- Daily Energy Market Update

- Posts

- Daily Energy Market Update December 19, 2025

Daily Energy Market Update December 19, 2025

Liquidity Energy, LLC

December 19, 2025

February WTI is up 5 cents at $56.04 February RB is up 65 cents at $1.7128 February ULSD is up 22 cents at $2.1272

Liquidity’s Daily Market Overview

Oil prices were little changed on Friday and poised for a second straight weekly decline as a potential supply glut and prospects of a Russia-Ukraine peace deal offset concern over disruptions from a blockade of Venezuelan oil tankers.

Analysts are widely projecting a global glut in oil supply next year, boosted by increased output from the OPEC+ producer group as well from the United States and other producers.

Uncertainty over how the U.S. would enforce U.S. President Donald Trump's intent to block sanctioned tankers from entering and leaving Venezuela tempered geopolitical risk premiums and weighed on oil prices on Friday, said IG analyst Tony Sycamore.

Venezuela, which pumps about 1% of global oil supplies, on Thursday authorized two unsanctioned cargoes to set sail for China, said two sources familiar with Venezuela's oil export operations.

Analysts wrote, oil faces downside risks. “Barring large supply disruptions or OPEC production cuts, lower oil prices in 2026 will likely be required to re-balance the market,” they said. “We expect the 2026 surplus to lead to an acceleration in OECD commercial stocks builds.”(Bloomberg)

Energy Market Technicals

February WTI price is trading near the lower Bollinger Band. Momentum has crossed up in oversold territory. Support comes in around 55.30 and resistance comes in at 56.85, the double top from Wednesday/Thursday.

FEB WTI

February RB is having a inside day while trading near its lower Bollinger Band. Support lies at the double bottom seen Tuesday/Wednesday at 1.6839-1.6840. Resistance lies at 1.7219.

Feb RBOB

ULSD February futures see support at 2.1146-2.1154 and then at 2.0934. Resistance comes in at Thursday’s high at 2.1803-2.1804 and then at 2.2066-2.2075.

Feb ULSD

Natural Gas Market Overview

Natural Gas--NGG6 is up 2 cents at $3.663

U.S. natural gas prices ended Thursday’s session with a familiar winter headline: storage fell sharply, but not as sharply as some traders expected — and the market sold off anyway.

The January NYMEX Henry Hub contract (the U.S. benchmark) whipsawed after a morning rally and ultimately finished lower, with late-session pricing around $3.89/MMBtu and down roughly 3% on the day.

The turning point was the weekly U.S. Energy Information Administration (EIA) storage report, released at 10:30 a.m. ET, which showed a 167 billion cubic feet (Bcf) withdrawal for the week ending December 12—a winter-sized pull, but slightly under some market expectations. (TechStock2)

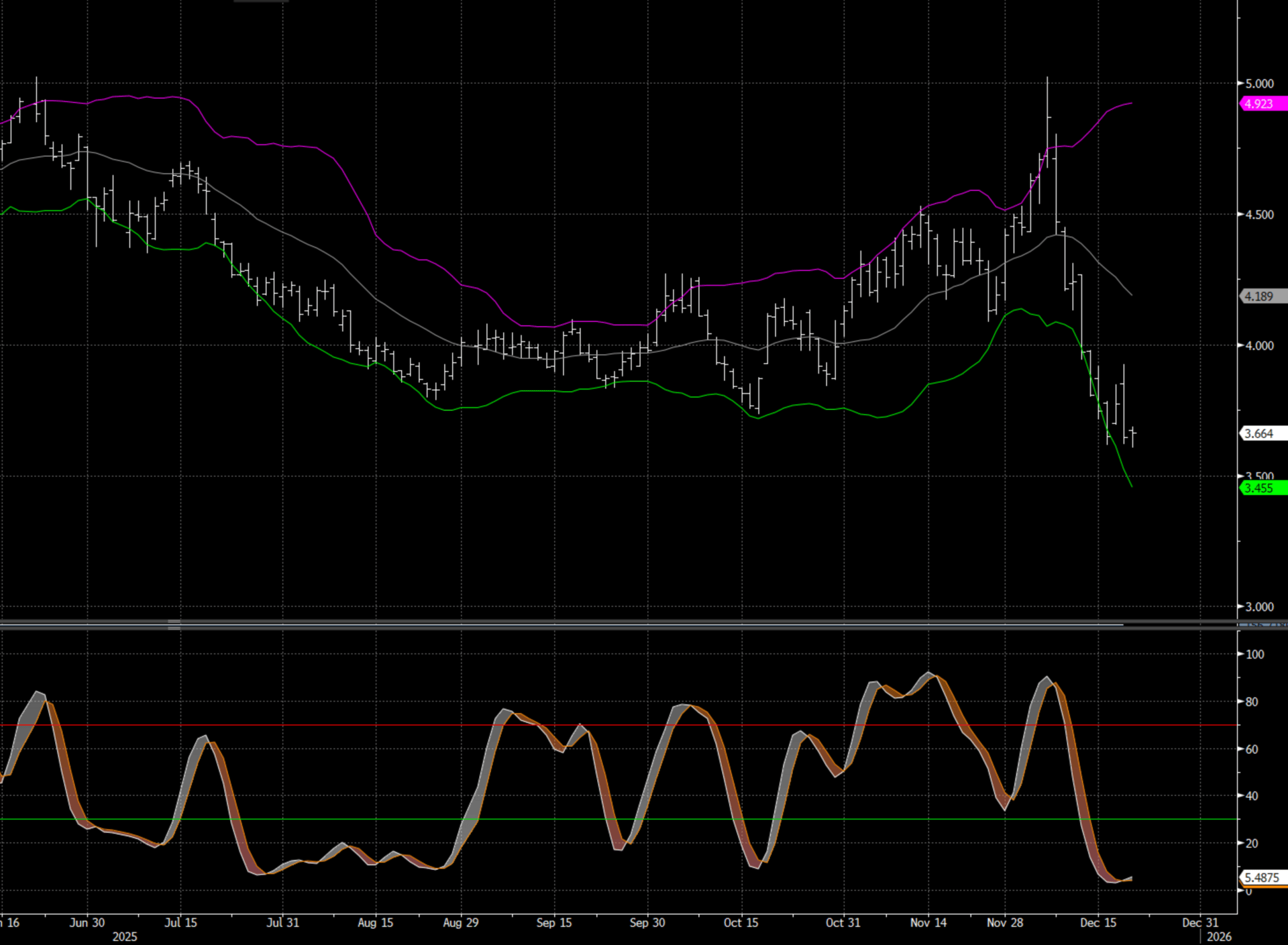

Natural gas (Feb) appears to have pulled back to a key area of interest around the $3.61 level, which is coinciding with lows from Tuesday and Thursday. This zone could be critical in determining whether the commodity can resume its longer-term uptrend.

Stochastic momentum has turned up from oversold territory.

ceFEB Nat Gas

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply