- Daily Energy Market Update

- Posts

- Daily Energy Market Update December 26,2025

Daily Energy Market Update December 26,2025

Liquidity Energy, LLC

March 3, 2026

WTI is up 2 cents at $58.37 February RB is down 0.83 cents at $1.7458 February ULSD is down 0.51 cents at $2.1486

Liquidity’s Daily Market Overview

Crude oil prices are near unchanged, while the products are lower. The crude oil market is currently being buffeted by the opposing forces of supply concerns/geopolitical tension and strong equity markets versus forecasts for oversupply in the months ahead.

News wires are touting the prospect for end of the year crude oil pricing to show the steepest annual drop since the Covid year of 2020. Brent and WTI prices are on track to drop about 17% and 19%, respectively, this year. (Reuters) But, on the week, crude oil prices are set to rise by 3%.

President Trump said that the US had hit ISIS targets in Nigeria on Christmas day. The attack was retribution for ISIS having attacked innocent Christians in the region. (USA Today)

The White House has ordered U.S. forces to enforce a two-month “quarantine” on Venezuelan oil, a move aimed at tightening restrictions on exports from the OPEC producer. (Investing.com) More than a dozen loaded vessels are in Venezuela waiting for new directions from their owners after the U.S. seized the supertanker Skipper earlier this month and targeted two additional vessels over the past weekend. (Reuters)

Additionally, oil shipments from Kazakhstan via the Caspian Pipeline Consortium are set to drop by a third in December to the lowest since October 2024 after a Ukrainian drone attack damaged facilities at the main CPC export terminal, two market sources said on Wednesday. (Reuters)

Russian President Putin indicated Russia might be open to a territory swap as part of a peace deal in a briefing to top Russian business leaders, the Kommersant newspaper reported. Ukraine's President is said to be scheduled to meet with President Trump this weekend. (Reuters)

The following headline and information is seen from Quantum Commodities today : Distillates: Supply pressure remains despite signs of recovery. The distillate market continues to grapple with a short-term supply overhang as winter demand fails to keep up with a post-maintenance schedule/slate. The weakness in the distillate and gasoline markets is evident in the retail pricing seen in the U.S. Today the AAA said the national average price for gasoline is $2.848, down from the price of one month ago of $3.042. The retail diesel price today, as per the AAA, is $3.537, down from the price of one month ago of $3.778.

Gold, silver and platinum have surged to fresh record highs ahead of the year-end holiday period. The rally is said to be underpinned by a weaker US dollar, risk-on sentiment and the geopolitical headlines that are also supporting the energy markets. (Investing.com)

Wednesday's volume in WTI futures was very low, underscoring the holiday trade in a shortened session. Volume was 268,579 contracts.

Energy Market Technicals

Momentum is positive for the energies.

WTI spot futures have a small stepladder pattern up look from the past few sessions. Support comes in at 57.38-57.42 and then at 56.60. Resistance lies at 59.05-59.11 and then at 59.64-59.67. The resistance we had pegged prior at 58.72-58.80 has been tested the past 2 sessions' with highs at 58.75/58.88.

ULSD February futures are currently trading in the middle of the range seen over the past 10 days. Resistance is seen at 2.1803-2.1804 and then at 2.2063-2.2075. Support lies at 2.1381-2.1398 and then at 2.1146-2.1154.

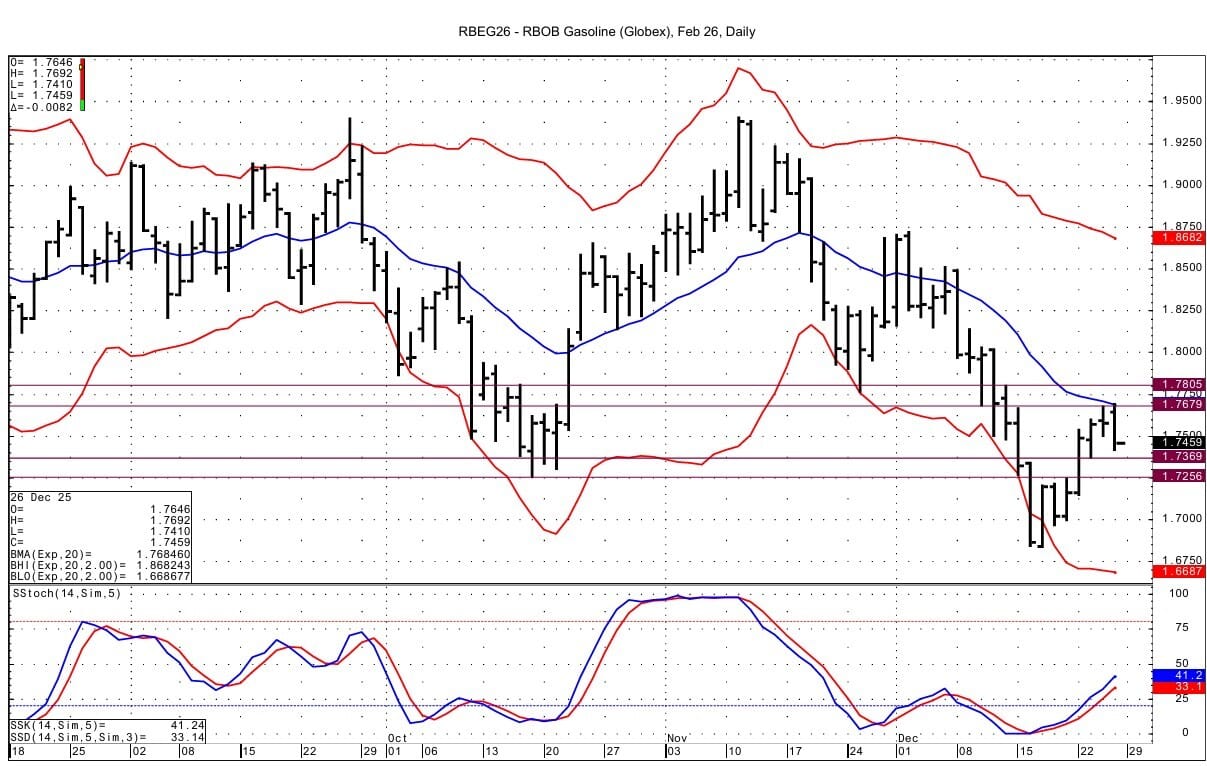

February RB currently has a double top from Wednesday/today at 1.7679/1.7692. Above that resistance comes in at 1.7805-1.7809. Support lies at 1.7369-1.7380 and then at 1.7256-1.7266.

Natural Gas Market Overview

Natural Gas--February NG is up 7.0 cents at $3.830

NG futures are higher as weather demand is set to increase after the weekend.

The January LN/NG options expire today with the following strikes showing significant open interest on the CME as per Wednesday's data. The $4.25 strike has total open interest of 32,163 contracts, while the $4.30 strike has a total open interest of 21,798 contracts. The $4.50 strike has open interest of 37,517 contracts.

Total natural gas demand in the US, including exports, for the week ending December 22 fell 11.5 percent week-over-week but remains 1.2 percent higher than the same week last year, according to preliminary data from S&P Global Commodity Insights (S&P Global). On Wednesday, LSEG projected average gas demand in the lower 48 states, including exports, would rise from 127.9 BCF/d this week to 136.4 BCF/d over the next two weeks. The demand forecast for this week and next was up 0.4 BCF/d from that seen Tuesday.

On Wednesday, the front end of the NG futures curve gave back some of the recent strong gains seen as on the day the weather forecasts gave back some demand. January NG settled down 16.6 cents, February down 13.6 cents and March down 7.4 cents.

CFTC data issued Wednesday for the week ended Tuesday December 16 showed money managers adding 40,288 contracts to their net short position in NG futures/options on the CME. That brought the net short total position up to 65,722 contracts. The increase in net shorts coincided with the straight line sharp sell off during that week of $1 in spot NG futures from the high $4.80 area seen the week before that. This large increase in money managers' net short positioning thus may have set the market up for the reverse move up seen at the beginning of this week with January futures and options set to expire.

Technically, February NG has positive momentum. Resistance comes in at 3.976-3.979 and then at 4.042-4.045. Support lies at the double bottom from Wednesday/today at 3.727-3.733. Below that support is seen at 3.617-3.618.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply