- Daily Energy Market Update

- Posts

- Daily Energy Market Update December 29,2025

Daily Energy Market Update December 29,2025

Liquidity Energy, LLC

March 3, 2026

WTI is up $1.20 at $57.94 February RB is up 2.40 cents at $1.7314 February ULSD is up 2.43 cents at $2.1312

Liquidity’s Daily Market Overview

Energies are higher with some news wire commentary citing heightened geopolitical tension in the Mideast and Venezuela. Also, some news accounts see a lack of progress in Ukraine peace talks as supporting energy prices. Some support may also be coming from news that China is set increase fiscal spending in 2026. The delayed DOE oil data is due out today.

Tension has increased in Yemen as Yemen's Saudi-led coalition said any military moves by the main southern separatist group STC in the eastern province of Hadramout that undermined de-escalation efforts would be countered to protect civilians, the Saudi state news agency reported on Saturday. (Reuters) Also adding to the Mideast tension are the recent strikes by the US against ISIS targets in Syria.

Mideast tension was seen further heightened by comments from Iran's President. Iranian President Pezeshkian has stated that Iran is in a "full-fledged war" with the United States, Israel, and Europe. The US and Iran were at odds at the UN Security Council last Tuesday over conditions for reviving nuclear talks, with the US saying it remains ready for direct negotiations but Iran rejecting Washington's terms. The Iranian President added : The enemy is fanning the flames of division. (Mena news agency)

Ukrainian President Zelensky said on Monday that significant progress had been made in talks with President Trump over the weekend and agreed that U.S. and Ukrainian teams would meet next week to finalize issues aimed at ending Russia’s war in Ukraine. Yet, both leaders acknowledged that several of the most contentious issues remained unresolved. President Trump said that he aims to have further talks with Zelensky and European leaders in January. (Investing.com / Sada News agency) Zelensky added that a meeting with Russia would be possible only after Trump and European leaders agree on a Ukraine-proposed framework for peace. (Reuters)

Amid the Ukraine peace talks, attacks continue between Ukraine and Russia. Russia attacked a key heating plant in Kherson and Ukraine targeted a Russian oil refinery. The Ukrainian strike on the Syzran oil refinery in Russia's Samara region took out the only primary oil processing unit at the refinery. Russia's attack targeted a Ukraine plant that had been a critical source of heating for tens of thousands of residents. (Oil Price.com)

S&P data shows a drop in tanker traffic to Venezuela, analysts cited by WSJ say.

China said it will expand government spending and improve how it deploys capital in 2026, aiming to balance supporting growth and containing debt risks, the Ministry of Finance said in a Sunday statement. (Bloomberg)

Saudi Arabia is expected to lower their OSP by 10 to 30 cents for February loadings to Asia of their flagship A-Light crude oil. The Medium and Heavy crude prices are seen staying steady or being lowered by 10 cents in the Reuters survey of 6 Asian based refining sources. The expectation for a 3rd straight monthly drop in the A-Light OSP would keep prices at a 5 year low relative to the Oman/Dubai average. Cash Dubai premiums have fallen in December from November, thus precipitating the Saudi OSP cut.

Retail gasoline prices in the US have fallen to their lowest level since March 2021. The AAA says that today's price is $2.825. One month ago, the price was $3.012. Diesel retail prices have dropped by 20 cents over the past month. Today's average retail price at the pump is seen at $3.552, down from $3.754 one month ago.

The DOE stats for the week ended Friday Dec 19 will be released today at 10:30 AM (EST). The API data released last Tuesday for the period showed crude oil supplies rising 2.39 MMBBL, gasoline supplies having risen by 1.09 MMBBL and distillate supplies up 0.685 MMBBL. Cushing oil supplies rose by 0.6 MMBBL in the API data. The WSJ survey for oil stats forecasted a drop of 2.6 MMBBL in crude supplies and a 0.4 MMBBL draw in distillate supplies, but a rise in gasoline stockpiles of 0.3 MMBBL.

Energy Market Technicals

Momentum is positive for the energies. Notable to us are the current double bottoms seen n the WTI and ULSD charts seen from last week's trading.

On the WTI DC based chart, support lies at the double bottom at $56.60-56.65. Resistance comes in at $59.17-59.21 and then at 59.64-59.67.

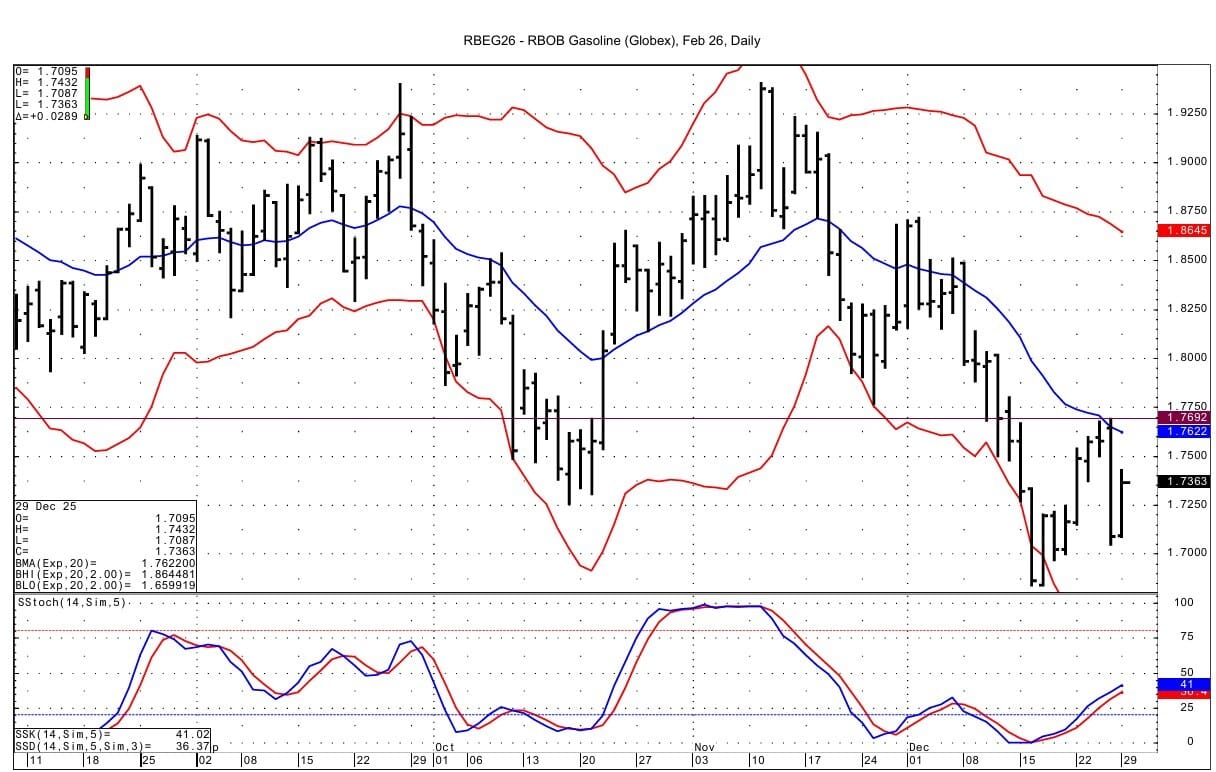

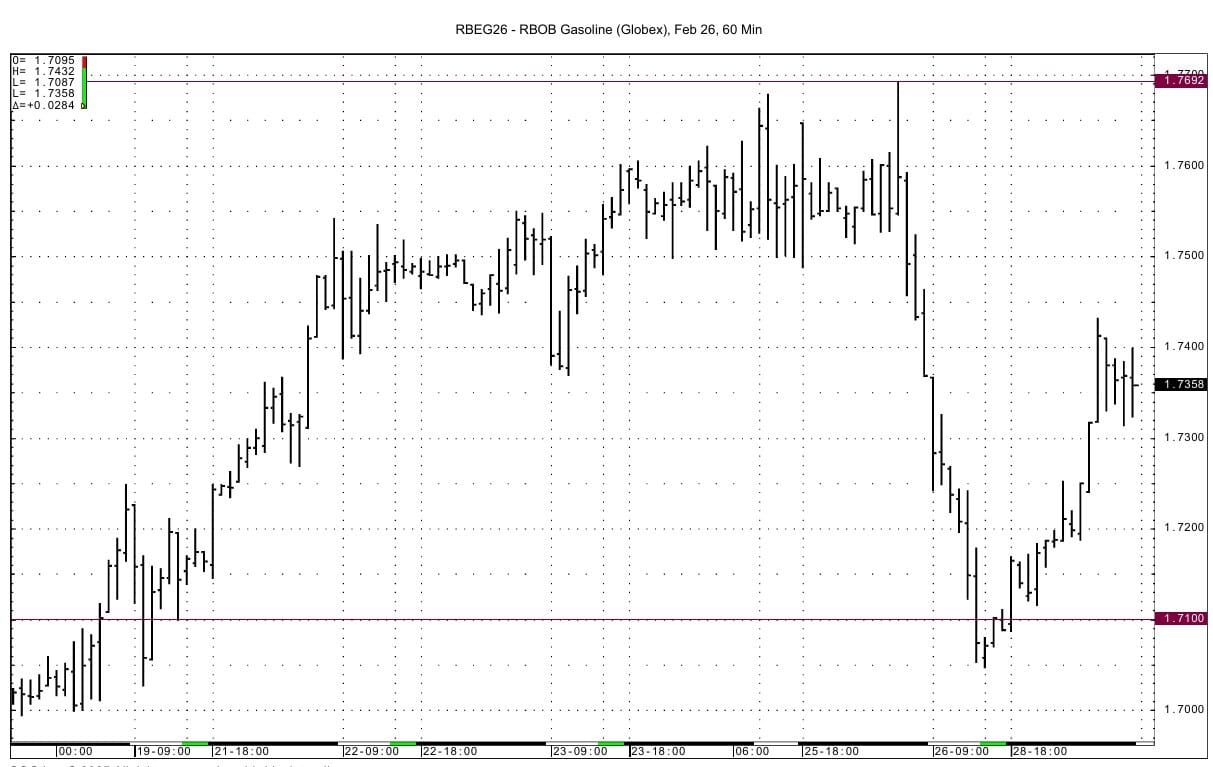

February RB support at 1.7100-1.7112 was tested overnight with the low of 1.7087. Resistance above comes in at the double top from Wednesday/Friday of last week at 1.7679-1.7692.

ULSD February support is seen at 2.1038-2.1054. Resistance comes in at 2.1718-2.1736.

.Natural Gas Market Overview

Natural Gas-- February NG is up 4.0 cents at $3.917

NG futures are higher after having a see-saw move so far today. The initial rally last night was seen due to some addition of heating demand from the American weather model. But, with next day cash prices well below the expiring January futures and the boost in demand seen as small, prices eased back to then trade lower.

These are comments seen the past day regarding weather predictions: NatGasweather's headline for today reads: Weekend data trends colder and prices gap higher. But a still too warm of a patterns leads to selling..... Celsius Energy added Sunday:" Over the weekend, the near-term temperature outlook didn’t change too much, initially losing some GWDDs before regaining some today (Sunday). After an early-week spike, look for GWDDs to settle at or just below the 5 year average into early January. However, by the second week of January, a blocking pattern could set up which would favor colder temperatures and an upward revision of this forecast. " ......The 15 day weather forecast shows days 2 through 8 with moderate go high demand, but days 9 thru 15 with moderate demand....NatGasweather adds : "The weekend weather data trended colder, especially Dec 29-31 and where more than 15 HDDs were added for these days. It wasn’t a surprise the weekend weather data added demand since it was the warmest of the past 50-years for that period going into the weekend. But the pattern is still much too warm the next 7-days and also for Jan 1-5." Average Lower 48 temperatures are forecast below normal in the coming days before gradually trending back above normal by around Dec. 5. NOAA 6-14 day forecast shows warm weather across most of the country except the north-eastern area.

The EIA gas storage data is to be released today at Noon for the week ended Friday Dec.19. Forecasts are calling for a draw of 169 to 170 BCF. That compares to last year's draw of 98 BCF and the 5 year average draw of 110 BCF.

US domestic natural gas production is estimated today at 113.7 BCF/d compared to the 30-day average of 113.56 BCF/d, according to BNEF data. While, LNG feedgas is seen today at 18.71 BCF/d; This is up from Friday's volume of 18.18 BCF/d and the lower figure of 17.33 BCF/d seen last Wednesday. (Market News)

The January NG futures expire today. One notable element for January NG pricing is the steep premium that the contract is holding currently over further back months. January is currently 53.0 cents over February and about $1.13 over the April contract.

Technically, NG futures have positive momentum. The February contract looks to be building a possible inverted head and shoulders pattern basis its daily chart, which suggests a possible move to as high as $4.47. The bottom at $3.47 provides the tip of the head with the shoulder line being the resistance areas at $3.97. Thus a break of the resistance/shoulder area at the 3.97 area could see a projected 50 cent up move to $4.47. Resistance for the February contract at 3.976-3.979 was almost tested with the session high of 3.975, which was seen in the opening moments of trading last night. Above that resistance lies at 4.042-4.045. Support comes in at 3.727-3.733.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply