- Daily Energy Market Update

- Posts

- Daily Energy Market Update January 29,2026

Daily Energy Market Update January 29,2026

Liquidity Energy, LLC

February 3, 2026

WTI is up $2.40 at $65.61 March RB is up 3.77 cents at $1.9418 March ULSD is up 2.28 cents at $2.4697

Liquidity’s Daily Market Overview

Crude oil is at a 4 month high today as concerns have mounted about a possible US strike against Iran. Spot ULSD futures are lower --possibly on some profit taking after the sharp runup of late. We also wonder if the prospect of increased imports into the US are weighing on prices. The DOE statistics showed an increase of 0.7 MMBBL in PADD 1 in distillate supplies ( the CME delivery point region) in Wednesday's stats.

President Trump warned Iran to make a nuclear deal or face military strikes. In a social media post on Wednesday, Trump said US ships he ordered to the region were ready to fulfill their mission “with speed and violence, if necessary.” In response, Iran has said it stands ready for dialogue but warned it would respond with unprecedented force if pushed. Trump is considering options that include targeted strikes on security forces and leaders to inspire protesters to potentially topple Iran's rulers, Reuters reported on Thursday, citing U.S. sources familiar with the discussions. Any escalation may pose a risk to Persian Gulf oil flows through the Strait of Hormuz, where around 20 MMBPD of crude oil passes. (Bloomberg/Reuters/ING)

The DOE data seen Wednesday was bullish for crude oil with exports rising and imports falling. Net crude imports fell by 1.706 MMBPD, equal to a loss in supply of 11.94 MMBBL. The DOE said that crude supplies fell by 2.295 MMBBL. Refiners cut runs by 395 MBPD. Additionally, the EIA's accounting adjustment added 457 MBPD or 3.199 MMBBL. Product demand improved on the week. Gasoline demand rose by 923 MBPD to 8.757 MMBPD ( beating the prior 2 years by 455 and 613 MBPD). Distillate demand rose by 545 MBPD to a strong figure of 4.069 MMBPD--beating 2024 demand by 312 MBPD, but lagging last year's demand by 437 MBPD.

As we noted yesterday: An article published Tuesday in Bloomberg noted that U.S. diesel prices have blown out to a premium over look-alike products in Europe that translate to about 40 cts/g, which it said was the widest in about three years. As one comment reads: "a spread that large between Europe and the U.S. will incentivize exports of diesel from Europe to the U.S. while discouraging exports from the U.S. to Europe. The U.S. generally exports about 1.1 MMBPD of ULSD to other countries around the world." Wednesday's DOE stats showed a drop in distillate exports of 343 MBPD down to 956 MBPD. That is for the week ended Friday Jan. 23. We suspect that the export figure will drop more in next week's data.

Energy Market Technicals

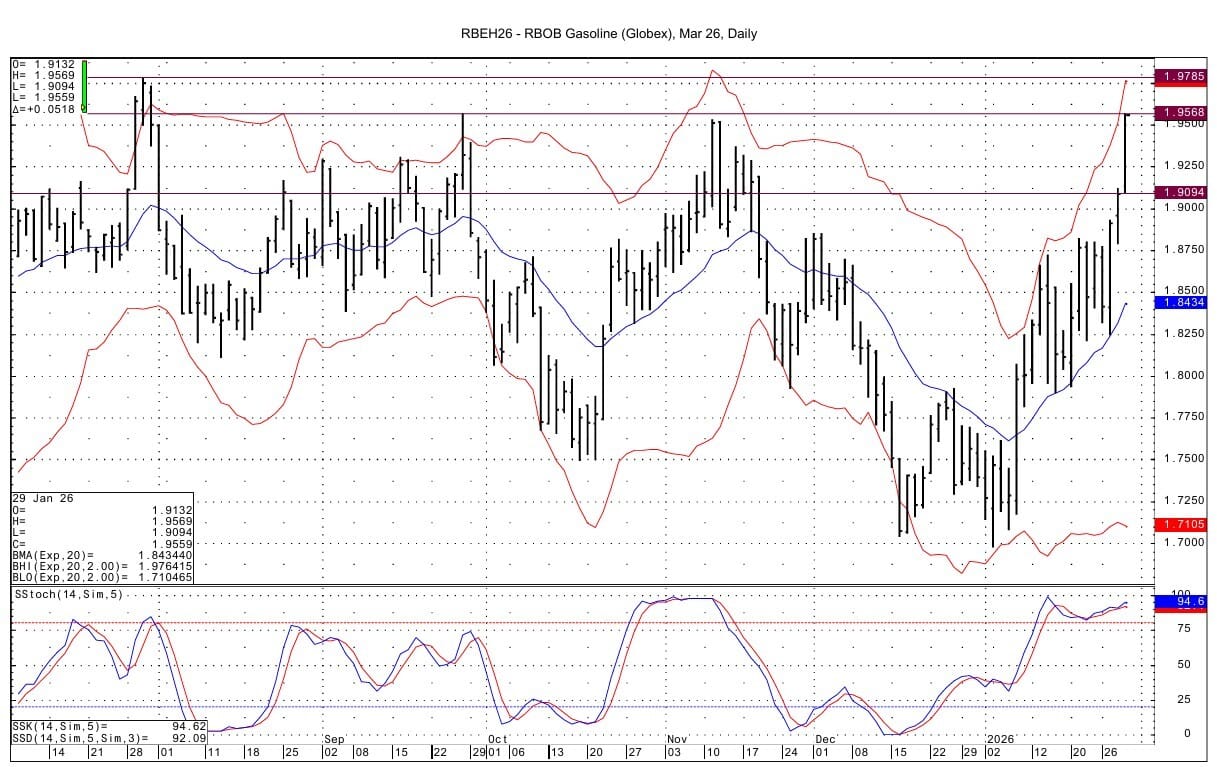

Technically the crude oils are testing their DC chart upper bollinger bands. Momentum for the crude oils remains positive. March RB & ULSD have positive momentum, although that for the March ULSD is getting overbought.

WTI resistance at 65.34-65.40 has been pierced. Above that resistance is seen at 66.42. Support lies at 63.66-63.69 and then at 62.72. The DC upper bollinger band on the WTI chart intersects at 65.36.

March RB resistance comes in at 1.9568. Above that resistance is seen at 1.9785.Support lies at the overnight low at 1.9085-1.9094.

March ULSD sees resistance at 2.4942. Resistance above that is seen at 2.5169-2.5175 from DC chart data. Support comes in at 2.4200-2.4210 and then at 2.3934-2.3952

Natural Gas Market Overview

Natural Gas--NG is up 14.0 cents at $3.872

March NG has started as the spot futures today and is higher -following February's strong expiration. The prospect remains for the cold weather to stick around. The latest weather run seen has added some decent demand.

The latest American model weather report added 22 HDD, as per NatGasWeather.

Today's EIA gas storage data is seen as somewhat bullish relative to the 5 year average. Forecasts are for a draw of 232 to 235 BCF--versus the 5 year average of -208 BCF.

There were several notable trades executed on the CME Wednesday in TTF options. The March 50/60 Euro call spread traded 0.44 Euro with .06 delta futures sales at Euro 36.00. In the March 2026 Euro 50/60 call spread, 1,500 contracts traded 0.44 Euro with .06 delta futures sales at Euro 36.00. March TTF today is trading near Euro 38. The October 2026 through March 2027 strip saw the Euro 31 call bought versus selling of the Euro 36 call and the Euro 23 put. The buyer of the 31 Euro call paid .05 Euro while also selling .33 delta futures at Euro 28.8. The October 2026 through March 2027 strip settled at an average of 29.62 Euro.

There was a sizable increase in open interest in the March April CSO flat put on the CME. The March April flat put traded 3,250 times at 3.5 cents. Smaller volumes traded 3.7 cents as well. The flat put was also sold versus buying of the $1.00 call. The call buyer paid 2.5 cents. The March April 75 cent call open interest fell by 4,000 contracts Wednesday. 2,500 lots traded at 5.5 cents. The March April 50 cent/$1.50 call spread traded 2,000 contracts at 7 cents. The March April futures spread settled at 15.0 cents Wednesday. 6,350 lots of the April through October $2.00 puts traded 1.4 cents. The April $7/$8 call spread traded 2,500 lots at a price of 0.9 cents.

Technically the March NG futures have momentum that is overbought basis its daily chart. The DC chart shows momentum pointing downward, but that seems very logical given the $2.7 loss of value from the premium that the February futures had versus March at Wednesday's settlement. There is a gap on the DC chart up to $5.900. Today March futures are trying to rise over the highs seen the prior 2 sessions. Upside resistance lies best at 3.985 and then at 4.055. Support is seen at 3.75 and then at the 3.66 area.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply