- Daily Energy Market Update

- Posts

- Daily Energy Market Update February 19,2026

Daily Energy Market Update February 19,2026

Liquidity Energy, LLC

February 19, 2026

April WTI is up $1.45 at $66.50 April RB is up 3.01 cents at $2.2349 April ULSD is up 4.75 cents at $2.4782

Liquidity’s Daily Market Overview

"Oil prices rose on Thursday, driven by increasing concerns over potential military conflict between the United States and Iran as both countries stepped up military activity in the oil-producing region." (Reuters)

The US said on Wednesday that the two sides were still far apart on some issues after US-Iran talks were held in Geneva on Tuesday. Iran issued a notice to airmen (NOTAM) that it plans rocket launches in areas across its south on Thursday, while the US has deployed warships near Iran. Iran and Russia plan naval drills in the Sea of Oman and Northern Indian Ocean today. Iran shut down the Strait of Hormuz for a few hours on Tuesday, Iranian state media reported Wednesday, without making clear whether the waterway, one of the world's most vital oil export routes, had fully reopened. (Reuters) The U.S. hasn't assembled so much air power in the region since the 2003 Iraq invasion, on top of which the Navy has 13 ships in the Middle East and the eastern Mediterranean Sea. (WSJ)

API Forecast Actual

Crude Oil +0.298/+2.7 -0.609

Gasoline -0.3/-1.2 +3.3

Distillate -0.9/-1.9 -2.0

Cushing n/av +1.4

Runs +0.2/0.6% n/av

The DOE petroleum data will be issued today at Noon (EST).

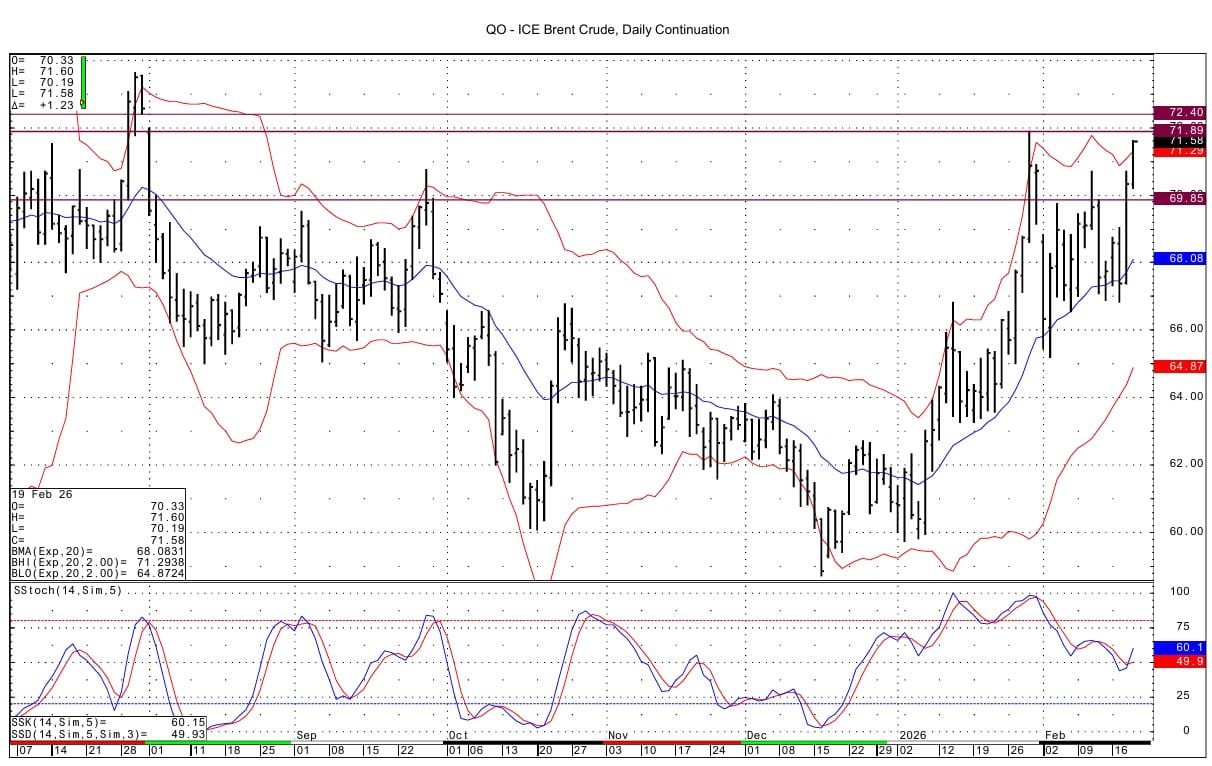

Energy Market Technicals

ULSD and Brent momentums have turned positive, while that for RB is neutral, and that for the April WTI is trying to turn positive. The Brent DC, April WTI, April ULSD and Gasoil DC charts have all tested their upper bollinger bands today.

WTI April futures have support at 64.92-64.93 and then at 63.97-64.02. Resistance is seen at 66.73 and then at 67.25. The upper bollinger intersects at 66.27.

Spot Brent futures see the upper bollinger basis the DC chart today lying at 71.28. Resistance above is seen at 71.89. There is a gap to fill on the Brent DC chart from 72.00 to 72.40. Support comes in at 69.85-69.86.

April RB support lies at 2.1875-2.1897. Resistance is seen at 2.2337, which has been tested this morning. Next resistance is seen at 2.2761 via data from the RB DC chart. The April RB daily chart's upper bollinger intersects at 2.2364.

April ULSD sees the upper bollinger lying at 2.2448. Resistance comes in at 2.4805 and then at 2.5152-2.5175 via DC chart data. Support is seen at 2.4245-2.4257 and then at 2.4143-2.4175.

The Gasoil DC chart upper bollinger is seen at 724.42. Resistance above lies at 743.00 and support is seen at 701.25-702.25.

Natural Gas Market Overview

Natural Gas---NG is up 5.1 cents at $3.062

NG spot futures are up slightly --holding over $3.00, after falling Wednesday to a 4 month low. A boost in HDD's in the prior forecast is supporting NG today, as are likely the strength in energies and the TTF contract. But, the overall tone still is of a warmer weather pattern as we head to the end of winter.

This morning Market News commentary re the weather says :"HDDs now coming within the normal toward the end of the 2-week GFS forecast period for the Lower US 48 states instead of sliding off precipitously in cities like New York and Philadelphia." The market rallied back over $3 in the afternoon Wednesday as a slightly cooler forecast was offered--especially in the 8-14 day outlook, as per Celsius Energy commentary. Although, the Commodity Weather Group on Wednesday said above-normal temperatures are expected across the eastern half of the US through February 22, while mostly normal seasonal weather is expected for the following week.

The EIA gas storage data due out today at its regular hour (10:30 AM EST) is seen as a draw of 149 to 152 BCF as per WSJ & Bloomberg surveys. This compares to last year's draw of 182 BCF and the 5 year average draw of 151 BCF.

The TTF European spot futures have gapped higher today. The increased tension between the US and Iran has lifted the TTF value today, given concerns about LNG shipping in the region. Gas markets are increasingly worried about shipments through the Strait of Hormuz—especially from Qatar, the second-largest exporter globally. News wire accounts though mention some of the TTF upside seen today may be mitigated by a milder weather forecast across Europe and stronger renewable output in Germany. Yet, European storage remains very low. EU gas storage sites were last 32.5 per cent full, compared with 43.3 per cent at the same time last year, Gas Infrastructure Europe data showed. (Reuters/WSJ) The gap created today goes from 31.980 to 32.100.

Technically the spot NG futures continue to have momentum that is oversold basis the DC and March daily charts. The question is whether the market still has the urge to test and stay below $3? Support is likely, we believe, at the prior 2 sessions' lows at 2.968 and then at 2.922. Resistance comes in at 3.147-3.149 and then at 3.242-3.249.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply