- Daily Energy Market Update

- Posts

- Daily Energy Market Update November 11, 2025

Daily Energy Market Update November 11, 2025

Liquidity Energy, LLC

March 3, 2026

WTI is up 55 cents at $60.68 RB is up 1.56 cents at $1.9867 ULSD is up 3.30 cents at $2.5434

Liquidity’s Daily Market Overview

Energies are higher now after dipping overnight as oversupply worries remain a key concern weighing on prices. But, sanction concerns have seen prices rebound, as per news wire accounts. The market is eagerly awaiting the monthly oil market reports forthcoming in the next 2 days. News wire accounts are filled with articles describing a range bound crude oil price. Equities worldwide are rising off of the hopes for the US government shutdown to end.

Ongoing worries associated with the Lukoil force majeure in Iraq suggest that if the reasons behind the force majeure are not resolved within six months, Lukoil will shut production and exit the project entirely, a senior Iraqi oil industry official said. The West Qurma-2 field accounts for around 9% of Iraq's total oil output and is currently producing around 480 MBPD, two oilfield officials said. Reuters had reported last week that Iraq's state oil firm SOMO cancelled loadings of three crude oil cargoes from Lukoil's equity production at the oilfield over the sanctions. Iraq has transferred operations at West Qurna 2 to Basra Oil and Missan Oil as a temporary measure to ensure production continues. (Market News)

The deal on the shutdown now heads to the House, where Speaker Mike Johnson has said he would like to pass it as soon as Wednesday and send it on to President Trump to sign into law. (Reuters) The prevailing view is that a handful of moderate House Democrats could vote in favor of the package, ensuring its passage to President Trump's desk. (Washington Post) The bill to provide US government funding until 30 January passed the Senate with the support of a number of Democrats.

"Crude oil remains trapped in its established range, with a softening backwardation signaling comfortable supply conditions," analysts at Saxo Bank say. Evidence of the softness is the December 2025 December 2026 spread having flirted with negative values the past few sessions. A Reuters analyst describes oil prices as having been "in a relatively narrow range of $60 to $70 in recent months, reflecting both warnings over rising oil supplies as well as concerns about trade wars and geopolitical conflicts." At an industry gathering in Abu Dhabi last week, heads of oil trading houses predicted that Brent oil prices would stay within the $60 to $70 range next year, with some suggesting that the feared oversupply may not be as large as the IEA predicts. “I’ve dubbed this the most anticipated oil supply, or oil supply driven glut, in history,” said one portfolio manager.

Restricted fuel exports as a result of the sanctions are propping up oil prices in the face of a crude oil glut, PVM's analyst said. "Fresh U.S. sanctions on major Russian oil producers and exporters are weighing on product exports. As a result, heating oil/gasoil and RBOB gasoline are moving in a different direction from crude," he said. European diesel refining margins are around 21-month highs of close to $31 per barrel , while European gasoline profit margins are at their highest in 18 months of almost $21 per barrel. (Reuters) The front end HO/CL crack remains near its best spot month value since February 2024 at $45.70.

But, will the cracks be under some pressure in the coming days and or weeks? Last week's DOE data showed refinery operations at 15.256 MMBPD. One year ago on the same week, refinery operations ran at 16.334 MMBPD. Are refiners set to return from some maintenance and are these strong refining margins gong to incentivize the refiners to ramp up operations??

Transportation Secretary Sean Duffy warns a 'substantial' number of Americans won't be able to travel for Thanksgiving. One big question for airlines is when the FAA will lift the government-required flight cuts. Duffy has said he first wants to see air traffic control staffing and safety data improve before removing current targets. When the shutdown ends, it could take several days or longer for air traffic to return to normal. (Reuters) Is this going to see HO/ULSD demand drop considerably? Especially given that Thanksgiving is one the busiest travel days in the year.

President Trump said that a US-India trade deal is close which would reduce the average tariff rate. However, Russia’s Interfax reported that India continues to buy Russian crude despite pressure from the US to reduce purchases.

This week's DOE oil inventory data will be delayed until Thursday due to Veterans Day. The report will be released at Noon (EST) Thursday.

Energy Market Technicals

WTI momentum basis the DC chart remains negative. RB momentum has turned positive. ULSD momentum is positive, but overbought.

WTI has risen over the resistance that was created in the prior 3 sessions at the 60.46-60.51 level. Resistance above is seen at 61.03-61.09 and then at 61.50. Support seems to have formed at the overnight low at 59.64-59.70. Below that the low seen last week at 58.83 provides support.

December Rb support comes in at the overnight low at 1.9524-1.9533 and then at 1.9353-1.9377. Resistance lies at 2.0094-2.0101.

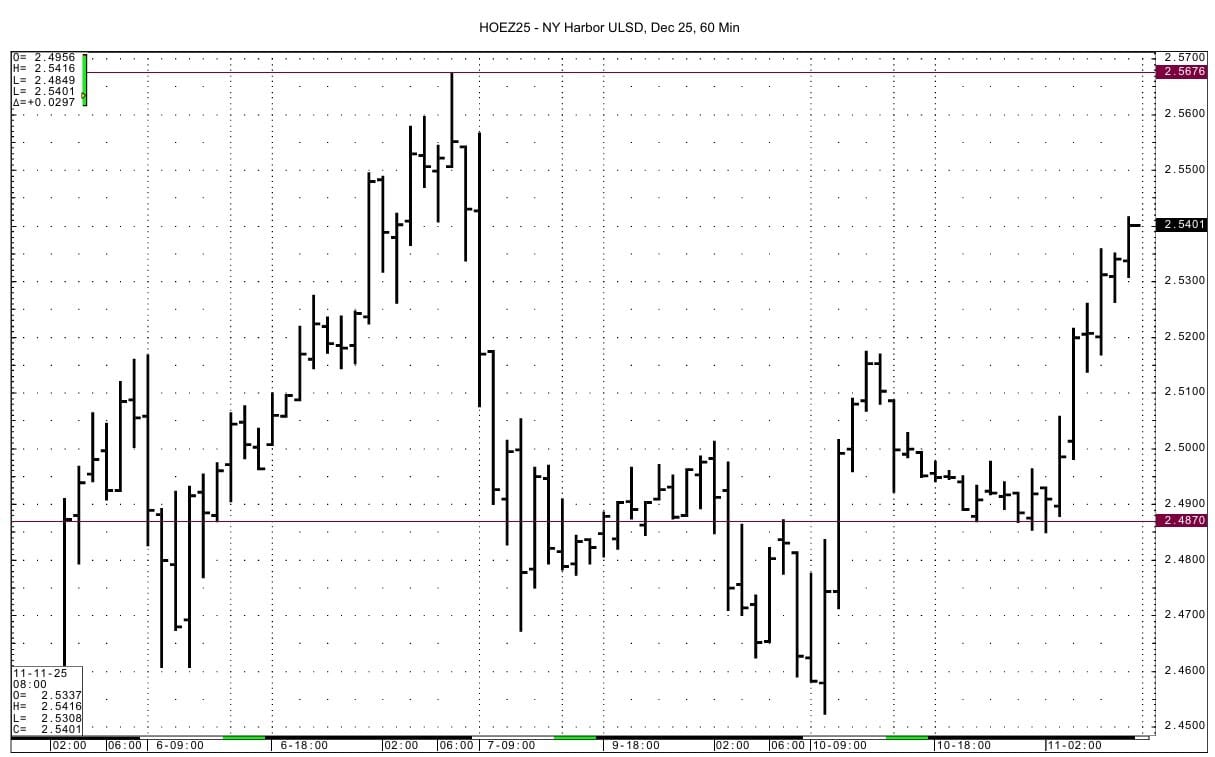

Spot ULSD futures have resistance at the high seen Friday at 2.5676. Support comes in at 2.4867-2.4875 via the December 60 minute chart. Below that support lies at 2.4650-2.4675.

Natural Gas Market Overview

Natural Gas--NG is up 1.8 cents at $4.356

After dipping overnight, NG futures are now up slightly as the market assesses weather forecasts, as this element of the gas market is the key determinant of price direction at present. Analysts say the recent rally could fade if the cold snap proves short-lived. Forecasts show temperatures moderating next week.

Monday's bounce from its intraday lows was likely due to the strong demand seen Monday as cold air enveloped much of the US. Houston saw a wind chill temperature of 32 degrees. Celsius Energy reported that the one day gas withdrawal from storage was greater than 14 BCF; Celsius Energy added that the GWDD's associated with the cold thus constituted the best Nov. 10th amount in the past 5 years on the back of lower wind generation, very strong residential/commercial heating demand, and LNG exports. But, they added that demand will drop sharply later this week as temperatures moderate. Lower 48 temperatures are forecast to rise above normal in the coming days to a peak around Nov. 16 before drifting cooler into the second week of the outlook. (Market News)

The EIA gas storage early estimates for this week's data are calling for a build of 33.5 to 40 BCF. NGI qualifies its 37 BCF forecast as a "typical start to winter". NGI adds that they see end of March 2026 storage being 1.980 TCF, if the heating season is an average one as per the last 5 seasons. NGI adds that the median average since 2010/2011 is 1.778 TCF; yet, they add that given strong LNG export gas demand, the 202 BCF difference in their estimate and the median since 2010 will be "absorbed". The Desk sees end March storage at 1.856 TCF. Last week, storage stood at 3.915 TCF. This week's EIA gas storage data will be released a day late; the report will be issued Friday at 10:30 AM.

LSEG said average gas output in the Lower 48 U.S. states has risen to 109.1 BCF/d so far in November, up from 107.0 BCF/d in October and a record monthly high of 108.0 BCF/d in August. Monday's estimate of November output so far was up slightly from the estimate of 109.0 BCF/d seen on 11/5. Bloomberg data seen Monday estimated lower 48 dry gas production at 111.10 BCF/d. One analyst suggested that gas producers were selling into the Monday rally.

LSEG projected average gas demand in the Lower 48 states, including exports, would jump to 119.3 BCF/d this week from 108.6 BCF/d last week, before easing to 115.3 BCF/d next week as temperatures moderate. The estimates for last week and this week were up a total of 1.0 BCF/d from those seen last Wednesday.

The average amount of gas flowing to the eight big U.S. LNG export plants has risen to 17.7 BCF/d so far in November from a record 16.7 BCF/d in October. Those flows are on track to increase further in coming months, Reuters adds. On November 5th, the LNG feed gas volume for November was averaging 17.4 BCF/d.

On Monday, the August LN/NG $3.50 / $3.00 put spread traded actively in a 1 by 2 ratio at a cost of 2.4 cents for the $3.50 put buyer. 4,000 by 8,000 contracts of the puts traded. Also 2,000 of the March April one month Calendar Spread Option (CSO) traded, with both the 50 cent call and 25 cent puts bought in one trade for a total cost of 36 cents. Twelve cents of that trade cost is roughly of intrinsic value with the spread trading about 13 cents Monday afternoon. Additionally in the March April one month CSO, the 50 cent/$1.00 cals spread traded actively at a cost of 3.6 cents. These positions were being closed, according to CME open interest data. In the April May one month CSO, the flat/ +10 cent call spread traded at a cost of 2.4 cents. This was an initiated position. The April May futures spread settled at minus 2.6 cents Monday. The February / March 1 month CSO $+1.00 call traded 11.4 cents. The December January one month CSO minus 10 cent call traded 1.5 cents.

Technically on Monday, NG bounced off support that we saw at 4.268 with intraday lows of 4.262-4.266. Below that support is seen at 4.183-4.192.Currently, the overnight price range for the NG spot futures is showing an inside trading day. Momentum is turning negative basis the DC chart, as the market has retreated from the fresh high for the rally seen in Sunday's overnight hours. The RSI indicator for the DC chart has fallen back below 70, thus relieving some of the overbought condition of the contract. Upside resistance is likely at the highs seen last week at 4.419-4.420 and then at 4.471-4.476. The Sunday night high is above that at 4.509.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply