- Daily Energy Market Update

- Posts

- Daily Energy Market Update July 28,2025

Daily Energy Market Update July 28,2025

Liquidity Energy, LLC

WTI is up $1.30 September RB is up 3.48 cents September ULSD is up 3.93 cents

Liquidity’s Daily Market Overview

Energies are higher as the U.S. & the EU agreed to a trade deal. Also seen as supportive is a possible extension of the trade truce between China and the U.S. The following headline seen this morning is also seen supporting oil prices :" TRUMP SAYS HE WILL REDUCE 50 DAY DEADLINE HE HAD FOR PUTIN". (Bloomberg) The 50 day deadline would end September 2nd.

Sunday's U.S.-EU framework trade pact sets an import tariff of 15% on most EU goods, while President Trump said the deal also calls for $750 billion of EU purchases of U.S. energy in the coming years. The 15% tariff rate is half the threatened rate and averts a bigger trade war between the two allies that account for almost a third of global trade. (Reuters)

On Sunday, the South China Morning Post, a Hong Kong-based English-language newspaper, reported that "Beijing and Washington are expected to extend their tariff truce by another three months at trade talks in Stockholm beginning on Monday." But, today a U.S. trade representative said : " ON CHINA TRADE: WANT TO MOVE FORWARD IN A POSITIVE WAY, DON'T EXPECT BIG BREAKTHROUGH TODAY" (Reuters)

An OPEC+ panel will meet online at 1300 GMT on Monday to review compliance with output agreements and discuss the market outlook, ahead of Sunday's separate gathering of eight OPEC+ members, at which it is expected that they will decide to increase oil output by a further 548 MBPD for September. This would mean that, by September, OPEC+ would have unwound its most recent production cut of 2.2 MMBPD, and the United Arab Emirates would have delivered a 300 MBPD quota increase ahead of schedule. Reuters commentary adds, though, some members have not raised production as much as the headline quota hikes have called for.

Baker Hughes said oil rigs fell by seven to 415 in the report issued Friday, their lowest since September 2021. The total oil/gas rig count has now fallen in 12 of the last 13 weeks. Baker Hughes said this week's decline puts the total rig count down 47 rigs, or 8% below this time last year. In Texas, the biggest oil and gas-producing state, the rig count fell by four to 249, the lowest since October 2021. The Permian basin dropped 3 rigs to 260, the lowest since September 2021. In the Eagle Ford shale in South Texas, the rig count fell by two to 39, the lowest since October 2021. Baker Hughes this week joined its U.S. rivals Halliburton and Schlumberger in warning of a slowdown in upstream activity and spending as weak and volatile oil prices have led producers to curb capital spending and drilling. (Reuters)

The Saudis are seen raising their OSP for Asian customers for September loadings. The September Arab Light OSP may rise to a 5 month high, a Reuters survey shows. The September official selling price for flagship Arab Light crude may rise 90 cents to $1.05 a barrel from August to between $3.10 and $3.25 a barrel, which would be the highest in five months, five refining sources said in a Reuters survey. The September OSPs for other crude grades - Arab Extra Light, Arab Medium and Arab Heavy - could gain 80-95 cents a barrel from August. The forecasts for OSP increases are seen due to a rise in the Dubai cash to swaps crude premiums seen over the past month. Also supporting the rise in the OSP's is the strong domestic demand seen this summer in the Mideast and Chinese demand as they have raised their refinery runs of late.

In the Middle East, Yemen's Houthis said on Sunday they would target ships of companies that do business with Israeli ports, regardless of nationality, in what they called a fourth phase of military operations against Israel over the Gaza conflict. (Reuters)

Bloomberg has an article with the following headline:" Oil Caught Between a $70 Summer and Growing Surplus Fears". The article cites several sources who are calling for a surplus in oil supplies as the year progresses. They cite the IEA and EIA' s analysis. The two widely-followed forecasters expect supply to eclipse demand by the most since the pandemic. The IEA sees a 2 MMBPD surplus, while the EIA sees a 2.1 MMBPD surplus. But, the Bloomberg article points out that from 2012 to 2024, the IEA has revised demand up on average close to 500 MBPD higher than when the estimate was first issued. The article also goes on to say that the surplus forecasts are in "a stark contrast with the here and now, where inventories at key storage hubs remain low, reflected in a bullish market structure that indicates tight supplies. Profits from turning crude into fuels are also far above seasonal norms, underpinning demand for crude."

The CFTC COT report seen Friday showed money managers reduced their net length in WTI, RB & ULSD in the data for the week ended Tuesday July 22. WTI net length in futures/options on ICE/CME combined fell by 19,090 contracts, as shorts were added and longs sold on the CME. RB net length fell by 13,138 contracts, while that for ULSD fell by 1,658 contracts. Speculators reduced their position in ICE Brent by 11,352 lots, as per ING. ING adds that net length in ICE gasoil rose by 8,012 lots to 98,180 lots, the largest position since June 2024.

Energy Market Technicals

Momentum remains negative for the energies, although that for RB & WTI look poised to turn positive if the rally continues for a day or 2. Technically there are near term supports that have formed over the past 2-3 days.

In WTI there is currently a double bottom from Friday/today at 65.00-65.05. Below that support is seen at 64.50-64.51. Resistance comes in at 66.72-66.74 and then at 67.69-67.76.

On the September daily RB chart, the past 3 days' lows lie between 2.0547 and 2.0574. Some support is likely above that at 2.0750-2.0756, via data from the 60 minute September chart. Resistance comes in at 2.1046 and then at 2.1308-2.1320.

ULSD for September sees support at 2.3850-2.3875 and then at 2.3576-2.3581. Resistance lies at 2.4436-2.4448 and then at 2.4790.

Natural Gas Market Overview

Natural Gas --September NG is up 5 ticks, while August is down 9 ticks.

September NG futures are slightly higher now having fluctuated between higher and lower pricing overnight. Spot August futures are near unchanged. Strong NG production and a weaker natural gas powerburn are seen as weights on the August futures price. Is the lure of a close for August futures near $3 with the options expiring today also a weight on prices? September may be benefiting from the EU trade deal sentiment and the prospect for hotter weather in the 2nd week of August.

US domestic natural gas production is estimated today at 108.59 BCF/d. This compares to the previous 30 day average of 107.95 BCF/d, according to Bloomberg data.

The NG futures rally seen overnight was said to be due to GWDD's having been added in forecasts over the weekend and the 2nd week of August's weather is seen above average after a brief cooldown after the intense heat of the next 3 days-as per Celsius Energy commentary. Lower 48 natural gas demand is up 2.52 BCF/d today at 82.8 BCF/d today to remain near the highest since April, Bloomberg shows.

Shares of U.S. LNG developers surged in premarket trading on Monday, after the EU pledged to purchase $750 billion worth of the super-cooled fuel over the next three years as part of a sweeping trade pact. (Reuters)

Today is the last trading day for the August NG/LN options contract. The $3.00 put options have open interest of 26,405 contracts. The $3.25 strike has the largest open interest with a total between puts and calls of almost 40,000 contracts.

The natural gas rig count rose by 5 units to 122, their highest since August 2023, in the Baker Hughes report issued Friday. (Reuters)

CFTC data seen Friday shows money managers added to their net short total by mostly selling longs in the week ended Tuesday July 22. The total net short position rose by 10,514 contracts to 30, 039 contracts.

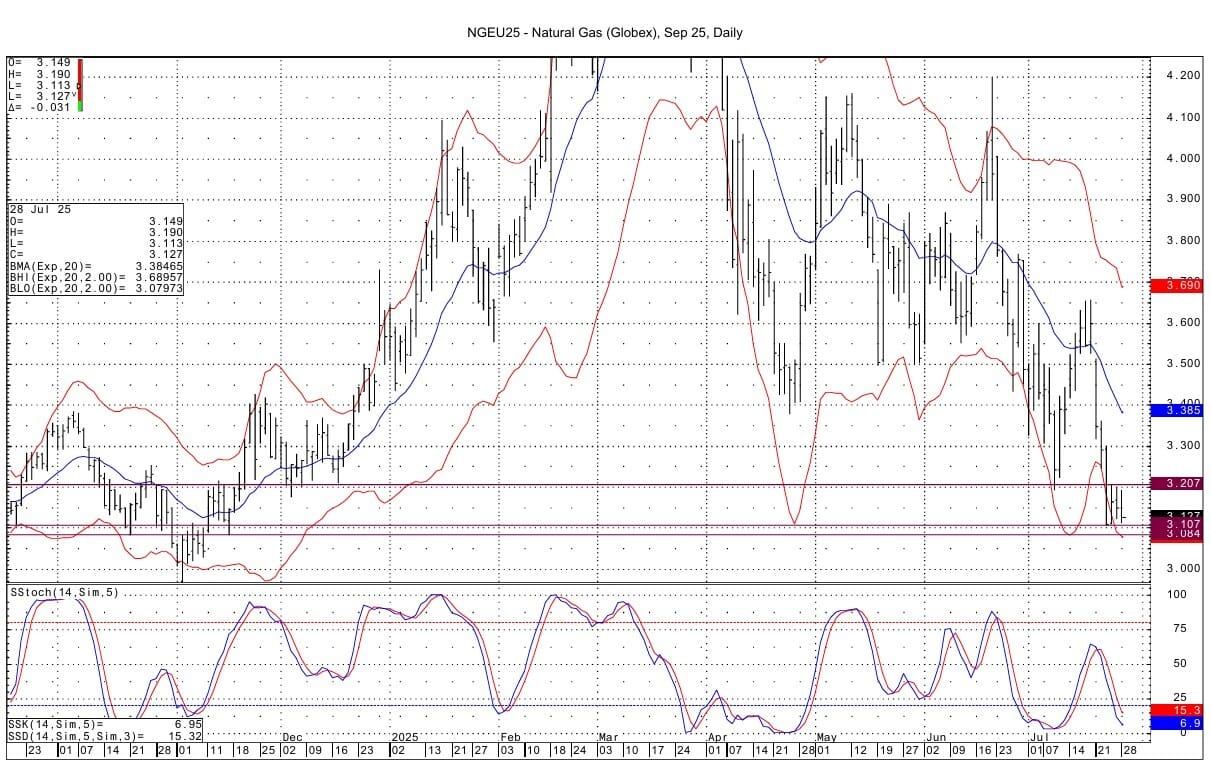

Technically, the spot NG futures have fallen to their lowest price ($3.047) seen since April 28. September NG futures, though, have as yet not fallen below the low seen last week of 3.107. Support below that is seen at 3.084-3.090. Resistance lies at 3.207 and then at 3.276-3.280.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply