- Daily Energy Market Update

- Posts

- Daily Energy Market Update September 2, 2025

Daily Energy Market Update September 2, 2025

Liquidity Energy, LLC

WTI is up $1.21 RB is up 5.32 cents ULSD is up 6.01 cents ( these value are versus Friday's settlement)

Liquidity’s Daily Market Overview

Energy prices are higher--both versus Friday's settlement price and versus the values seen Monday morning. The same factors that supported prices Monday are seen helping today again. Concerns over Russian and Iranian supply, with possible U.S. and European sanctions looming. A rate cut by the Federal Reserve this month is also seen supporting. Additionally some commentary cites technical buying, seeing as money managers had recently lowered their WTI length to its lowest amount in 18 years.

“The main support for oil prices is the geopolitical premium. No one believes anymore that a peace deal between Russia and Ukraine is imminent.”, as per one analyst. U.S. Treasury Secretary Bessent said Washington would look at sanctions on Russia this week. (Bloomberg) Additionally, Reuters cites the fact that 17% or 1.1 MMBBPD of Russian processing capacity has been shut, due mostly to Ukrainian attacks. European nations are considering further sanctions against Russia, including freezing $245 billion of Russian assets. (BBC News) Russia/Ukraine strikes remain at an elevated levels with further Russian refineries struck at the weekend. This morning saw the following headlines : RUSSIA, US TO HOLD NEW ROUND OF CONSULTATIONS: Interfax, the Russian news agency" - (Bloomberg) "RUSSIA, US FOREIGN MINISTRIES TO HOLD CONSULTATIONS: Interfax"

OPEC+ is seen keeping their production unchanged when they meet September 7th. "I expect OPEC+ to hold fire through the current refinery maintenance season to assess if the widely expected downside to crude prices will materialize,”, said BNP's energy strategist. A further tranche of 1.66 MMBPD of idle OPEC+ production capacity output is formally due to remain offline until the end of next year. “The phase-out of the additional voluntary production adjustments may be paused or reversed subject to evolving market conditions,” the producers said in a statement on OPEC’s website. (Bloomberg)

The U.K., France, and Germany (the ‘E3’) last week started the process of triggering the ‘snapback’ mechanism of restoring sanctions on Iran. The move by the E3 comes well before the October 18 official deadline that marks the latest point at which the snapback mechanism could be triggered. U.S. Secretary of State Rubio subsequently stated that Washington will work with the E3 and other members of the UN Security Council to complete the snapback sanctions process in the coming weeks. (Oil Price)

One news wire suggests that better than expected Japanese GDP data supported energy prices overnight. The Japanese economy grew by 1.3% in the 2nd quarter, which was much better than the 2.6% drop analysts surveyed by Kyodo News had expected. (The Street) Japan is the world's 4th largest oil importer.

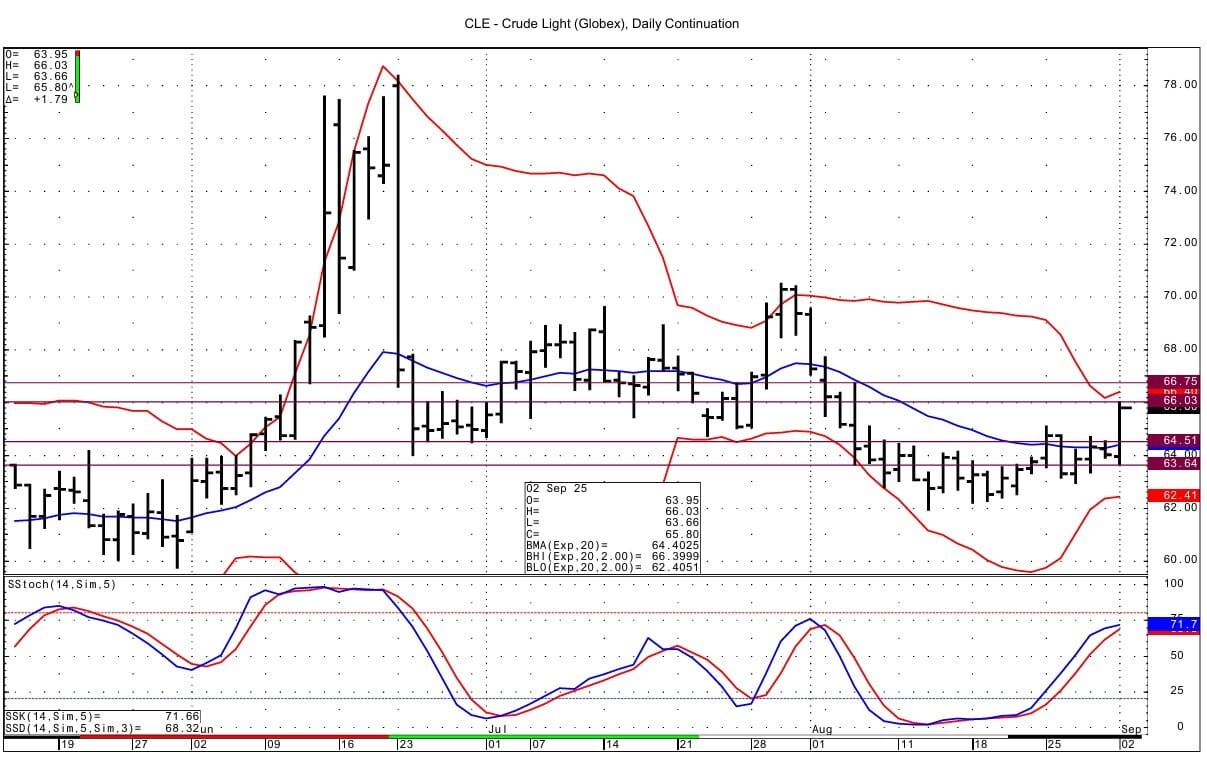

Energy Market Technicals

Momentum for the products remains negative, while that for WTI remains positive.

Technically spot WTI futures have tested resistance at 65.98-66.03 this morning having risen to its highest price in almost 4 weeks. Above this , next resistance is seen at 66.74-66.75. Support lies at 64.50-64.52 and then at 63.64-63.66, which is the low of the 2 day session. Although the price has risen, the overall picture remains one of a commodity that is in a sideways pattern.

Spot RB futures have risen over the lower bollinger band, which lies at 2.0225. Support lies at 1.9842-1.9852 and then at 1.9632-1.9635. Resistance comes in at 2.0489-2.0500 and then at 2.0719-2.0732

ULSD spot futures see support at 2.3102-2.3118 and then at 2.2800-2.2817. Resistance is seen at 2.3825-2.3830 and then at 2.4188-2.4204.

Natural Gas Market Overview

Natural Gas---NG is down 11.8 cents ( versus Friday's settlement)

NG spot futures are lower versus Friday's settlement and versus early Monday prices. Although the tone has become more bullish for NG in recent days on the back of the EIA storage data seen the past 2 weeks, implying a tighter supply picture, the weak fall/shoulder season weather pattern has raised some skepticism.

The EIA data seen the past 2 weeks suggested greater power burns amid sluggish renewable power generation.

Bloomberg estimates lower 48 dry gas production today at 107.01 BCF/d, up from the previous day's level of 106.91 BCF/d. These production numbers are lower versus Sunday's level of 108.13 BCF/d.

Celsius Energy data shows wind power generation today being down 6.5% from Monday and down 51.7% versus year ago level. They put the natural gas demand boost versus a year ago at 1.0 BCF/d.

Early estimates seen for this week's EIA gas storage data are calling for a build of 53 to 59 BCF. This compares to last year's build of 16 BCF and the 5 year average build of 36 BCF.

TTF gas prices in Europe have stabilized with wind generation seen as weak, thus boosting gas power burns. Also Norwegian field maintenance has cut flows to Europe. EU Gas storage is almost 78% full, below the 92% year-on-year and lower than the 5-year average of 85%, but are still on pace to meet the EU’s 80% target by early November.(FX Street/Trading News) Momentum technically basis the DC chart for TTF is negative. Support is seen at the Euro 30.300 level. Resistance lies at Euro 34 area and then at Euro 35.67.

Support at 2.922-2.929 has been pierced this morning. Below this, support comes in at 2.850-2.858. Below that support comes in at 2.774. Prices had rallied over $3.00 Friday late and early on in Sunday's session with a high of $3.065. The $3.00 level looks to be resistance on a rally. Momentum is still positive on the DC chart, and turned positive on the weekly continuation chart this week from an oversold condition.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Your Daily Edge in the Markets

Want to stay ahead of the markets without spending hours reading?

Elite Trade Club gives you the top stories, trends, and insights — all in one quick daily email.

It’s everything you need to know before the bell in under 5 minutes.

Join for free and get smarter about the markets every morning.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply