- Daily Energy Market Update

- Posts

- Daily Energy Market Update February 3, 2026

Daily Energy Market Update February 3, 2026

Liquidity Energy, LLC

February 3, 2026

WTI is up 44 cents at $62.58 RB is up 1.76 cents at $1.8690 ULSD is up 3.22 cents at $2.3920

Liquidity’s Daily Market Overview

Energies are higher, boosted by strong equities in Asia and rallies in metals. Energies are also being helped by the dollar having weakened some. The energies are gaining back some ground that was lost Monday as the market was weighed down by the de-escalation of tension between Iran and the US.

Global shares surged on Tuesday, led by a nearly seven per cent jump in South Korea’s benchmark and a 3.9 per cent rally in Tokyo that took the Nikkei 225 to a record as investors bought tech-related shares. Gold gained 6.7% on Tuesday, while silver’s price rebounded nearly 14%, as a risk-on tone returned to wider markets and the US dollar weakened. Copper rose by 4.6% in step with the other metals and also boosted by a call from a Chinese group for them to stockpile copper. (Bloomberg)

Iran and the U.S. are expected to resume nuclear talks on Friday in Turkey, officials from both sides told Reuters on Monday, and Trump warned that with big U.S. warships heading to Iran, bad things could happen if a deal was not reached. (Reuters)

On Monday, Trump unveiled a deal with India that slashes U.S. tariffs on Indian goods to 18% from 50% in exchange for India halting Russian oil purchases and lowering trade barriers. The US will remove the additional 25% tariff imposed on India for its purchases of Russian oil. This is after Trump said India agreed to stop buying Russian oil. (Reuters/ING)

ING commentary adds that if India does stop buying Russian oil then this will further pressure the Russian Urals crude oil discount to attract buyers. A lack of buyers means Russia would ultimately be forced to reduce output, tightening up the oil market. Indian refiners have already reduced their purchases of Russian oil following US sanctions on Rosneft and Lukoil, and the EU ban on refined product imports made from Russian oil. Indian imports of Russian oil are estimated to be in the region of 1.1 to 1.2 MMBPD in January, down from around 1.8 MMBPD in November 2025.

Russia's Deputy Prime Minister Novak said on Tuesday that there is currently a balance on the global oil market, while demand will be gradually rising in March and April, when asked about the OPEC+ group's plans for its production policy. (Reuters)

Market News commentary reads as follows: " Despite the lower risk premium, near term crude curve backwardation remains strong and call volatilities are holding well above the puts suggesting ongoing tight supply concern and upside price risks." ING writes: "Despite the easing in flat price, the prompt ICE Brent time spread remains firm, suggesting continued tightness in the market." The front Brent spread of April vs May is trading at +74 cents--having risen from about +39 cents over the past 2 weeks.

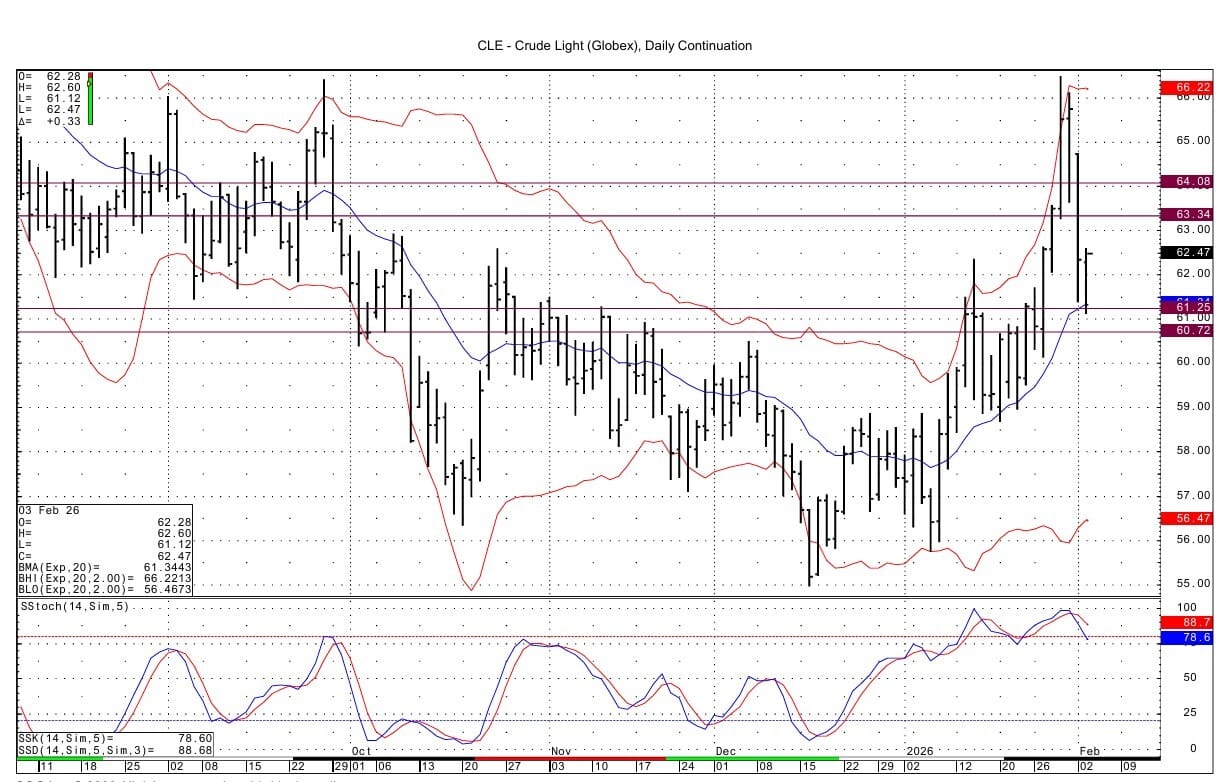

Energy Market Technicals

Momentum remains negative for the energies basis the DC charts.

WTI spot futures see support at 61.21-61.25, which was tested with the overnight low of 61.12. Below that support lies at 60.67-60.72. Resistance is seen at 63.34-63.39 and then at 64.08-64.15.

ULSD spot futures support comes in at 2.3482-2.3507 and then at 2.3133-2.3147. Resistance lies at 2.4250-2.4264 and then at 2.4535-2.4550.

RB spot futures support is seen at 1.8214-1.8221 and then at 1.7970-1.7978. Resistance lies at 1.9024-1.9036

Natural Gas Market Overview

Natural Gas--NG is up 3.0 cents at $3.267

NG futures are slightly higher as they are having an inside trading day versus yesterday's price range. The market is likely reassessing whether the market "overshot" to the downside in Monday's selloff with commentary reminding people that winter is not over. Large gas withdrawals from storage will be seen in the coming weeks.

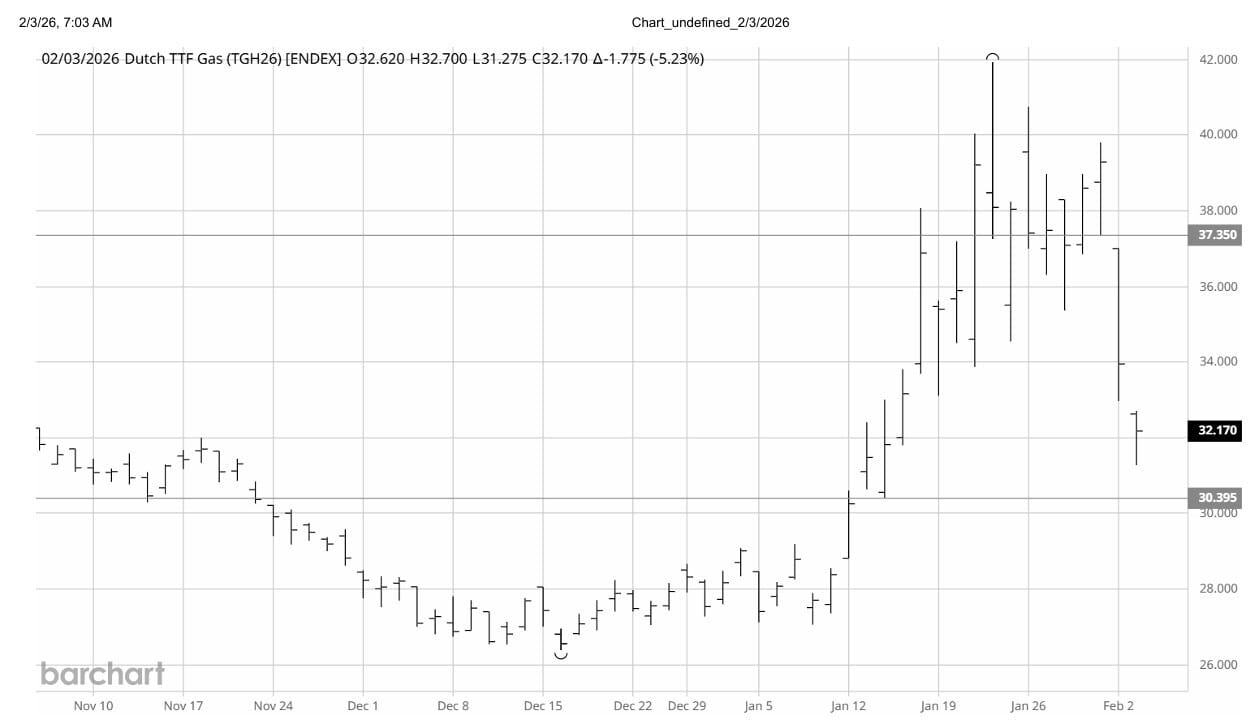

The TTF European futures have gapped down today for the second day in a row, as forecasts for milder weather in the coming weeks weighed on sentiment and concerns over the impact of a massive winter storm in the U.S. eased. However, tight storage levels leave the market vulnerable until the heating season ends, market watchers say. Inventories across the European Union have fallen below 41% of capacity, compared with 53% in the year-earlier period and a five-year average of 57%. Based on the withdrawal rates from the last ten years from now until the end of March, the EU storage level would fall to an average of 24% of capacity at the end of the season. (WSJ/Market News) More notable are the storage levels for some countries within Europe. Germany's gas storage is at 34% capacity, while Dutch reserves dropped to 28% as of the end of January. To reach the mandatory 90% storage target by November 1, 2026, Europe will need to embark on one of the most aggressive and expensive gas-buying campaigns in its history. This will likely keep global gas prices elevated throughout the spring and summer of 2026. (markets.chroniclejournal.com)

Early estimates for this week's EIA gas storage data are calling for a draw of 370 to 379 BCF. That would be a record, as the largest recorded draw is 359 BCF, which was seen in January 2018. Last year saw a draw of 195 BCF and the 5 year average draw for the period is 190 BCF.

Yesterday on the CME, the March NG futures saw Trading at Settlement (TAS) volume of over 54,000 contracts, which is extremely large. The March TAS contract traded up to as high as +10 ticks, which is very unusual. Normally the TAS will trade between flat and plus or minus 2 to 3 ticks in a session. This all suggests to us that there was significant interest to buy March futures on the close on Monday. This is underscored by the fact that the March contract rallied 10 cents between 2:27 and 2:30 PM, which thus includes the 2 minute settlement period.

Notable trades in LN/NG options on the CME from Monday include 5,000 contracts of the March April CSO $1.00/$1.50 call spread trading 1.5 cents. Open interest in the $1.00 and $1.50 calls fell Monday. The March April futures spread settled Monday at 6.4 cents. In the October January CSO, the -$1.25/-$1.50/-$1.75 put butterfly traded 2.6 cents. Also in the October January CSO, the -50 cent call was sold against buying of the -$2.00 put at a cost of 3.0 cents. The October January futures spread settled Monday at -$1.112. The March $5/$7 call spread traded 6.8 cents with .12 delta futures sales at $3.56 included.

Technically, March NG futures settled 25.65% lower Monday. It is the largest one day percentage decline since Friday, Dec. 22, 1995, and the largest one day dollar decline since Tuesday, June 14, 2022. Volume was extremely heavy for the NG futures on the CME at 1,877,418 contracts. Is this suggesting an interim low was made Monday?

Open interest rose by a lot as well. CME NG futures open interest rose by 74,533 contracts with increases seen in the strip from March 2026 to November 2026 and in the January 2027 contract. Is this open interest increase a result of more so new short positions or long positions given the large volume that traded in the last 3 minutes amid the aforementioned rally?

Momentum is negative for the NG futures basis the March daily chart. Support lies below at 3.114-3.125 and then at 3.051. Resistance comes in at 3.390-3.400 and then at 3.476-3.479.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

How 2M+ Professionals Stay Ahead on AI

AI is moving fast and most people are falling behind.

The Rundown AI is a free newsletter that keeps you ahead of the curve.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses — tailored to your needs.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply