- Daily Energy Market Update

- Posts

- Daily Energy Market Update August 15, 2025

Daily Energy Market Update August 15, 2025

Liquidity Energy, LLC

WTI is down 37 cents RB is down 1.11 cents ULSD is up 0.44 cents

Liquidity’s Daily Market Overview

Crude oil prices are lower as the market awaits the meeting between Presidents Trump and Putin, with the market suggesting the meeting may lead to sanctions being eased on Russia, even as the results of such an easing may take a while to come to fruition. Also weighing on prices today is disappointing Chinese economic data.

This morning , President Trump has said that something will come of his meeting with President Putin. Crude oil rallied Thursday, as the market may have been factoring in some disappointment that the meeting may not resolve any issues, as President Trump himself said Thursday: "THERE'S A 25% CHANCE MEETING IS A FAILURE---TRUMP: THIS PUTIN MEETING SETS UP SECOND MEETING---TRUMP: THEY'LL MAKE A DEAL AND 'DIVVY' THINGS UP AT 2ND MEETING” -(Bloomberg) Trump has said he believes Russia is prepared to end the war in Ukraine. However, he is also threatening to impose secondary sanctions on countries that buy Moscow's oil if the peace talks don't advance. (Reuters)

Citibank analysis regarding the meeting sees Brent oil prices possibly falling into the low $60's if a deal is reached. UBS analysis adds :" An expectation of a ceasefire translates into more Russian production. Even if there is a deal, it would likely take longer to ease sanctions on Russia because that would have to go through the U.S. Congress." Bloomberg commentary adds: " While tangible progress on a ceasefire would be bearish for energy prices, it’s unlikely that US sanctions on Russian LNG projects would be lifted imminently. " WSJ commentary reads as follows: " Oil prices could swing wildly depending on how the summit goes. Any movement toward a peace deal on Russia's war in Ukraine war could lead to crude benchmarks dropping below $60 a barrel, some analysts say. If the talks end with the U.S. imposing stricter sanctions, prices could top $80 a barrel."

China's factory output growth slumped to an eight-month low in July, while retail sales slowed sharply. Industrial output grew 5.7% year-on-year in July, National Bureau of Statistics (NBS) data showed on Friday, the lowest reading since November 2024, and compared with a 6.8% rise in June. It missed forecasts for a 5.9% increase in a Reuters poll. Retail sales, a gauge of consumption, expanded 3.7% in July, the slowest pace since December 2024, and cooling from a 4.8% rise in the previous month. They missed a Reuters forecast gain of 4.6%. China is being buffeted by President Trump's tariff policies, a continued slumping property sector, excessive competition in the domestic market and extreme weather, as per Reuters commentary. China's 2025 GDP growth is forecast to cool to 4.6% - falling short of the official goal of 5.0% -and falling from last year's 5.0% growth. The GDP is seen easing even further to 4.2% in 2026, according to the Reuters poll.

Further aiding crude prices Thursday was news regarding Iran. Sanctions 'Snapback' On Iran In Late August Increasingly Likely : With Iran stonewalling requests to return to the negotiating table with the United States, the three European signatories to the 2015 Iran nuclear deal appear likely to trigger the renewed impositions of sanctions on Iran. if Tehran does not change course, sanctions are likely to be reinstated on August 29. (Market News feed)

A Reuters analyst wrote this week:" The recent decision by the main producer in OPEC+, Saudi Arabia, to raise its official selling prices to its main Asian customers for September-loading cargoes seems to be at odds with a strategy to reclaim market share. This is already being reflected in Saudi allocations to Chinese refiners, with 1.43 MMBPD scheduled to be shipped in September, down from 1.65 MMBPD in August, Reuters reported on August 11 citing several trade sources. Saudi oil, and the crudes from other producers that follow Aramco’s pricing, are now less attractive to importers than rival grades that are priced against global benchmarks, such as Brent and West Texas Intermediate. China is ramping up imports from some producers outside the OPEC+ grouping. For example, China’s imports from Brazil are estimated by commodity analysts Kpler at 1.39 MMBPD in August, a record high and up from 739 MBPD in July.

In WTI/LO Calendar Spread Options (CSO), the April, May and June 1 month CSO put spreads traded. The -$0.75 put was bought against selling of the -$1.00 puts for a cost of 3 cents. The 1 month April & May futures spreads were trading near flat Thursday, while the June 1 month spread was trading near +4 cents. CME open interest data shows the -$1.00 put part of the trade was being initiated for the most part, while much of the -$0.75 put portion was being closed out.

Today is the expiration of the September WTI LO options contract. The $65 strike has the highest open interest of any nearby options with a total of about 42,000 contracts.

Energy Market Technicals

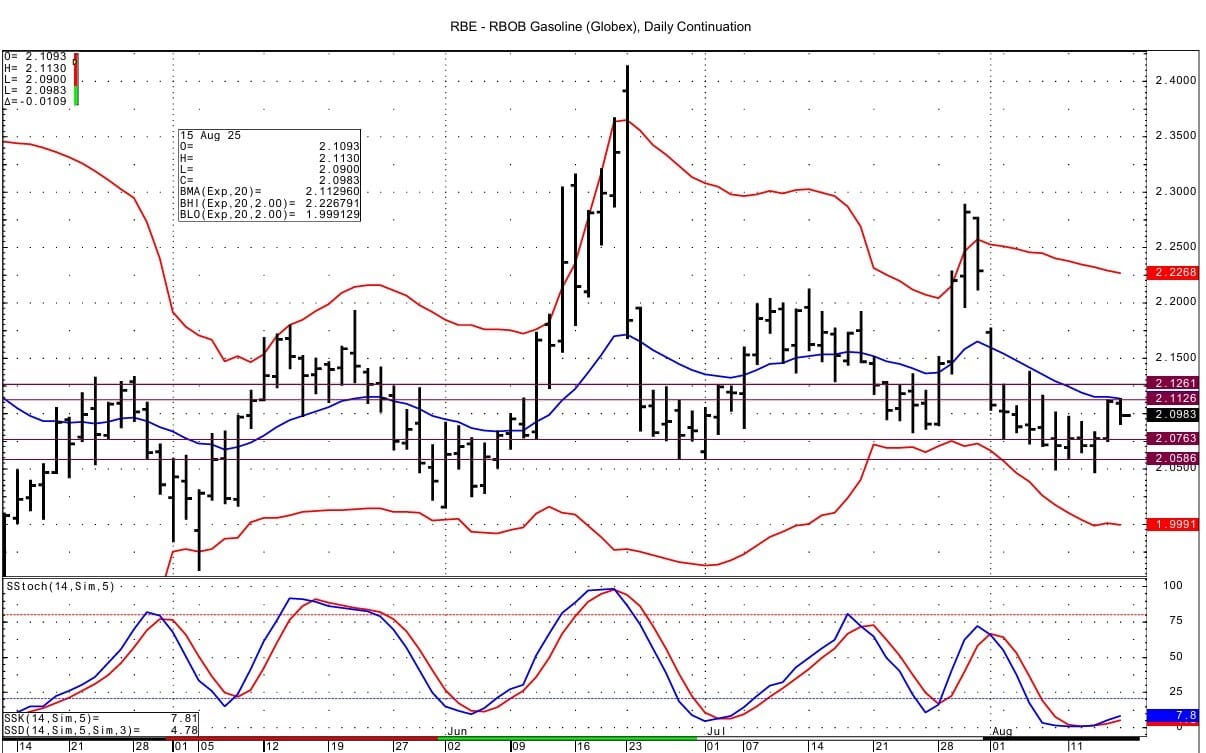

Technically WTI momentum basis the DC chart is turning positive as the current WTI spot futures price is above the prior 5 days' lows. RB momentum basis the DC chart is positive, while that for ULSD remains negative at an oversold level.

WTI spot futures have support at the recent low at 61.94 and then at 61.02-61.06. Resistance lies at 64.34-64.44, which are the highs from earlier this week. Above that resistance is seen at 65.09-65.11.

RB spot futures have resistance at the double top from yesterday/today at 2.1126-2.1130. Above that resistance lies at 2.1248-2.1261. Support is seen at 2.0748-2.0763 and then at 2.0585-2.0590.

ULSD for September sees support at 2.2023-2.2028 and then at 2.1720-2.1728. Resistance comes in above at 2.2562 and then at 2.2936-2.2954.

Natural Gas Market Overview

Natural Gas--NG is up 7.0 cents

September natural gas futures are higher today continuing the somewhat positive move seen yesterday. Futures have been helped the past 24 hours by stronger feedgas volume, a better demand forecast and a slight reduction in production. All that even as Thursday's EIA number raised the surplus to the 5 year average.

LSEG on Thursday showed August U.S. average natural gas production at 108.1 BCF/d. This is down 0.2 BCF/d from the average they showed Tuesday of 108.3 BCF/d.

On Thursday, LSEG projected average gas demand in the Lower 48 states, including exports, would ease from 111.9 BCF/d this week to 111.5 BCF/d next week. These forecasts were up 1.0 BCF/d total from those seen Wednesday and followed the increase of 2.8 BCF/d in the demand forecast seen Wednesday from Tuesday.

Freeport LNG's export plant in Texas was on track to take in more natural gas on Thursday in a sign that one of its liquefaction trains exited a short-term outage on Wednesday, according to a company filing with state regulators and gas flow data from LSEG. Freeport told Texas environmental regulators that one of three liquefaction trains at the plant, Train 2, shut on August 13 due to a problem with a compressor system. LSEG said the amount of gas flowing to Freeport was on track to reach 2 BCF/d on Thursday, up from 1.6 BCF/d on Wednesday. That compares with an average of 1.9 BCF/d over the prior seven days. The three liquefaction trains at Freeport are capable of turning about 2.1 BCF/d of gas into LNG. (Reuters)

The EIA gas storage number issued Thursday showed an increase of 56 BCF. This raised total storage to 3.186 TCF. This is +196 BCF/+6.56% versus the 5 year average, but -79 BCF/-2.42 % versus last year's level. The storage number in widening the current storage surplus to the 5 year amount further underscores less worries over a supply shortage come the winter. This looks to have been reflected in NG futures pricing again Thursday. Similar to Wednesday, on Thursday in NG futures, the winter strip lagged behind the front 2 months. September futures settled up 1.3 cents and October settled up 2.0 cents, while the December through March portion settled down between 2.6 and 4.2 cents.

On the CME Block board on Thursday, 1,300 lots of November and December call spreads traded as one trade. The November $3.75 / $4.00 call spread was sold -collecting 5.6 cents---against which the December $4.25 / $4.75 call spread was bought at a cost of 11.6 cents. Also Thursday, the October January 3 month Calendar Spread Options traded. The -$1.25 put was bought versus selling of 2 of the -$1.75 puts for a cost of 11 cents to the -$1.25 put buyer. And also in the October January 3 month calendar spread options, 4,000 contracts of the -$1.00 calls traded 3.5 cents. The majority of this call option trade was an initiated position as per CME open interest data.

A colleague suggests that NG futures are settling into a range: "This is a new consolidation range being formed ; for simplicity and utilizing major option points of $2.50 and $3.00. With it being “new” I do expect to see some decent volatility to test the extremes but expect both the $3 and $2.50 to hold till later in consolidation cycle."

Technically spot NG futures have risen above resistance at 2.881-2.887. Next resistance lies at 2.983-2.985 and then at 3.074-3.078. Support comes in at 2.858-2.859, which is above the overnight low of 2.836. Below that support lies at the prior 3 days' lows between 2.764-2.774. Momentum has turned positive basis the DC chart with the uptick in prices seen the past 24 hours.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply