- Daily Energy Market Update

- Posts

- Daily Energy Market Update November 6, 2025

Daily Energy Market Update November 6, 2025

Liquidity Energy, LLC

March 3, 2026

WTI is up 19 cents at $59.79 RB is up 3.58 cents at $1.9451 ULSD is up 7.44 cents at $2.5069

Liquidity’s Daily Market Overview

Energies are higher led by strong increases in product prices, with ING saying that the rise in the crack margins is more a function of supply concerns rather than strong demand. Market News commentary cites refinery disruptions for the strong HO/ULSD pricing. The DOE data seen yesterday supports the notion of supply concerns -with gasoline supplies falling to their lowest level since November 2022.

The DOE data disappointed as crude oil stockpiles built versus a small draw that was forecast; the crude oil build corroborated that seen the night before in the API data. Also somewhat disappointing was the distillate stocks draw being less than expected and less than seen in the API data. Crude supplies built as imports rose by 873 MBPD. Bloomberg states that this week's crude oil build of 5.202 MMBBL was the most seen since July. The market likely was also disappointed by the fresh record crude oil production figure of 13.651 MMBPD, rising from last week's record of 13.644 MMBPD. Distillate stocks were negatively impacted by the drop of 312 MBPD in distillate exports. Gasoline stocks dropped by 4.729 MMBBL to 206 MMBBL, their lowest level since November 2022, despite exports and demand that were relatively flat, as per Bloomberg reporting. Midwest gasoline stocks fell to the lowest level ever at 42.536 MMBBL. The prior low was 42.550 MMBBL, seen in September 2022. (Reuters)

Marathon's Galveston refinery had a hydrogen compressor trip at the resid hydrotreater unit early Wednesday, per a Texas Commission on Environmental Quality filing. The refinery has a total capacity of 631 MBPD. Further underscoring the disruptions to supply is the ongoing outage from one week ago at the large Al-Zour refinery in Kuwait. The refinery is a key supplier of diesel and jet fuel to Europe. (Energy Intelligence)

The notion of supply concerns has also been boosted this week by the claim by Ukraine that they struck Lukoil’s Norsi refinery in Russia. Norsi has a capacity of around 340 MBPD. The refinery is a key supplier to the Moscow region; it was previously attacked in mid-October. Today, Ukraine is said to have launched at least 75 drones at Russia, sparking a fire in an industrial area of the southern city of Volgograd, affecting a refinery there. (Investing.com) A technological unit at the Belarus 200 MBPD Naftan refinery caught fire but the blaze, involving diesel fuel, has been brought under control. (Market News) Additionally, yesterday we noted the cessation of fuel exports from the Russian terminal at Tuapse on the Black Sea.

Additionally, a market commentary re the current diesel inventories in the U.S. says: " the general consensus the last three years is that relatively mild winters had saved the diesel and heating oil market from a seasonal price spike. But given the inventory numbers, it may be time for diesel consumers to begin praying for another balmy few months. " The commentary cited the fact that distillate supplies did not grow in the third quarter as much they should, as they remain below last year. (Freight waves) Distillate fuel oil stocks are at 111.5 MMBBL, which is 4.3 MMBBL below year ago level. The DOE says that supplies remain 9% below the 5 year average.

Saudi Arabia cut the OSP for December loadings on its flagship Arab Light into Asia by $1.20/bbl to leave it at a premium of $1/bbl over the benchmark – the lowest level since January. OSP's for Heavy and Medium crudes to Asia were cut by $1.40. Prices were left unchanged to NW Europe and the Med, while prices to the U.S. were cut by 50 cents. (ING) The $1.20 cut in the A-Light OSP to Asia was in line with the Reuters survey forecast.

Today's strong uptick in HO/ULSD prices comes even as the FAA has signaled that U.S. airplane flights will be cut by 10% beginning Friday in 40 "high volume" markets, due to staffing issues by air traffic controllers amid the US government shutdown. (AP News)

India’s Reliance Industries, usually a major buyer of crude, sold a shipment of Iraqi oil to a refiner in Europe. The reasons for the move were unclear. (Bloomberg) Much interest is being focused on Indian refiners buying ( and thus selling ) activities as they have been major buyers of Russian crude in recent years; the market is curious now to see how Indian refiners proceed amid the US sanctions levied against Russian oil.

In the year to November 4, global oil demand has risen by 850 MBPD, below the 900 MBPD projected previously by J.P. Morgan, the bank said in a client note.

The boss of commodities trader Mercuria said at the Adipec conference on Wednesday that an oversupply in the oil market is likely to be as much as 2 MMBPD next year. (Bloomberg)

Energy Market Technicals

Momentum for the RB & crude oil are negative basis the DC charts, while that for the HO is positive, although near overbought. HO futures today have risen to their best spot value since July 21-while the RB has a stepladder up pattern from the past few days as it reaches into the DC chart gap that goes up to 1.9692.

WTI spot futures still seem stuck in a sideways trading pattern. Support comes in at 59.00. Resistance lies at the highs from the prior 2 sessions at 61.03-61.09 and then at 61.50.

RB spot futures see resistance at the gap at 1.9680-1.9692 and then at 1.9901-1.9916. Support lies at 1.8990-1.9006.

ULSD spot futures resistance is from highs seen in June at 2.5275 and then at 2.5544. Support is likely at the recent prior highs at 2.4645-2.4664 and then at the double bottom from Wednesday/today at 2.4260-2.4264.

Natural Gas Market Overview

Natural Gas--NG is up 5.9 cents at 4.291

NG futures are higher, but are having their 2nd inside trading day in a row. The market seems buffeted by strong LNG demand and cooler weather upcoming versus strong production and ample storage-even as today's EIA gas storage data will shrink the surplus to the 5 year average.

On Wednesday, LSEG said average gas output in the Lower 48 states rose to 109.0 BCF/d so far in November, up from 107.0 BCF/d in October and a record monthly high of 108.0 BCF/d in August. Today's gas output, as per Bloomberg data, is 110.07 BCF/d, versus the 30 day average of 109.1 BCF/d.

EIA gas storage estimates for today's data are calling for a build of 31 to 33 BCF, as per news wire surveys. This compares to last year's build of 68 BCF and the 5 year average build of 42 BCF.

The average amount of gas flowing to the eight big U.S. LNG export plants rose to 17.4 BCF/d so far in November, up from a record 16.6 BCF/d in October. (Reuters)

Lower 48 natural gas demand is estimated 1.41 BCF/d higher today at 79.54 BCF/d compared with the 30-day average of 74.5 BCF/d and five-year seasonal average around 70.2 BCF/d, Bloomberg shows.

The next day Henry Hub cash price continued Wednesday to trade at a large discount to the front month December futures. Cash was quoted $3.550/$3.630 mid-morning versus December futures printing $4.321. The differential of 69 to 77 cents was slightly less than the 83 cents differential seen Monday, but wider than the 41 to 51 cents one seen last Thursday. The November /December futures spread settled on expiration at -43.9 cents, which was the narrowest the spread had been in 6 1/2 months.

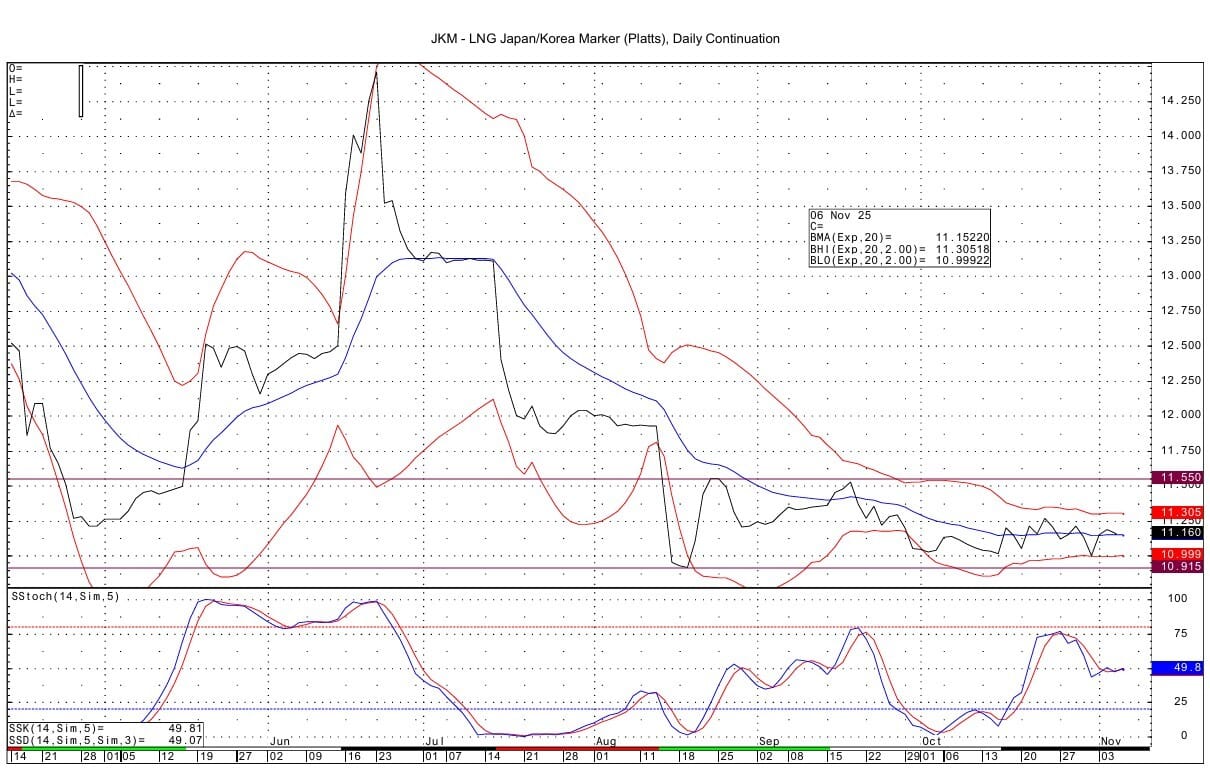

Above average winter temperatures in large parts of China may curb the nation’s LNG imports further: Bloomberg. The JKM Asian futures gas contract has been in a narrow sideways trading pattern over the last 3 months, with highs near $11.550 and lows near $10.915 /MMBtu during that time.

TTF European gas futures are slightly lower with market commentary citing strong LNG imports. "The market shrugged off concerns that lower-than-expected wind power generation would boost demand for natural gas, instead focusing on the rising availability of supply," ANZ analysts say. The latest positioning data shows that investment funds cut their net long in TTF by 24.8TWh over the last week to 21.4TWh, the smallest net long held since March 2024. In fact, the investment fund gross short stands at a record high of a little more than 393TWh, despite the European balance remaining vulnerable in the 2025/26 winter, with storage 83% full vs. a five-year average of 92%. "The large gross short does leave some positioning risk in the market, particularly if there are any surprises through the heating season," ING analysts say. (WSJ) Here, as in the JKM market, the TTF futures have a mostly sideways pattern to price action seen over the past 3 months.

Global data centre electricity demand is expected to almost double by 2030, reaching about 1,587 TWh, up from 860 TWh in 2025, according to S&P Global Market Intelligence. The increase will be fueled by AI, crypto mining and cloud computing demand. (S&P Global Commodity Insights)

Technically, momentum on the NG DC chart looks to be cresting and is overbought. Resistance is seen at the high of 2 days ago at 4.396 and then at 4.444-4.447. Support comes in at 4.183-4.186.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply