- Daily Energy Market Update

- Posts

- Daily Energy Market Update September 15,2025

Daily Energy Market Update September 15,2025

Liquidity Energy, LLC

WTI is up 49 cents RB is up 1.83 cents ULSD is up 3.03 cents

Liquidity’s Daily Market Overview

The energies are higher. The products are being supported by Ukrainian attacks on Russian refineries over the weekend. Also supportive is news that President Trump has urged European NATO allies to stop buying Russian oil. But, weak Chinese retail sales and industrial output seen over the weekend are limiting some of the gains.

Ukraine launched a large attack with at least 361 drones targeting Russia overnight, sparking a brief fire at the vast Kirishi oil refinery in Russia's northwest region, Russian officials said on Sunday, (Reuters) The facility, operated by Russian oil major Surgutneftegas, produces close to 355 MBPD of crude, and is one of Russia’s top three by output. To try to ease the domestic gasoline shortage, Russia has paused gasoline exports, with officials Wednesday declaring a full ban until Sept. 30 and a partial ban affecting traders and intermediaries until Oct. 31. (NY Post)

Trump said on Saturday the U.S. is prepared to impose fresh energy sanctions on Russia, but only if all NATO nations cease purchasing Russian oil and implement similar measures. The EU is sticking to its deadline to phase out Russian oil and gas imports by 2028, it decided last week, despite pressure from the U.S. to move more quickly. (Reuters)

China’s economic slowdown deepened in August with a raft of key indicators missing expectations, as weak domestic demand persisted, as per CNBC reporting. Retail sales last month rose 3.4% from a year earlier, data from the National Bureau of Statistics showed Monday, missing analysts’ estimates for 3.9% growth in a Reuters poll and slowing from July’s 3.7% growth. Industrial output growth slowed to 5.2% in August, compared to the 5.7% jump in July, marking its weakest level since August 2024, according to LSEG data. Economists had expected the data to be unchanged from the previous month.

But, despite the economic slowdown inherent in the data above, China continued to stockpile crude oil in August, as per oil import data seen today. China's surplus crude surged to just over 1 MMBPD in August as robust imports and domestic production totaling 15.95 MMBPD trumped an increase in refinery processing. China's refiners processed 14.94 MMBPD in August, up 7.6% from the same month last year to be the second-strongest month in the past 17 months. However, crude oil imports were 11.65 MMBPD in August and domestic output rose 2.4% from the same month in 2024 to 4.3 MMBPD. The 1 MMBPD oil supply surplus in August was almost double the 530 MBPD surplus seen in July. Reuters commentary adds that "it is worth noting that not all of this surplus crude is likely to have been added to storage, with some being processed in plants not captured by the official data." Imports from Venezuela were 561 MBPD in August, according to data compiled by commodity analysts Kpler, which was the strongest month in records going back to 2013. Arrivals from Venezuela are also poised to increase further in September, with Kpler tracking imports of 755 MBPD so far.

CFTC data seen Friday showed money managers reduced their net length in WTI and ULSD in the week ended Tuesday September 9. WTI net length held in futures/options on ICE/CME combined fell by 14,840 contracts. The drop was mostly due to longs being liquidated. Money managers thus held their least bullish position in WTI since June 2006, as per ING reporting. Money managers also reduced their net long in ICE Brent by 41,476 lots. ULSD length fell by 13,241 contracts as longs were sold and shorts were added.

The Baker Hughes oil rig count issued Friday showed an increase of 2 units.

RB open interest on the CME rose by nearly 11,000 contracts in Friday's activity. We see this as continued new length being added in the November, December and January contracts.

Energy Market Technicals

RB and crude oil momentum basis the DC charts remain positive, while that for the distillates remains negative. Overall, the energies are in a sideways trading pattern.

WTI spot futures see support at the recent low at 61.45. Resistance lies at 64.08-64.10 and then at 65.10-65.11.

ULSD for October sees support at 2.2800-2.2817 and then at 2.2644-2.2664. Resistance lies at 2.3367-2.3371 and then at 2.3508-2.3522.

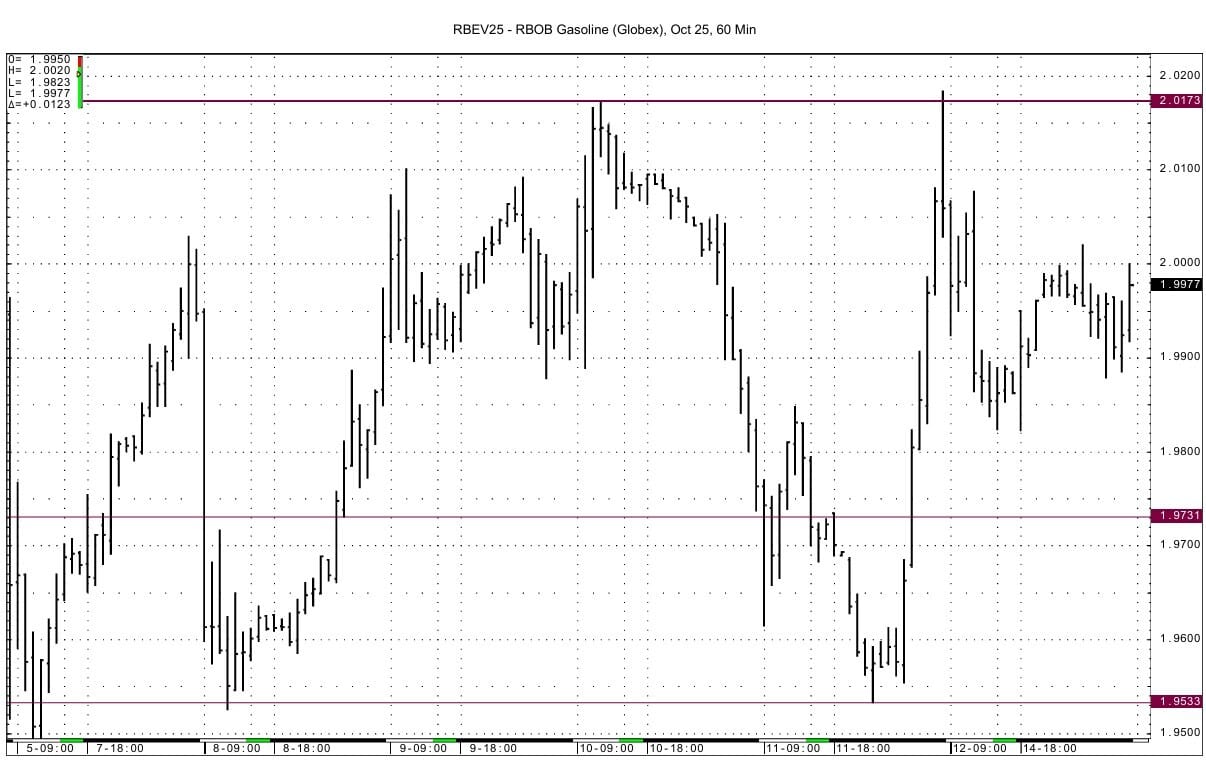

October RB support comes in at 1.9730-1.9740 and then at 1.9526-1.9533. Resistance lies at 2.0173-2.0184 and then at 2.0462-2.0466.

Natural Gas Market Overview

Natural Gas -- NG is down 1.1 cents

NG futures are down slightly after trying to rally overnight. The GWDD forecast was lowered over the weekend, thus suggesting weaker demand. Rising production is also cited for the easing back of prices this morning.

Over the weekend, both the GFS & ECMWF near-term models trended milder with fewer GWDDs expected over the next 2 weeks. (Celsius Energy)

US domestic natural gas production is estimated 0.702 BCF/d higher today at 108.7 BCF/d after a dip to 107.98 BCF/d yesterday, according to Bloomberg data. Despite the fact that output has ticked back up in recent days, production in September is averaging 107.6 BCF/d so far, down from August's record level of 108.3 BCF/d.

NG prices settled a little higher for the spot contract Friday as weather services including Atmospheric G2 and Vaisala called for above-normal temperatures into late September, suggesting a potential lift in air conditioning demand and power burn.

The Baker Hughes gas rig count issued Friday saw an unchanged amount.

CFTC data issued Friday showed that money managers covered some of their net shorts in the week ended Tuesday September 9. The net short total fell by 11,971 to 24,979 contracts. This was mostly due to longs being added.

Technically, the October spot futures are holding up better again today than the contracts behind, as was seen in Friday's settlements. On Friday, the October contract was the only month that settled higher until November 2028. We suspect that this suggests short covering and or a less eager selling stance for the front month contract. Yet, momentum basis the DC chart remains negative and there is currently a double top in the October contract from Friday/today at 3.000 / 2.995. Above the double top, resistance lies at 3.062-3.065. Support comes in at 2.895-2.897 and then at 2.850-2.858.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Reply