- Daily Energy Market Update

- Posts

- Daily Energy Market Update July 16,2025

Daily Energy Market Update July 16,2025

Liquidity Energy, LLC

WTI is down 78 cents September RB is down 1.64 cents September ULSD is down 2.21 cents

Liquidity’s Daily Market Overview

WTI crude has reversed earlier slight gains and is lower on the day due to concerns regarding U.S. tariff proposals. Earlier gains were seen based on stronger Chinese refinery data and OPEC's continued strong demand outlook. API data shows a small crude build as per Reuters reporting. Earlier reports had shown a build in crude supplies of 19 MMBBL in the API data, but that seems to have been wrong data.

API Forecast Actual

Crude oil -1.2/+7.0 +0.839

Gasoline -1.0/-2.6 +1.93

Distillate -0.825/+0.8 +0.828

Cushing n/av +0.063

Chinese refinery thruput rose in June by 8.5% year on year and up 8.8% from May's level. State run refineries came out of maintenance. Their run rate was up 5.3% to 79.95%. Teapot/independent refiners dropped their run rate by 2.0% to 67.9%. The total Chinese run rate of 15.15 MMBPD was the highest since September 2023. June's rate was up from the low rate seen in May of 13.92 MMBPD. Chinese refiners began raising processing rates ahead of the expected peak demand in the third quarter despite generally slowing consumption of gasoline and diesel. Refiners sought to capture the higher margins, especially for diesel, in June. (Oil Price) Analysts expect strong Chinese imports and refining output to continue into July amid peak travel season and state-held refiners rebuilding gasoline and diesel stocks, which are at multi-year lows, as per Reuters citing traders and analysts. One consultant says that state refiners in the 3rd quarter will raise their run rate to 83.5%. (LSEG)

President Trump has threatened a 30% tariff on imports from the European Union from August 1, a level European officials say is unacceptable and would end normal trade between two of the world's largest markets. The European Commission is preparing to target 72 billion euros ($84.1 billion) worth of U.S. goods for possible tariffs if talks with Washington fail to reach a trade agreement. (Reuters)

Yesterday, in its monthly report, OPEC maintained its oil-demand forecast for 2025 and 2026, expressing optimism that global trade tensions will ease in the coming months. It stated that the global economy could see stronger-than-anticipated growth in the second half of the year, despite trade conflicts. (Investing.com)

The Department of Energy/Energy Information Administration average weekly retail diesel price rose 1.9 cents/gallon to $3.758 in the data published Tuesday. This marked the 5th increase in 6 weeks with the benchmark rising by 30.7 cents over the 6 week period. (Freight Waves)

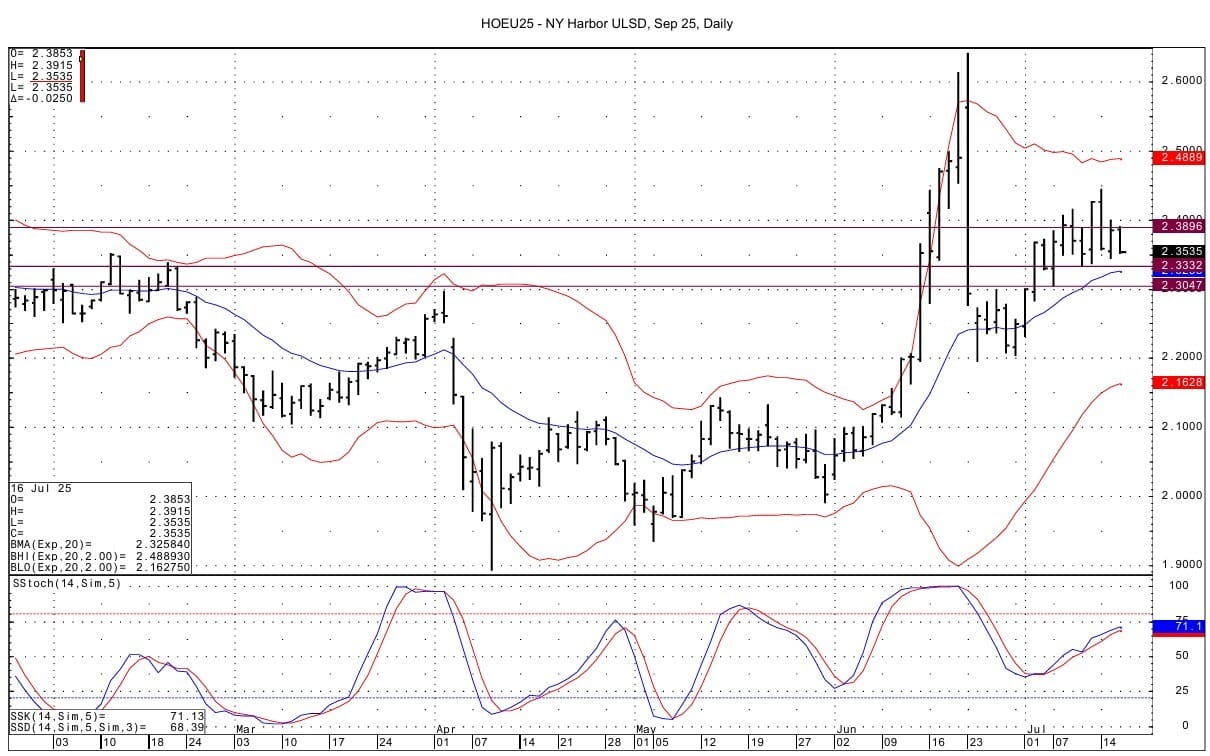

Energy Market Technicals

Momentum for the RB & ULSD is positive basis their September daily charts. We are using the September contracts as they now have the highest volume traded. WTI momentum basis the DC chart has the look of cresting thus possibly turning lower in the coming days.

WTI spot futures have support at 65.22-65.29 and then at 64.50-64.51. Resistance lies at the 67.58 area.

September RB support lies at 2.0959-2.0968 and then at 2.0626-2.0628. Resistance comes in at 2.1366-2.1374 and then at 2.1508-2.1520.

September ULSD support lies at 2.3325-2.3332 and then at 2.3042-2.3063. Resistance lies at the overnight high at 2.3896-2.3915.

Natural Gas Market Overview

Natural Gas - NG is up 4.3 cents

Henry Hub front month is ticking up further today amid continued strong cooling demand forecasts and robust LNG feedgas exports, as per Market News commentary this morning. NGI talks of "robust" power burns.

NatGasWeather on Tuesday said the 8-15 day forecast is for highs in the upper 80s to 100s in most of the US, especially California, the Southwest, and Texas. News wire commentary seen elsewhere cites the Texas demand as being particularly supportive given the strong natural gas demand seen in that state. Dallas is set to see highs of 97 to 99 degrees over the next 10 days, which are a few degrees above normal. San Antonio is set to see highs of 97 to 100 degrees over the next days. The average temperature there for the period is 95 degrees.

The average amount of gas flowing to the eight big U.S. LNG export plants rose to 15.8 BCF/d so far in July as liquefaction units at some plants slowly exited maintenance reductions and unexpected outages. That was up from 14.3 BCF/d in June. (Reuters)

Technically NG still has positive momentum. Upside resistance is seen at 3.574-3.576 and then at 3.635-3.644. Support below is seen at 3.418-3.423. The stepladder upward pattern continues.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply