- Daily Energy Market Update

- Posts

- Daily Energy Market Update October 14,2025

Daily Energy Market Update October 14,2025

Liquidity Energy, LLC

WTI is down $1.30 at $58.19 RB is down 1.92 cents at $1.8246 ULSD is down 4.85 cents at $2.2012

Liquidity’s Daily Market Overview

Energies are lower with spot crude futures at their lowest level since early May. Prices are being pressured by the ongoing "trade spat" between the US and China. Also weighing on prices is the IEA report today forecasting a greater supply surplus than they had forecast prior.

"The oil market has been in surplus since the start of the year, but stock builds have so far been concentrated in crude in China and gas liquids in the U.S.," the IEA said. The oil market is facing an even larger surplus than previously anticipated, with global inventories soon poised to rise as large crude shipments make their way to major hubs, the IEA said in its closely watched monthly report. The IEA raised their 2025 and 2026 global oil supply growth forecasts each by 300 MBPD. 2025 global oil growth is seen at 3.0 MMBPD, and for 2026 it is seen at 2.4 MMBPD. The IEA's global oil demand growth forecast for 2025 was reduced by 27 MBPD to 710 MBPD, while that for 2026 was raised by 1 MBPD to 699 MBPD. The global oil market surplus will reach 3.6 MMBPD in the fourth quarter, compared with a 1.9 MMBPD average so far this year, the IEA said in its monthly oil report today.

The IEA said that they see drone attacks on Russian infrastructure weighing on Russian refinery runs until mid-2026. The IEA currently sees Russian processing rates at just under 5 MMBPD through June 2026, and a recovery toward 5.4 MMBPD later. The IEA adds that Ukraine drone attacks have cut Russian refinery runs by 500 MBPD. With the drone strikes weighing on refinery runs, Russia raised its crude exports in September to 5.1 MMBPD, the highest since May 2023, according to the IEA. The crude exports rose on the month by 370 MBPD, as per the IEA. Export curbs amid the reduced refinery runs has seen Russian fuel supplies to other countries in September fall to their lowest in a decade at 2.4 MMBPD. September's fuel oil product exports fell by 140 MBPD, mainly driven by gasoil and fuel oil. The IEA added that Russian (Financial Post/Reuters)

The U.S. and China have raised new tariffs and export controls on each other, but they may just be a negotiating tactic, as per commentary from Time magazine. Last Thursday, China raised export controls on rare earths that are set to take effect November 8th. In response, Trump on Friday announced a 100% tariff on Chinese goods, on top of existing levies on Chinese products. On Tuesday, Beijing also announced sanctions against five U.S.-linked subsidiaries of South Korean shipbuilder Hanwha Ocean, while the U.S. and China will begin charging additional port fees on ocean shipping firms. Some easing of tension between China and the U.S. was seen on Monday, as the U.S. Treasury Secretary said that there had been substantial communication with China over the weekend and that he is optimistic that there can be a de-escalation with China. The Treasury Secretary said he expects to meet with his Chinese counterpart in Asia in coming weeks. (Politico/Reuters) China’s Ministry of Commerce said the two sides have continued to communicate, urging Washington to ‘show sincerity’ after flare-up, as working level talks were held Monday. (South China Morning Post)

News reports say that Saudi Arabia's crude exports to China will fall to 40 MMBBL in November as refiners switch to cheaper spot supplies from other Middle East producers. This is down from October imports into China from Saudi Arabia of 51 MMBBL. Data shows that the price of Middle East crude benchmarks Dubai & Oman is currently more than $1 lower than its average last month. This makes spot cargoes for Chinese buyers more appealing than long-term supplies, sources say. (Energy News)

Reuters details comments from oil executives from a conference in London this week in which the executives see the oil market rebalancing in the medium term from the current surplus. TotalEnergies CEO said that oil production from producers outside of OPEC will start to decline if oil prices fall to $60 per barrel. ExxonMobil's CEO warned that decline rates could hit 15% per year without investment in unconventional oil and gas fields, and said that in his view oversupply will be a "short-term issue." ConocoPhillips CEO said that oil prices could recover to $70-75 a barrel, as in the mid-cycle supply will have to be generated to meet demand. He posed the question as to where oil supply will come from in the face of plateauing or peaking U.S. unconventional supply. He sees demand growth at 1 MMBPD over the next decade.

Today the retail gasoline price at the pump in the U.S. fell to its lowest price since January 14th. Today's price is $3.076, as per AAA data. One month ago the price was $3.175.

The API and DOE weekly oil statistics will be released a day later this week due to yesterday's Federal holiday. API data will be released Wednesday evening and the DOE report will be issued Thursday at noon.

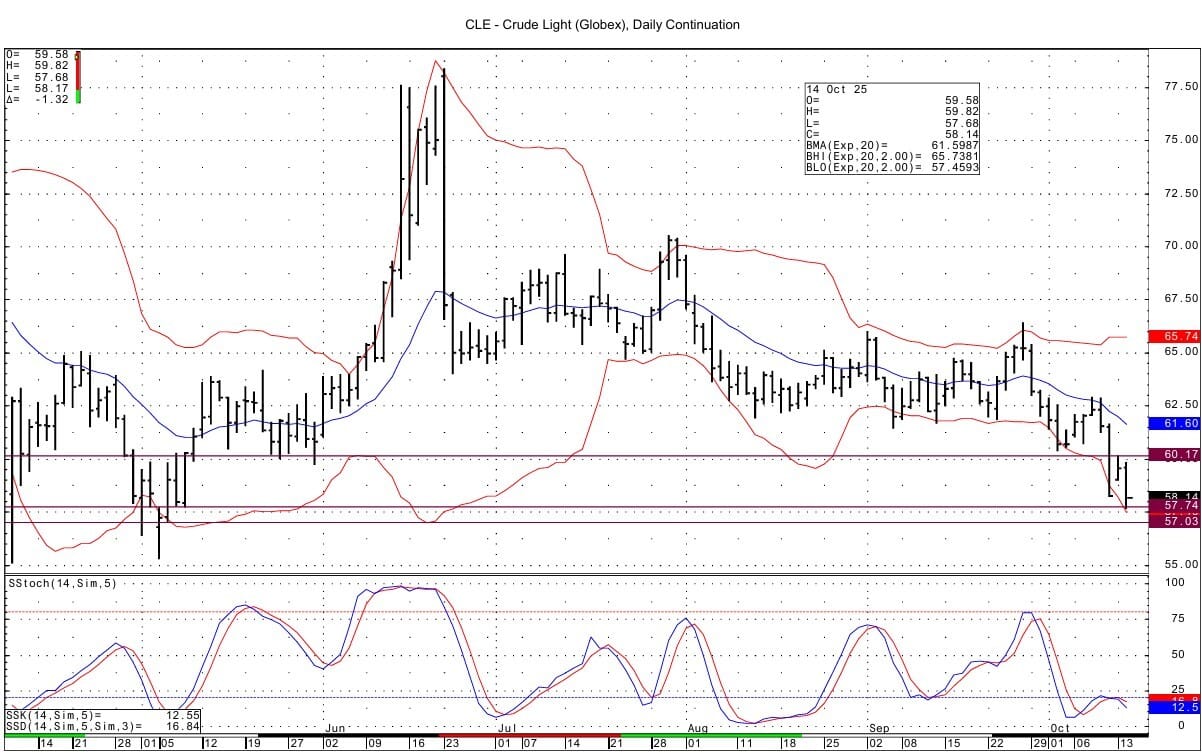

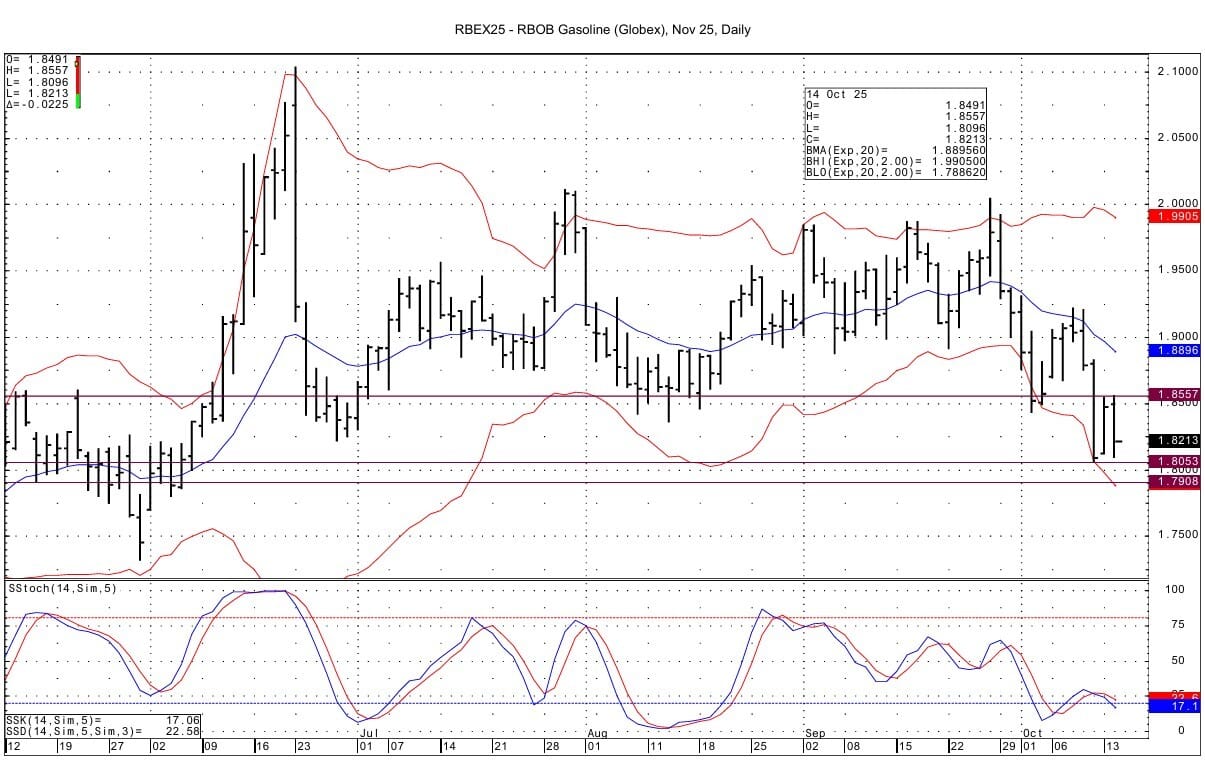

Energy Market Technicals

Technically momentum is negative for the energies on the DC charts. There are double tops from yesterday/today on the November RB & ULSD.

WTI support at 57.74-57.81 has been tested today with a low of 57.68. Light support below that lies at 57.03. Resistance comes in at 60.17-60.26.

RB spot futures see support at 1.8053 and then at 1.7900-1.7908. Resistance lies at the double top at 1.8548-1.8557.

November ULSD sees its double top at 2.2600-2.2608. There is likely some resistance below that from prior lows at the 2.2278-2.2295 area. Support comes in at the lows from last Friday and mid-August at 2.1875-2.1879, that were tested today with a low of 2.1847. Below that support is seen at 2.1693.

Natural Gas Market Overview

Natural Gas --- NG is 7.8 cents at $3.040

NG futures are lower as one market analyst's comment sums up pricing: “Yet until colder weather arrives, it may remain difficult for natural gas to sustain a break higher.”

November NG was stronger than the rest of the winter strip in Monday's activity. Was this a result of some short covering based on the index roll that ended Monday, thus seeing buying of November against selling of January contracts? November settled up 1.2 cents, while December settled down 1.8 cents, while January settled down 1.1 cents, February down 0.8 cents and march down 0.5 cents.

Analysts from Enverus estimate that the Haynesville region ( of Eastern Texas and Northern Louisiana) now holds only about 614 top-tier drilling locations, roughly one year’s worth of prime wells. Producers have extracted most of the “sweet spots,” forcing them to either accept thinner returns or wait for prices to rise. To sustain export and domestic demand simultaneously, Haynesville would need to raise production by one-third, covering roughly 40% of the expected LNG expansion. That would require prices near $5.00 per MMBtu, well above the current $3.00 mark, to make less-productive areas economical. The Permian Basin, rich in associated gas, continues to flare and choke back production because of limited takeaway capacity. Meanwhile, the massive Appalachian Basin in the Northeast is hampered by political and environmental hurdles that block new pipelines to the Gulf Coast. This bottleneck forces LNG terminals in Louisiana and Texas to lean disproportionately on Haynesville volumes. Without fresh investment in midstream infrastructure, those pipelines risk becoming the weak link that curtails export growth. One gas producing company executive says : " The balance is delicate: an extra $1 increase in gas prices could make U.S. LNG less competitive globally, but without that premium, domestic output cannot sustain the export surge." (TradingNews.com)

Technically NG futures have negative momentum basis the DC chart. Support at 3.021-3.023 has been tested today with a low of 3.020. Next support is then at 2.960-2.964, with a gap to fill on the DC chart down to 2.944. Near term resistance is seen at 3.130-3.138.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply