- Daily Energy Market Update

- Posts

- Daily Energy Market Update November 24,2025

Daily Energy Market Update November 24,2025

Liquidity Energy, LLC

March 3, 2026

WTI is up 16 cents at $58.22 January RB is up 0.71 cents at $1.8212 January ULSD is down 3.54 cents at 2.3587

Liquidity’s Daily Market Overview

Energies are mixed with RB and crude oil higher, while distillates are quite a bit lower as the market is consumed with ongoing talks between the US and Ukraine aimed at ending the Ukraine conflict. Crude prices have been supported somewhat by the possibility for a December rate cut by the Fed, which is seen lifting risk-on sentiment.

One analyst said : “Several factors point to a peace agreement or possibly a ceasefire moving closer over the weekend, which supports further price declines this week.” Negotiations may be extended beyond the Nov. 27 deadline initially set by US President Donald Trump, Rubio said. Obstacles to a deal remain, including concern among European leaders that the initial proposed framework was too generous toward Moscow. (Bloomberg) But, President Trump said on Monday that the U.S. and Ukraine had made "big progress" in settling on a peace proposal to put to Russia. While the Ukraine leader said Monday to European leaders: "Putin wants legal recognition for what he has stolen, to break the principle of territorial integrity and sovereignty, and that's the main problem." (WSJ)

The Baker Hughes oil rig count issued Friday showed an increase of 2 units.

The latest positioning data shows speculators increased their net long in ICE Brent by 13,497 lots over the last week. The move was driven by fresh longs entering the market. Speculators increased their net long in ICE gasoil over the last reporting week, given the market's strength. The managed money net long increased by 3,909 lots for the week ended Tuesday November 18. (ING) CFTC data issued Friday showed money managers' positioning as of October 7th. For ULSD, the net change from September 23 positioning was a fall in net length of 3,214 contracts to 18,297 contracts, as there was a slight increase in new short positions. From September 23rd to October 7th, the RB net length fell by 8,594 contracts to 42,363 contracts, as longs were shed. Managed money increased their net short in WTI futures/options on ICE/CME combined between September 23rd and October 7th, largely as short positions on the CME were increased by 37,911 contracts during that span. Thus, the money managers net short position in WTI futures/options on ICE/CME totaled 42,487 contracts as of October 7.

Reports suggest that the 615 MBPD Al-Zour refinery in Kuwait is set to start increasing output through December, after facing issues since October that kept it operating at only around a third of capacity. A ramp-up in output should help ease some of the lingering supply concerns, as will any loosening of sanctions against Russia, which has seen the January HO/CL crack fall a further $1.87 today to $40.62. That is down from the high near $49.35 seen last Tuesday. Reports have Citgo and Pemex bringing back some of their operations at their Texas refineries. Details were not seen. (Quantum Commodities)

Energy Market Technicals

Momentum remains negative for the energies.

The WTI DC chart lower bollinger band intersects at 57.75. There is a double bottom from Friday/today for the spot WTI at 57.38 / 57.42. There remains a rollover gap above from 58.80 to 58.86. Above that resistance is seen at 60.44-60.51.

January RB support is seen at 1.7971-1.7984 and then at 1.7846-1.7863. Resistance lies at 1.8345-1.8351 and then at 1.8558-1.8564.

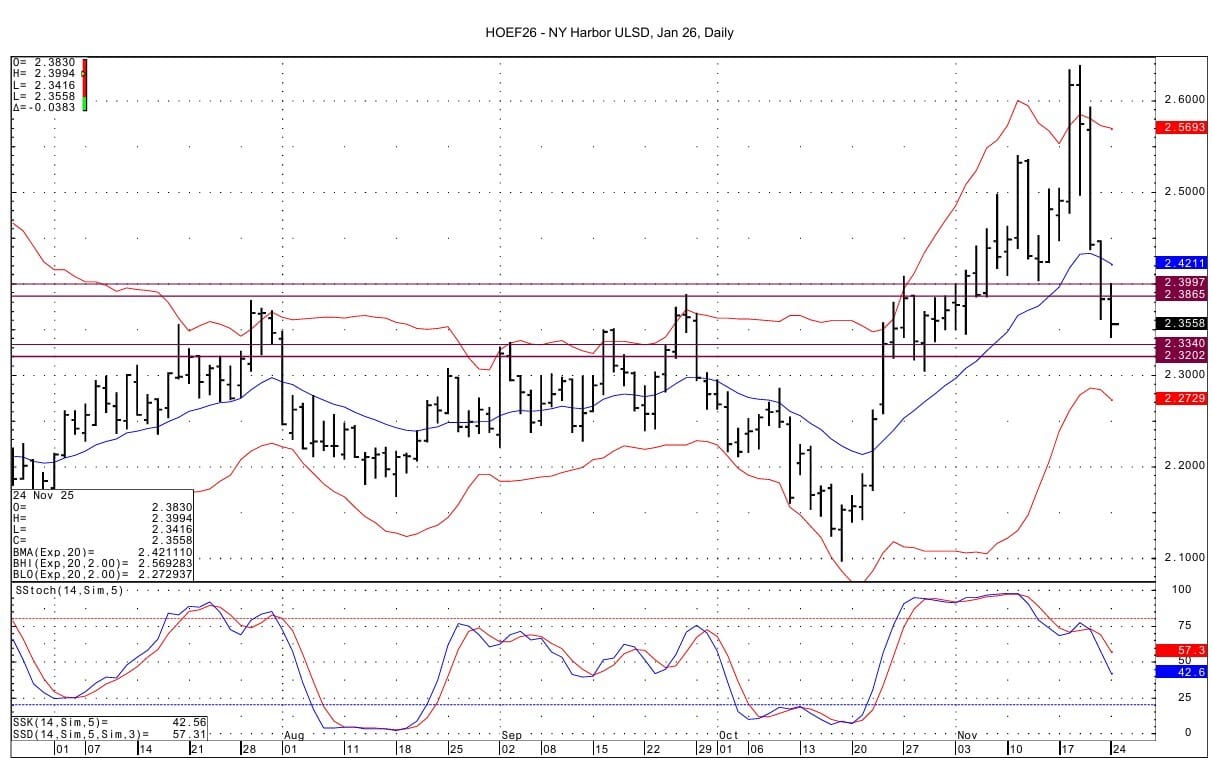

ULSD January futures see support at 2.3340-2.3363 and then at 2.3187-2.3204. Resistance lies at 2.3861-2.3865 and then at 2.3994-2.3997, which is the overnight high.

Natural Gas Market Overview

Natural Gas--January NG is down 10.3 cents at $4.640

January NG futures are down, despite a colder forecast for late November into early December and strong feedgas demand. The near term weather though is on the warm side. Also this week's EIA gas storage number is seen as a small build.

LNG feedgas demand continues to hover just below record highs at 18.5 BCF/d today, up +4.5 BCF/d vs last year. However, the total natural gas supply (production + imports), at 114.6 BCF/d, is also up between +4-5 BCF/d, neatly offsetting the greater LNG feed gas demand, as per Celsius Energy commentary.

Heading to the December futures expiration tomorrow, the front month spread has narrowed in conjunction with a narrower cash/spot futures differential. The front month NG spread has narrowed to as high as -12.3/-12.5 cents in the past 2 sessions; this is versus a settlement of -23.2 cents seen 1 week ago. On Friday, Henry Hub next day cash traded $4.210, which was 21 cents higher than seen Thursday, This was versus December futures printing near $4.62. The cash spot futures differential thus narrowed to roughly 41 cents --from the 53.5 / 59 cents differential seen Thursday and that of $1.00 seen on the prior Friday.

Going forward, the expectations for end of season (March EOS) gas inventories in storage will carry greater weight. Celsius Energy is forecasting EOS storage at 1.766 TCF. The EIA this month said they see EOS at 2.000 TCF. The Desk forecasts EOS at 1.842 TCF. As we enter the winter withdrawal season, these March EOS estimates will hold greater weight in the markets assessment of futures pricing, as will each day's weather outlook.

Celsius Energy is forecasting a build of 8 BCF in this week's EIA storage data. This would be the worst gas storage number seen in the past 6 years. In 2023 there was a build of 3 BCF. The best storage number seen since 2020 occurred in 2022 with a draw of 80 BCF. This week's EIA gas storage data will be released one day early on Wednesday Nov. 26 at Noon due to the Thursday Thanksgiving holiday.

The December LN/NG options expire today with open interest data from the CME showing the nearby strike with the largest total open interest is in the $4.50 strike with nearly 67,000 contracts. This large amount of open interest may act as a magnet for the December futures settlement today. The December $4.25 strike has open interest totaling over 39,000 contracts.

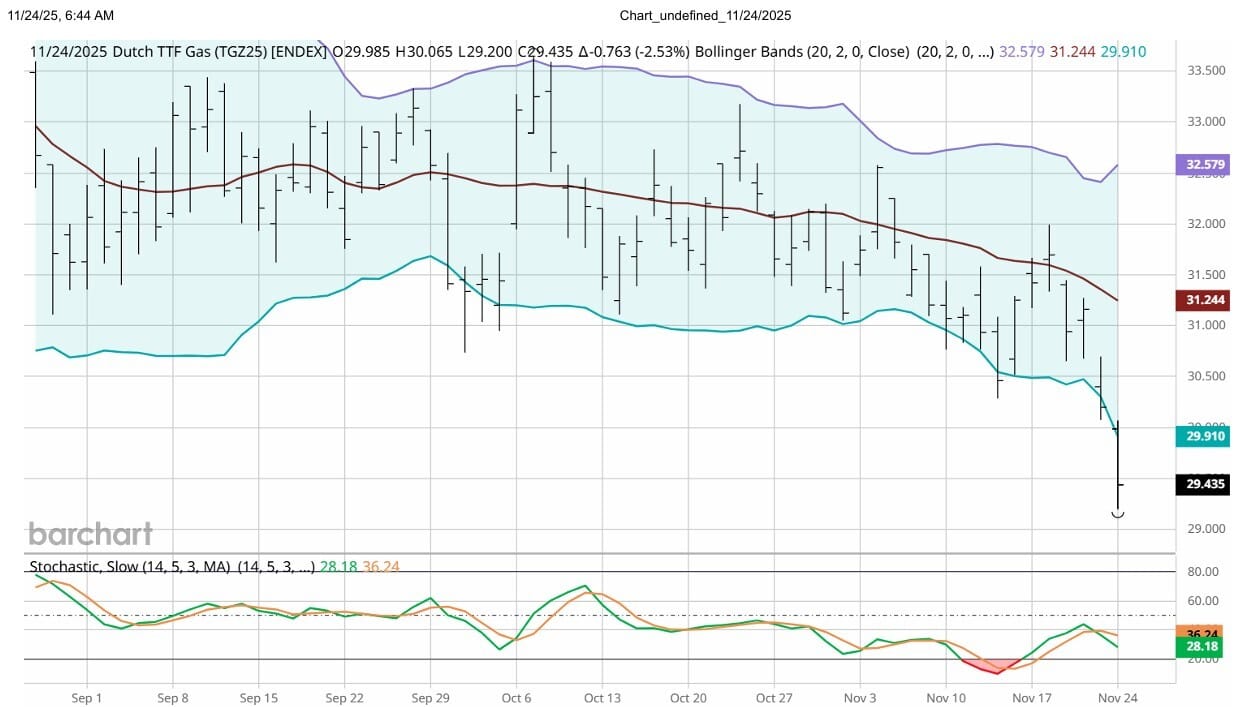

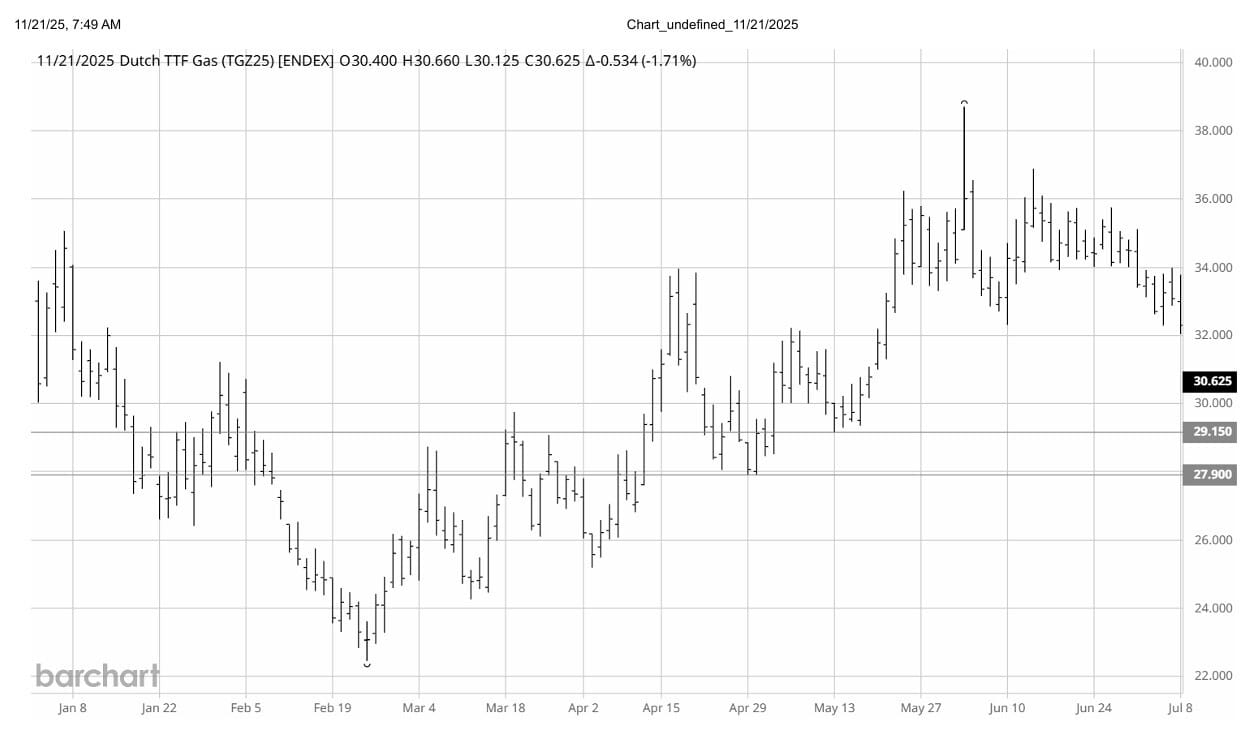

The prospect for a solution to the Ukraine war has seen the European TTF gas futures fall to their lowest spot price since May 13, 2024. Support at Euro 29.15 from data from May 2024 was almost tested with today's low of Euro 29.20. Below this support is seen at Euro 27.900. The TTF spot futures are testing the contract's lower bollinger band on the DC chart today.

The Baker Hughes gas rig count issued Friday showed an increase of 2 units.

Money managers shed 32,765 contracts of their net short position by covering shorts in the period from September 23 to October 7. Their total net short position thus stood at 42,487 contracts.

Technically, momentum is negative and the prior 3 highs for the January futures have created a bit of a wall of resistance lying between 4.800 and 4.806. Nearby support comes in at 4.554.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply