- Daily Energy Market Update

- Posts

- Daily Energy Market Update 6-27-2025

Daily Energy Market Update 6-27-2025

Liquidity Energy, LLC

WTI is up 50 cents August RB is down 0.57 cents August ULSD is down 1.07 cents

Liquidity’s Daily Market Overview

Crude oil prices are higher today on the back of the strong DOE data seen this week and hopes for resolution to tariff issues between the U.S. and its trading partners with a deadline of July 9 looming. The news wires though point to the fact that crude oil is set for its largest weekly decline since March 2023.

“We just signed with China yesterday,” Trump said during a briefing at the White House Thursday, though he did not provide further details. The pact marks a significant step in stabilizing trade relations between the two countries. The U.S. Commerce Secretary added that trade agreements with 10 key US trading partners are imminent, as countries from Canada to Japan struggle to get over the finish line with just two weeks to go. Meanwhile, the Trump administration has signaled a willingness to roll back the self-imposed tariff deadline of July 9 as pressure builds. (Yahoo Finance)

The July August ULSD spread settled wider by 3.04 cents on Thursday, which we believe was a further reaction to the strong DOE data, that showed a large draw in inventories of distillates. Also, the spread may have been boosted by positions being closed out ahead of Monday's expiration for the July contract. Distillates likely found further support Thursday from news of inventory declines in Europe and Singapore. Data on Thursday showed that the independently held gasoil stocks at the Amsterdam-Rotterdam-Antwerp (ARA) refining and storage hub fell to their lowest in over a year, while Singapore's middle distillates inventories declined as net exports climbed week on week. (Reuters)

Notable in Thursday's activity were the open interest figures from the CME for ULSD and RB. ULSD open interest rose by 8,242 contracts even as the soon to expire July contract shed 5,075 contracts. We see the ULSD open interest increase as mostly new length. RB open interest fell by 11,186 contracts as July contracts were liquidated ahead of Monday's expiration and August short covering may have occurred.

A headline today from the Russian news agency Tass quotes Deputy Prime Minister Novak saying that OPEC+ may discuss an output hike at the July 6th meeting.

A CNN headline seen Thursday mentioned the U.S. was considering easing sanctions on Iran as a possible incentive to begin talks. The U.S. Press secretary said that the U.S. was on a diplomatic path with Iran. The news led to a 25 cent pull back in WTI spot futures at the time. But, Iran’s Foreign Minister said no agreement had been reach for the resumption of talks with the US, according to the Islamic Republic News Agency.

VLCC rates for Gulf-to-China routes have dropped to approximately $63,000 per day, down from nearly $100,000 just two weeks ago. The fall reflected improved vessel availability and a partial unwinding of war-risk premiums, which had surged during the height of the Iran-Israel-US showdown. AIS data shows a return to normal operating patterns near Hormuz, with fewer tankers loitering off Oman or taking evasive routes. But, insurers have not removed war-risk surcharges entirely. (Oil Price)

Energy Market Technicals

Momentum remains negative for the energies. The energies are showing inside trading days today versus yesterday's price ranges.

WTI spot futures see support at 64.51-64.60. Resistance lies at 66.90 and then at 64.83

August RB support lies at 2.0465-2.0486 and then at 2.0290-2.0300. Resistance lies at 2.1083-2.1098.

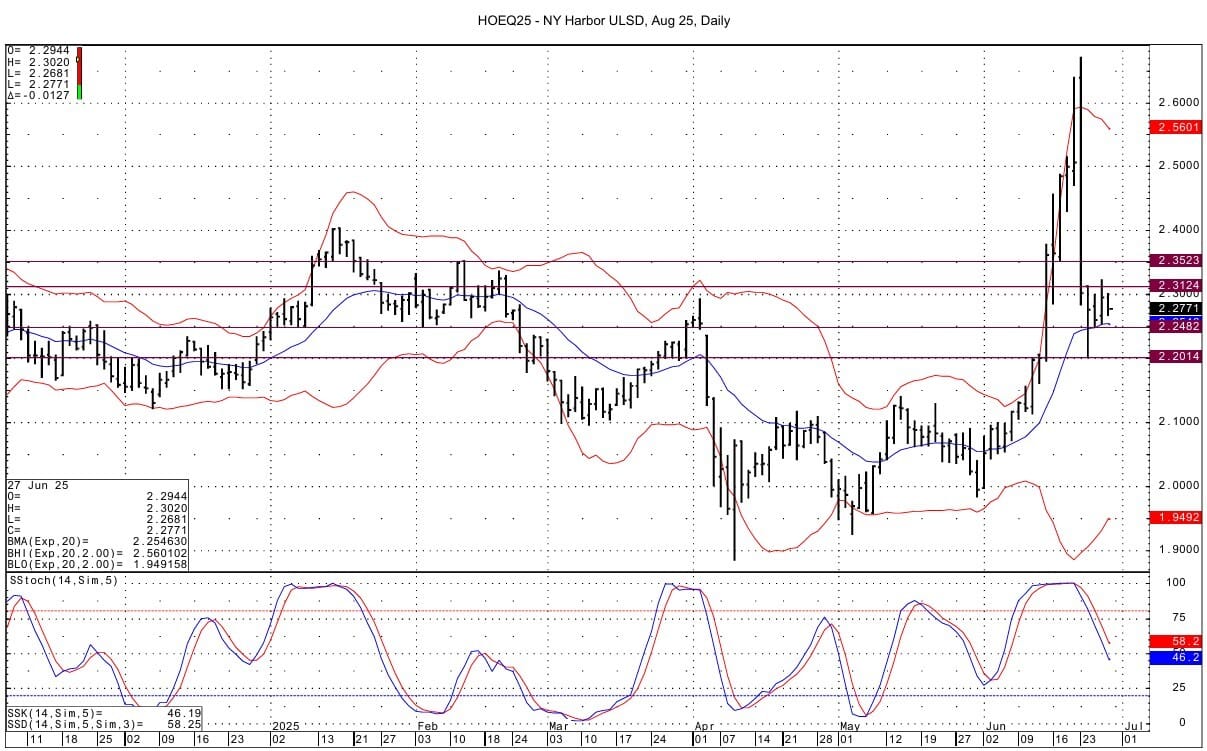

August ULSD support is seen at 2.2482-2.2495 and then at 2.2014. Resistance comes in at 2.3124-2.3139 and then at 2.3520-2.3523.

Natural Gas Market Overview

Natural Gas-- NG is up 7.4 cents

NG prices are higher today as above normal temperatures are forecast for the southeast and northwest, as per the NOAA. A technical bounce after the sharp selloff seen this week is likely also boosting gas prices.

Average Lower 48 temperatures are still forecast above normal throughout the coming two weeks. NOAA 6-14 day forecast shows above normal temperatures focused in the southeast and northwest. The GFS 6z 15day has risen over 5 CDDs nationally.

The EIA NG gas storage built by 96 BCF, which was 7-8 BCF more than forecast, marking the 10th consecutive week of above-average injections, driving NG futures prices to a fresh low for the day. Total storage rose to 2.898 TCF, which is now +179 BCF / +6.58% versus the 5 year average, but still -196 BCF / -6.33% versus last year's level. Initial estimates seen for next week's EIA storage data are calling for a build of 51 to 52 BCF. The 5 year average build for the period is +61 BCF and last year's build for the week was +35 BCF.

July futures expired weakly as the price fell to its lowest value since December 17 basis the July daily contract. The first month spread widened to as much as -27.0 cents. The July futures fell to converge with the next day Henry Hub cash, after being as much as 80+ cents above the cash price on June 16.

In NG / LN options, 1,850 lots of the October $4.25 calls were bought at a cost of 18.6 cents. Coupled with the option was a delta sale of October penultimate futures at $3.58. In the NG/LN the August 2025 $3.25 Put was bought with delta August futures buys at $3.43. The options traded 13.7, 13.8 and 13.9 cents in some volume ; a total of 4,500 lots went in the put option. Also in NG/LN options, the October January 3 month CSO -75 cent call traded 1,000 times each at 2.0 and 1.9 cents. These were opening trades for the most part given the open interest increase seen in CME data.

Technically on Thursday, the futures tested the lower bollinger bands on the August daily and DC chart bases. There is now a rollover gap on the DC chart. The gap goes from July's high of 3.425 seen yesterday to today's August low of 3.513. Support for the August futures lies at 3.527-3.530 and then at 3.453-3.454. Resistance comes in at 3.684 and then at 3.760-3.764.

Enjoyed this article?

Subscribe to never miss an issue. Liquidity’s Daily Energy Market Updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply