- Daily Energy Market Update

- Posts

- Daily Energy Market Update October 6,2025

Daily Energy Market Update October 6,2025

Liquidity Energy, LLC

WTI is up 45 cents at $61.33 RB is up 1.91 cents at $1.8793 ULSD is up 0.64 cents at $2.2427

Liquidity’s Daily Market Overview

Energies are higher as OPEC+ decided to raise output by less than was expected by many news accounts, thus "tempering some concerns about supply additions, though a soft outlook for demand is likely to cap near-term gains." (Reuters)

""Eight OPEC+ members led by Saudi Arabia said they would boost production by 137 MBPD in November, the same as the output increase in October, the group said after an online meeting Sunday.""(WSJ) As one comment reads :" The modest supply adjustment—unchanged from October—signaled the group’s cautious stance amid fragile global demand." UBS expects only 60-70 MBPD of actual OPEC+ production hitting the market in November--against the pledged 137 MBPD--as some members have to compensate for past overproduction, while others face capacity limitations. UBS adds: "With every monthly addition, market participants will likely start to realize that some group members are maxed out," the UBS strategist says. "So the market focus at some point will quickly shift to declining spare capacity in the oil market." (WSJ)

In the run-up to the meeting, sources said although Russia was advocating for an increase of 137 MBPD to avoid pressuring prices, Saudi Arabia would have preferred double, triple or even four times that to quickly regain market share. The modest production update also comes at a time of rising Venezuelan exports, the resumption of Kurdish oil flows via Turkey, and the presence of unsold Middle Eastern barrels for November loading, one analyst said. (Reuters)

Saudi Arabia kept its flagship A-light OSP crude price to Asia unchanged for November loadings. The price was expected to be raised by 20 to 40 cents as per a Reuters survey last week. The prices for Medium and Heavy to Asia for crude loadings for November were reduced by 30 cents. The Reuters survey had forecast those prices to rise by 30 to 60 cents. But, te OSP's were lower than forecast as last week the spot premium for Dubai crude in the Mideast fell to a 22 month low, as rising supplies weighed, as per Reuters reporting. Saudi OSP's to the U.S. were reduced by 50 cents. Prices to the Med and NW Europe for November loadings were reduced by $1.20. In the near term, some analysts expect the refinery maintenance season starting soon in the Middle East to also help cap prices. Additionally, lower oil burning for summer A/C generation is likely to be a drag on Mideast crude prices.

Despite the U.S. pressuring, India, one of the top buyers of Russian crude, to ease on its purchases of oil from Russia, an Indian government official told Reuters on Monday that there is enough supply of Russian oil for Indian refiners as attacks on Russian energy facilities have led to increased availability, helping in part to support the oil market.

The Baker Hughes oil rig count seen Friday showed a decrease of 2 units. The Permian basin saw a decline of 2 rigs, which is overall supportive for crude prices given the large amount of oil being drilled there.

Speculators sold 11,466 lots of ICE Brent for a second consecutive week over the last reporting week, a move predominantly driven by rising gross shorts positions. (ING) There was no data for WTI, RB & ULSD positioning as the CFTC Commitment of Traders report normally issued Friday was not released due to the US government shutdown.

The retail gasoline price in the U.S. is at its lowest since August 19. Today's price is $3.133. The EIA forecast in early September that retail gasoline prices would average $3.10 per gallon in 2025, down $0.20 per gallon from last year. Prices are expected to fall even more in 2026, down to an average of $2.90 per gallon.

Russian seaborne diesel and gasoil exports dropped 20% in September from August due to refinery outages as a result of Ukrainian attacks, as per LSEG data. (Reuters)

Energy Market Technicals

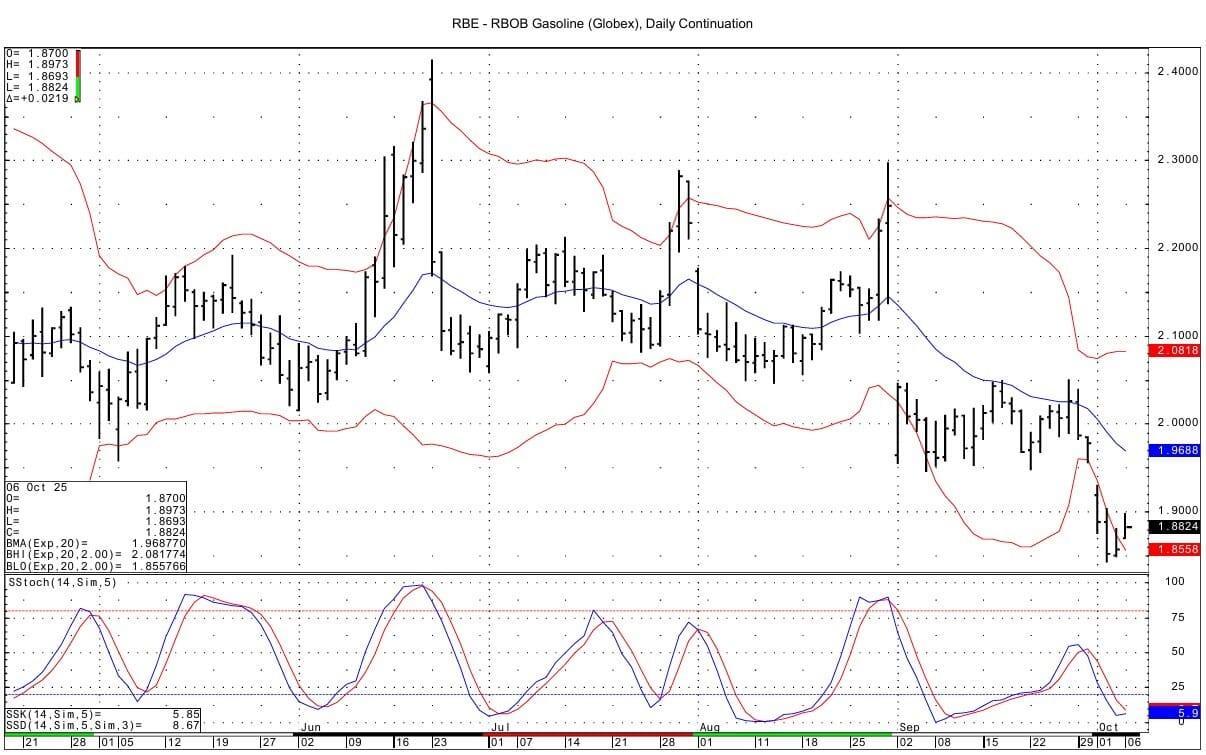

Technically RB and the crude oils have rebounded after testing their lower DC chart bollinger bands last week. In fact, the RB has risen back above the lower bollinger band after trading well below it in the prior 3 sessions. Momentum remains negative for the energies, but that for RB is getting near oversold.

WTI spot futures have support at the low seen last week at 60.40-60.47 and then at 59.74. Resistance lies at 62.52-62.54 and then at 63.18-63.26.

RB spot futures see support at 1.8589-1.8590 and then at 1.8420-1.8435. Resistance lies at 1.9039-1.9043 and then at 1.9173-1.9176.

ULSD spot futures support comes in at 2.2278-2.2295 and then at 2.2057. Resistance is seen at the overnight high at 2.2697-2.2714. Above that resistance lies at 2.2936-2.2954.

Natural Gas Market Overview

Natural Gas---NG is up 8.7 cents at $3.411

NG prices are up with U.S. production down, U.S. demand up and feedgas volume for LNG export running over the 30 day average. Also supportive is the strength in TTF prices, which have gapped higher as Qatari maritime operations have been suspended.

Lower 48 natural gas demand is estimated 1.97 BCF/d higher today at 68.7 BCF/d, Bloomberg shows, to edge back above the five-year seasonal average.

U.S. domestic natural gas production is estimated 0.44 BCF/d lower today at 107.6 BCF/d compared to an average of 108.1 BCF/d over the previous week, according to Bloomberg data.

LNG terminal feedgas is today estimated at 15.84 BCF/d, Bloomberg shows, compared to the 30-day average of 15.36 BCF/d. Cove Point supply remains at zero amid maintenance. Thus, when the Cove Point plant returns in about one week's time, LNG feedgas volume would rise to over 16 BCF, as Cove Point's facility has a daily liquification capacity of 0.75 BCF/d.

TTF prices in Europe have gapped higher today with Qatar suspending all maritime operations, due to a technical malfunction in the Global Positioning System (GPS). Additionally aiding TTF prices is the fact that EU gas storage stood at 82.75% of capacity as of October 4, down from 94.32% last year and at their lowest levels since 2021, data from industry lobby group Gas Infrastructure Europe showed. Europe will need to import up to 160 additional liquefied natural gas cargoes this winter due to lower storage and a decline in pipeline flows from Russia and Algeria, according to analysts and data, deepening its dependency on U.S. gas. By the end of the current winter in March 2026, storage volumes could drop to a seven-year low of 29% of capacity, according to Kpler. (Reuters)

UBS sees U.S. LNG exports exceeding 18 BCF/d by late 2026, while reduced associated gas output and potential winter volatility could lift prices above $4.20 in 2026. According to UBS strategists, the U.S. natural gas market is transitioning from domestic oversupply to export-driven tightening. UBS warned that total U.S. gas output could stagnate as lower oil drilling reduces associated gas production. Assuming normal temperatures, UBS said it maintains a “constructive” outlook and continues to favor longer-dated contracts, including those for delivery in summer 2026. “We continue to believe a higher price is required to secure the supply growth needed to accommodate greater US natural gas exports in 2025 and 2026”. (Trading News.com / Investing.com)

The Baker Hughes natural gas rig count issued Friday showed an increase of 1 unit.

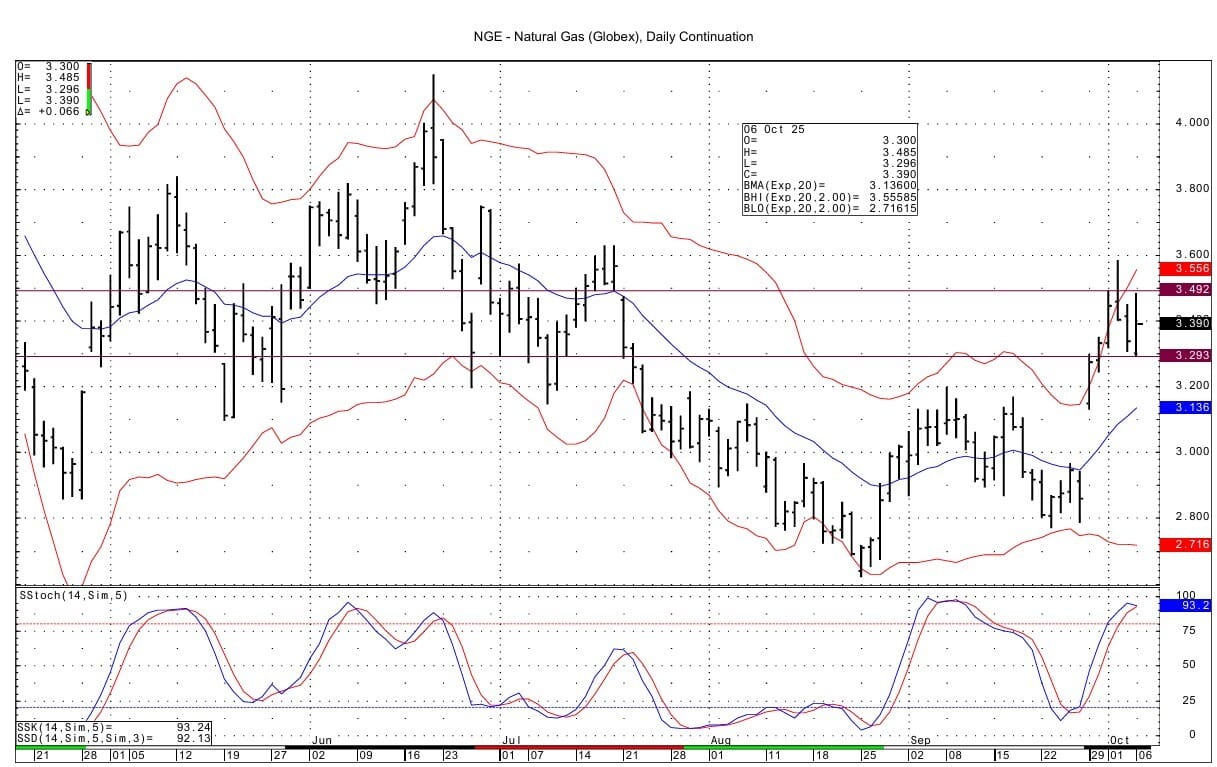

Momentum remains positive for the NG basis the DC chart, although it is getting near overbought and seems poised to be cresting. The current spot NG futures price is well off the overnight high of 3.485, while on the flip side, the low for the session of 3.296 was seen on the opening last night with the price quickly shooting up to above 3.33. Resistance lies at the session high at 3.485-3.494. Support lies at the session low at 3.293-3.296.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply