- Daily Energy Market Update

- Posts

- Daily Energy Market Update July 9,2025

Daily Energy Market Update July 9,2025

Liquidity Energy, LLC

February 3, 2026

WTI is up 12 cents RB is up 0.43 cents ULSD is down 2.92 cents

Liquidity’s Daily Market Overview

Energies are mixed today with crude oil & RB higher, but ULSD lower. The higher crude price is seen supported by the EIA lowering their forecast for U.S. crude production this year and by further attacks on ships in the Red Sea. Reuters cites short covering for supporting the crude rally, as well as President Trumps' decision to put a 50% tariff on copper.

API Forecast Actual

Crude Oil -1.5/-2.1 +7.1

Gasoline -0.221/-1.5 -2.2

Distillate -0.907/+1.4 -0.8

Cushing n/av +0.1

Runs -0.5%/Unch n/av

For 2025 the EIA reduced their U.S. crude oil production forecast by 50 MBPD to 13.37 MMBPD. The EIA sees U.S. oil production falling from just over 13.4 MMBPD in Q2 of 2025 to under 13.3 MMBPD in Q4 of 2026, due to less drilling and well completion as a result of falling oil prices. The EIA raised global oil production estimates for 2025 and 2026. The forecast for global oil production in 2025 was raised by 200 MBPD to 104.6 MMBPD and that for 2026 was raised by 600 MBPD to 105.7 MMBPD. Global oil demand estimates were left unchanged for this year and next at 103.5 and 104.6 MMBPD respectively. The other item that changed quite a bit is the price forecasts for WTI and Brent for this year. The prices were raised due to the increase in geopolitical risk seen from the Iranian nuclear program. WTI is now seen averaging $65.22 in 2025, which is up $2.89 versus June's forecast. The 2025 Brent price forecast was raised by $2.92 to $68.89. Prices are seen falling back in 2026 due to rising global oil inventories. The 2026 price estimates were made before the OPEC+ decision of this past weekend to raise production more than was expected. In 2026 WTI is seen averaging $54.82, which is down 76 cents from the June forecast, while the Brent forecast for 2026 was lowered by 76 cents to $58.48.

Two seafarers on a bulk carrier have been killed in a drone and speedboat attack in the Red Sea blamed on Yemen’s Houthi rebels, the second incident in a day after months of calm. The Houthis have not claimed responsibility for the incident but Yemen’s exiled government and the European Union said it was the group’s work. Hours before the attack, the Houthis claimed they had sunk another bulk carrier off south-west Yemen on Sunday. (The Guardian)

President Donald Trump said he will announce a 50% tariff on copper on Tuesday, hoping to boost U.S. production of a metal critical to electric vehicles, military hardware, the power grid and many consumer goods. Commerce Secretary Lutnick said the copper tariffs are likely to be in place by the end of July. This would be the first time copper has faced import duties into the US. While the move doesn’t come as a surprise, the size of the levy is surprising. The market had expected a tariff of up to 25%. U.S. Comex copper futures jumped more than 12% to a record high after Trump announced the planned tariffs. (Reuters)

Iran hasn’t asked for nuclear negotiations with the United States to resume, an Iranian Foreign Ministry Spokesman said on Tuesday, disputing U.S. President Donald Trump’s remarks that a new round of talks is scheduled to be held soon. (Oil Price)

Iraq’s Dhi Qar Oil Company has raised oil production by a combined 80,000 barrels per day across three strategic southern fields. The expansion reduces Baghdad’s near-term dependence on politically fraught northern exports via the Kurdish region, which remain suspended amid ongoing arbitration with Turkey. The Dhi Qar push reflects Iraq’s shift toward intensifying output from brownfield assets rather than launching new megaprojects, many of which remain stalled by financial and logistical hurdles, with officials now calling for probes. (Oil Price)

Energy Market Technicals

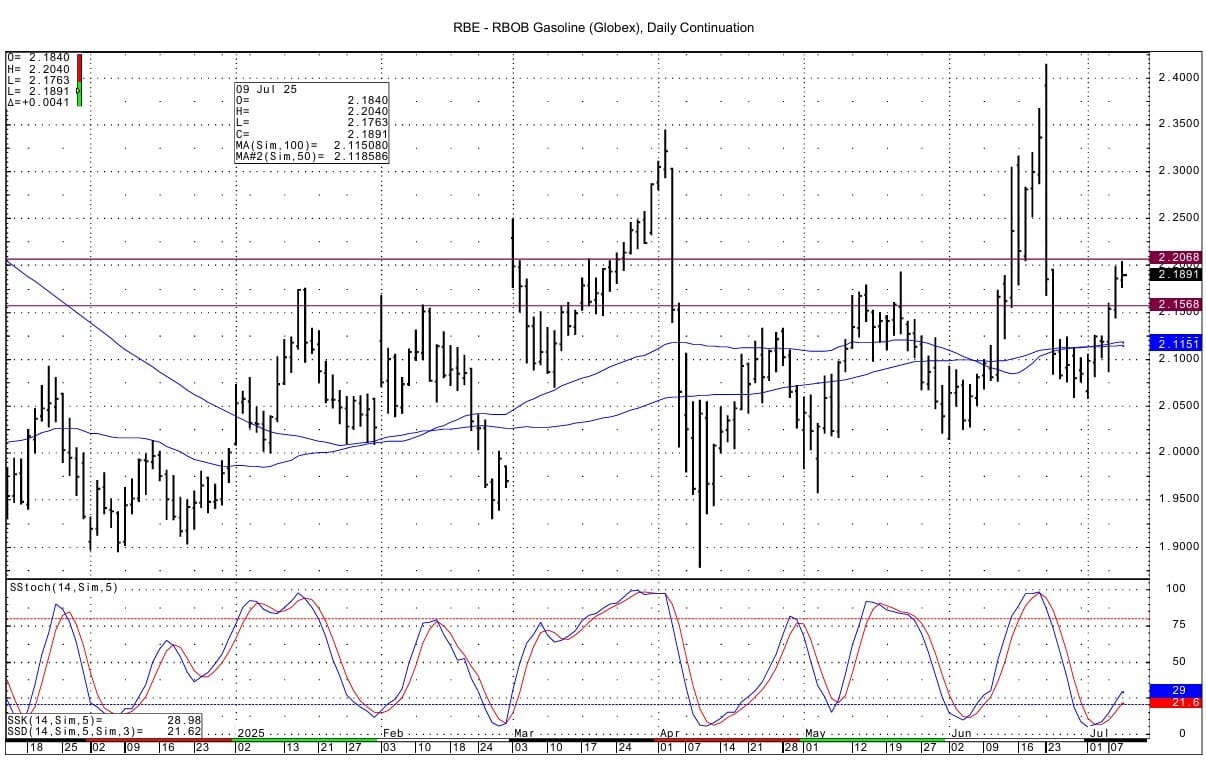

Momentum is positive for the RB and crude oil on the DC chart bases, with that for the HO trying to turn positive.

There is a double top on the WTI spot futures chart from yesterday/today at 68.91/68.94. Above that resistance lies at 70.22-70.29. Support is seen at 67.25-67.33 and then at 66.53-66.60.

ULSD has a steep upward look on the DC chart, but the current price is below the highs of the past 5 sessions. Resistance comes in at 2.4556-2.4562. The overnight high is above that at 2.4650. Support comes in at 2.3809-2.3814 and then at 2.3406-2.3422.

RB spot futures have support at 2.1552-2.1568. Resistance lies at 2.2050-2.2068. Some support may come from the 50 day moving average on the DC chart moving over the 100 day moving average.

Natural Gas Market Overview

Natural Gas--NG is down 7.1 cents

NG futures have slipped further today as weather demand is not seen as strong enough and storage supplies are seen as ample, underscored by the EIA raising their end of season storage forecast.

In NG, the EIA's STEO shows End of Season (end of October) gas inventories at 3.910 TCF, which is 5% more than the June forecast and would see inventories end October at 3% above the 5 year average. The greater inventories are a result of more NG production and less demand from the power sector, the EIA said. The greater inventories has caused the EIA to lower their NG average price forecasts for 2025 and 2026. Henry Hub natural gas prices for 2025 are seen averaging $3.67, which is down 35 cents from last month's forecast. The 2026 NG average price forecast was lowered by 47 cents to $4.41. The EIA expects that natural gas will average just almost $3.40/MMBtu in 3Q25, 16% less than last month’s forecast.

U.S. power consumption will hit record highs in 2025 and 2026, the EIA said in its short-term energy outlook on Tuesday. The demand increases come in part from data centers dedicated to artificial intelligence and cryptocurrency, and as homes and businesses use more electricity and less fossil fuels for heat and transportation. But, the EIA said natural gas' share of power generation would slide from 42% in 2024 to 40% in 2025 and 2026. Coal will see a 1% rise in its share in 2025 from 2024, but will fall back by 2% in 2026, as renewable output rises. The percentage of renewable generation will rise from 23% in 2024 to 25% in 2025 and 26% in 2026

The fall in natural gas prices has come even as the power burn generation gas figure has been strong, as per Celsius Energy commentary. After a holiday weekend dip in the gas power burn demand, a hot East Coast & weak wind generation sent power burn above 47 BCF/d Monday, up +3 BCF/d vs 2024. The gas share of the power stack was a very strong 45.5%, which is close to 2025 highs. Burns were seen holding steady Tuesday, as per Celsius Energy.

The European Parliament on Tuesday gave its final sign-off on a deal to loosen the EU's rules on filling gas storage. The deal allows EU's member states to achieve the 90% filling target at any point in time between October 1 and December 1, taking into account the start of the member states withdrawal period. Once the 90% target is met, it should not be required to maintain that level until 1 December. (Reuters)

China is not buying LNG on the spot market despite a seasonal increase in demand for electricity for air-conditioning, Bloomberg has reported. The Chinese see the LNG price as expensive. The IEA says :" We expect that China’s LNG imports will remain weak in the second half of the year, amid subdued demand, higher piped gas imports and an uncertain macroeconomic outlook,”. Meanwhile, natural gas deliveries via pipeline from Russia are set to jump by 25%, the IEA also said, suggesting China was being price-sensitive. yet, the IEA adds that China will have to return to the LNG market to import gas to fill their reserves ahead of the winter.

Technically, NG has negative momentum basis the DC chart. Support at 3.260-3.264 has been tested overnight with a low of 2.260. Below that support is seen at 3.214-3.217. Resistance comes in at 3.375-3.381 and then at 3.469-3.472, which are the highs from the prior 2 sessions.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply