- Daily Energy Market Update

- Posts

- Daily Energy Market Update August 18,2025

Daily Energy Market Update August 18,2025

Liquidity Energy, LLC

October WTI is up 30 cents October RB is up 1.16 cents October ULSD is down 0.87 cents

Liquidity’s Daily Market Overview

Crude oil & RB are higher now after trading lower much of the overnight session as the market is focused on the talks today between Presidents Zelensky and Trump, which has raised the belief that a peace deal will open the door to more Russian supply coming to market. But, this morning the crude oil price has risen as a White House official said that India needs to stop buying Russian oil as it is funding Russia's war effort.

White House trade adviser Peter Navarro said India's purchases of Russian crude were funding Moscow's war in Ukraine and had to stop. New Delhi was "now cozying up to both Russia and China," Navarro wrote in an opinion piece published, opens new tab in the Financial Times on Monday. Separately, Indian Oil Corp, the country's top refiner, will continue to buy Russian oil depending on economics, the company's head of finance told an analyst meeting on Monday. A planned visit by U.S. trade negotiators to New Delhi from August 25-29 has been called off, a source said over the weekend, delaying talks on a proposed trade agreement and dashing hopes of relief from additional U.S. tariffs on Indian goods from August 27. (Reuters)

The energy market opened lower Sunday as Friday's post meeting comments saw President Trump fail to reiterate his desire for a ceasefire in the Ukraine conflict. Instead it seems that he is leaning more so to a full cessation/peace settlement of the conflict with the 2 sides swapping territory. Trump said that he would hold off for now on imposing tariffs on those buying Russian oil. One market analyst said : "What we do know is that the threat of immediate sanctions on Russia, or secondary sanctions on other countries is put on hold for now, which would be bearish." (Reuters)

On Friday, Bloomberg reported that Mexican oil loadings are down 35% in the first half of August on higher domestic refining. Port disruptions also curtailed exports. Exports were down about 550 MBPD in the Aug. 1-15 period, down 35% from July and the lowest since June, when they plunged to a 46-year low. Volumes dropped as Pemex ran its refineries at a 9-year high in June

The Baker Hughes oil rig count showed an increase of 1 unit in Friday's report.

CFTC data showed money managers reduced their net length in WTI futures/options on ICE/CME combined by 27,177 contracts in the week ended Aug. 12. The reduction was mostly driven by longs on the CME being shed. ING says that speculators net length on the CME is the lowest since April 2009 at near 49,000 lots. RB net length fell by 2,898 contracts. ULSD net length in futures /options on the CME rose by 871 contracts for the week ended August 12.

The retail diesel price at the pump in the U.S. fell today to its lowest level in almost 6 weeks. The average today, as per AAA data, is $3.690. Just 12 days ago, it was as high as $3.740.

Energy Market Technicals

The lows for today's session were seen on the opening Sunday evening. Momentum for the crude oils and RB are neutral at near oversold levels. ULSD's momentum is oversold.

October WTI sees support at the low of last week at 61.29 and then at 60.08-60.14. Resistance lies at 63.48-63.54 and then at 64.98-65.05.

October RB support comes in at 1.8847-1.8867. Resistance lies at the double top from Thursday/Friday at 1.9456-1.9457.

ULSD for October sees support at 2.1948-2.1958 and then at 2.1646. Resistance is seen at the double top from Thursday/Friday at 2.2508-2.2517.

The DC Gasoil chart also shows momentum that is oversold as the contract has been in a range the past 4 sessions with support at 644.25-645.50 and resistance at 658.00-658.75. There is a gap on the DC chart up to 671.50. Support below the past 4 session's lows comes in at 635.75-636.25.

.Natural Gas Market Overview

Natural Gas--NG is down 7.5 cents

NG futures are lower as a cooler forecast and lower LNG feedgas volume back under 16 BCF/d are weighing on prices.

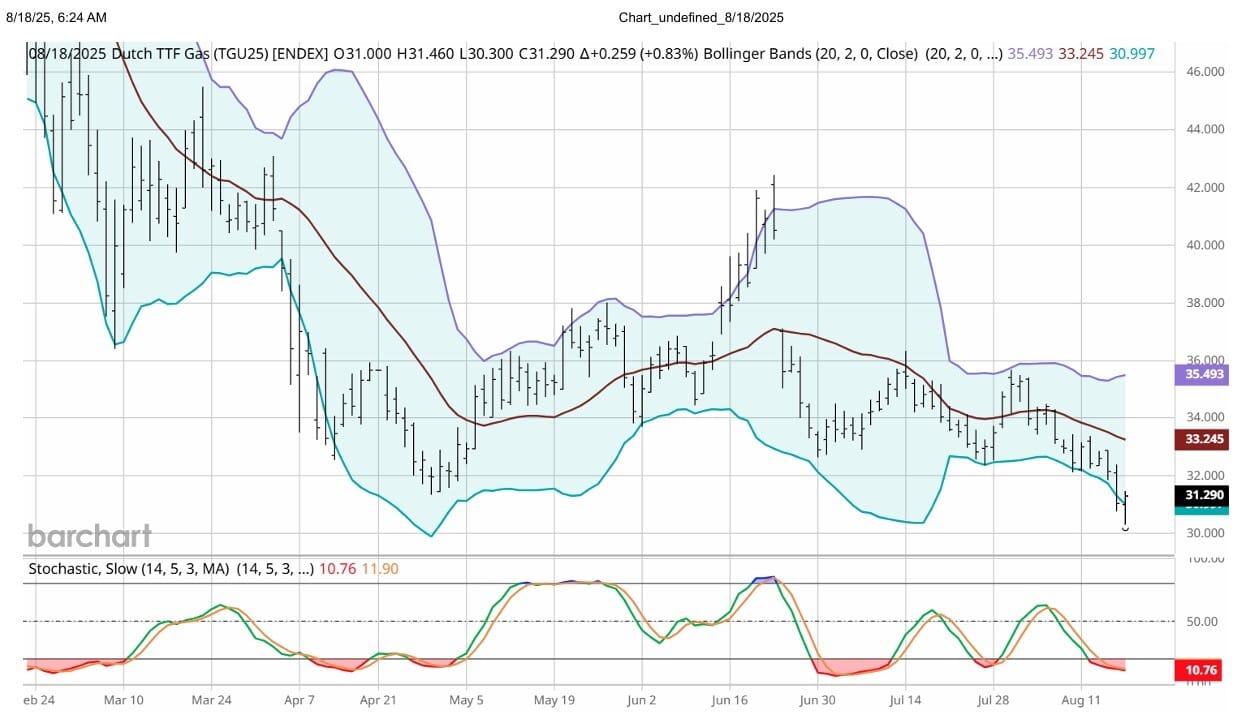

In Europe, the spot TTF futures price is now slightly higher versus Friday's settlement after falling overnight to its lowest price since May 17,2024. The price was pressured by the talks to be held today between Presidents Trump, Zelensky and European leaders. The belief is that a peace deal will open the door to more Russian supply coming to market. (Bloomberg). ING points out that the weakness in the TTF price seen in recent sessions has caused the JKM to TTF premium to widen, which will divert LNG cargoes to Asia. But, they add :" However, with EU gas storage almost 74% full and still lagging both last year’s levels and the 5-year average, Europe will need to continue to see strong LNG inflows in order to get close to the 90% storage target." Possibly supporting TTF prices is news that Norway reported an unplanned outage at its Hammerfest LNG export plant this weekend. Hammerfest LNG plant is the largest export facility for LNG in Europe. Technically, the spot TTF futures have attacked the DC chart's lower bollinger band the past 2 sessions.

Key demand areas like Texas and the Eastern portion of the U.S. are set to see temperatures fall to below normal in the 7 to 14 day period. Washington, DC will see temperatures in the next 14 days running anywhere from 1 to 13 degrees below average. Houston, TX will see temperatures in the 4 to 10 day period falling 2 to 4 degrees below normal.

Today, Bloomberg data has LNG feedgas (preliminary) volume at 14.27 BCF/d. Last Thursday, that volume was at 15.77 BCF/d.

On Friday, Henry Hub next day cash natural gas was quoted 2.96/2.97 versus September NG printing 2.942 at that time. Thus the minus 17 cent differential for futures versus cash seen Wednesday had shrunk today to -2 to -3 cents.

LSEG forecast that the week ending Friday Aug. 15 had demand forecasted at 111.7 BCF/d for the week, while this coming week would have demand of 110.9 BCF/d. These 2 weeks forecasts were -0.8 BCF/d lower than those seen Thursday. The forecast for next week is for demand equaling 109.6 BCF/d.

Friday's NG futures rally was seen due to a hotter forecast than normal through the end of August, as per Reuters reporting. Also several sources say that short covering, profit taking was a cause for some of Friday's rally.

CFTC data showed money managers added 23,025 contracts to their net short total in the week ended Tuesday Aug. 12. That brought their net short total up to 50,752 contracts.

The Desk commented that currently the rate of gas injections into storage this season is 23% above the 5 year average. If the 5 year average refill rate of 9.1 BCF/d continued through the end of the injection season, gas inventories would end the season (EOS) at 3.949 TCF, which would be 196 BCF over the 5 year average of 3.753. Last week NGI suggested that EOS inventories would be 3.952 TCF. The EIA in their STEO released last Tuesday dropped their EOS from July's forecast of 3.910 to 3.872 TCF.

The Baker Hughes gas rig count showed an decrease of 1 unit in Friday's report.

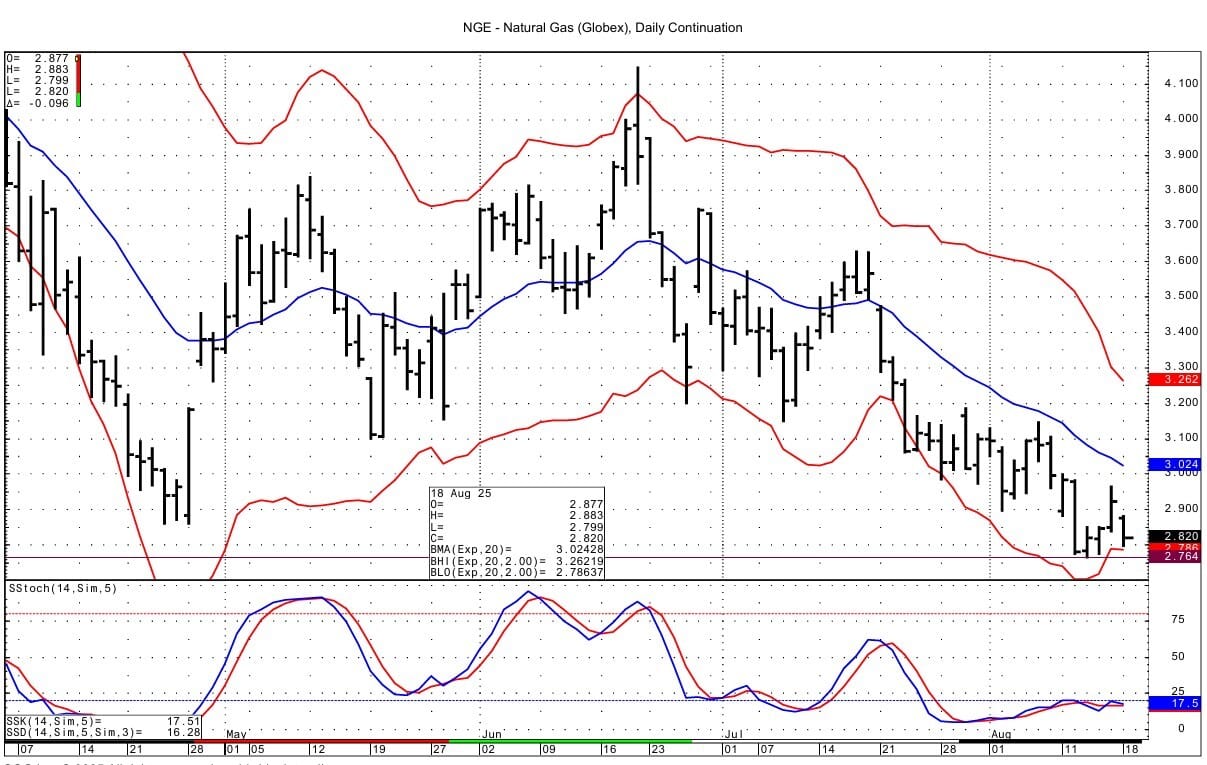

Technically NG spot futures have momentum basis the DC chart that is trying to remain positive. Support for the spot futures is seen at the lows from last week at 2.764-2.774 and then at 2.688 from lows from October/November 2024. Resistance comes in at 2.884 and then at 2.932-2.935.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply