for September 13-17 and trended warmer across the southern and central US for September 18-22.

The EIA gas storage data due out Thursday os seen as a build of 70 to 74 BCF as per early estimates seen. This compares to last year's build of 36 BCF and the 5 year average build of 56 BCF. Average total solar and wind output was down 7% for the reporting period. However, any incremental demand for gas-fired power generation was more than made up for by cooler temperatures. Overall, Lower 48 cooling degree days came in at 36, down 8 (18%) week/week. NGI adds :" Overall to date this injection season, weekly injections have averaged 11.5 Bcf more than the previous five-year average." End of injection season (EOS) inventories are thus seen at 3.944 TCF as per NGI. The Desk survey is calling for the EOS level to be 3.935 TCF. Te EIA last month projected the EOS to be 3.872 TCF, which would be 2% above the 5 year average. As of last week, inventories were 5.58% over the 5 year average.

We saw a flurry of activity in the Calendar Spread options (CSO) in Monday's activity. The October/ January $-1.00 call/$-1.50 put fence traded 5.3 cents 4,000 lots worth. 3,000 lots of the October/January $-1.30/$-1.15 put spreads traded at a price of 4.3 cents. This -$1.30/-$1.15 put spread was an initiating trade as per CM open interest data. The October/January NG futures spread settled at $-1.12, narrower by 1.2 cents versus Friday's price. The high price for the spread seen Monday was $-1.059. In the December/January CSO, the $-0.15/$-0.30 call spread traded 5.0 cents. Some of this 2,000 lot trade was an initiation of a position.

Technically NG has positive momentum that is overbought. Support for the spot futures lies at last week's double bottom at 3.021-3.022. Resistance comes in at 3.186-3.187 and then at 3.267-3.270. Today's spot futures price range so far is within that seen yesterday.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply